- Crude oil analysis: Investors await OPEC+ meeting Nov 30

- We expect rollover of Saudi and Russia cuts

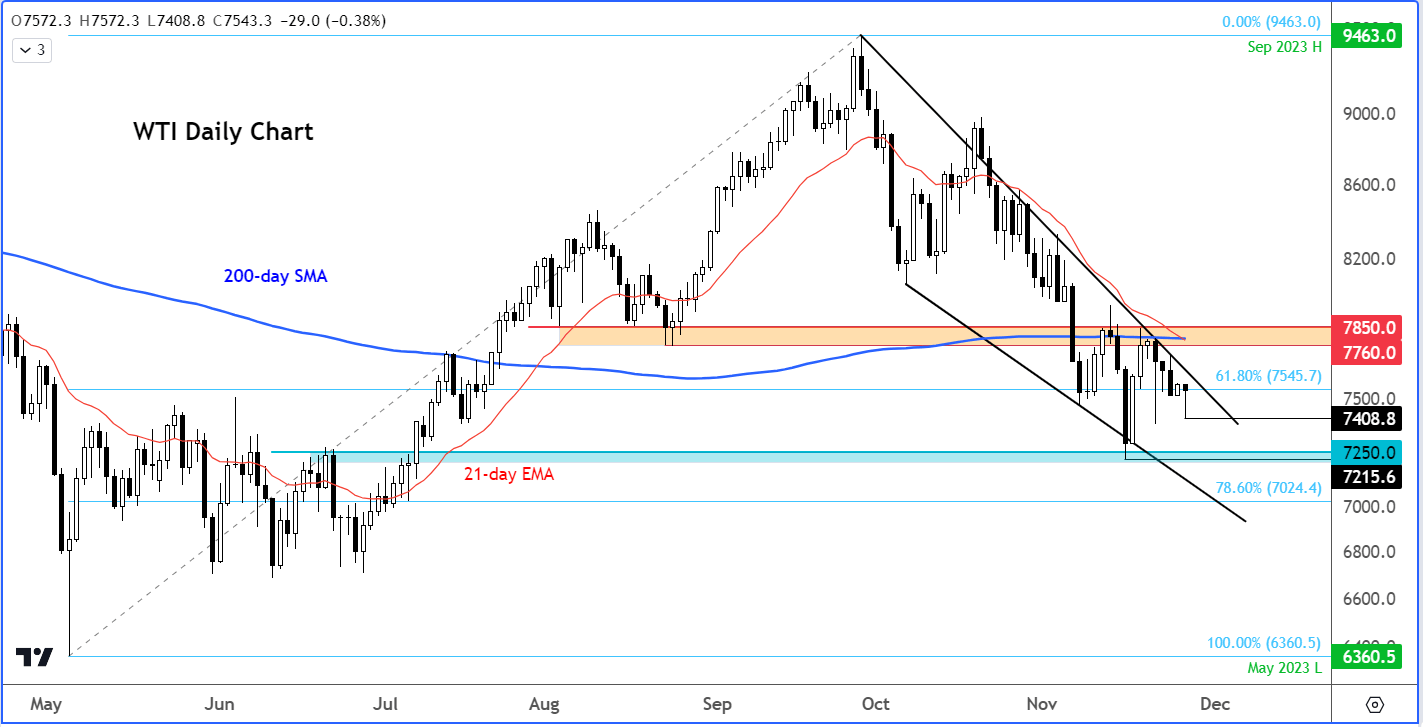

- WTI needs an interim higher high above $77.60-$78.50 to signal trend reversal

After a 5-week decline and a weak start to this week’s trading, crude oil prices were coming off their lows at the time of writing, recovering some of the 1.3% earlier decline. Oil prices will remain in focus after the OPEC+ last week decided to delay their meeting by three days as reports suggested that members could not agree on output levels. The group are now due to meet on the last day of this month on Thursday. Oil prices will be in for a volatile few days. Traders will be trying to predict what sort of action will be taken and the impact they will have on oil prices in the near-term outlook. Judging by the recovery of oil prices from their earlier lows on Monday, they are expecting the OPEC+ to extend curbs on supplies into 2024. The sharp declines over the past several weeks means investors have now priced in much of the negative influences related to the demand-side, with global data being poor for much of this year and US stockpiles rising sharply in recent weeks, all to suggest that demand is weaker than expected.

Crude oil analysis: It is all about OPEC+ meeting this week

Last week saw oil prices take a tumble after the OPEC and allies including Russia (AKA OPEC+) postponed a ministerial meeting by three days to November 30. Apparently, there are differences on production targets for African oil producers. It is clear that Saudi is dissatisfied with some of the other OPEC+ members who are not complying with the cuts. According to Reuters, those differences have now narrowed, with the group moving closer to a compromise. But while the group’s de facto leader Saudi Arabia seeks quota cuts, some of the other members are resisting, according to some reports. All told, I expected a breakthrough in the talks. Saudi Arabia is likely to roll over its additional voluntary cut of 1 million barrels per day (bpd) into next year, and Russia should likewise extend its own cuts, at least until the first quarter of 2024. If so, this should alleviate some of the selling pressure on oil prices moving forward.

WTI crude oil technical analysis

Crude oil prices have started to show some signs of bullishness on the lower time frame, but this hasn’t stopped the bears to defend key resistance levels. The bulls are still in need of seeing an interim higher high to provide a clear indication of a bottom. With key resistance coming in around the $77.60 to $78.50 range (see shaded area on the chart), WTI will need to climb above here to signal change in the trend, especially as we also have both the 21 and 200-day moving averages converging within this zone too.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade