The 2021 Financial Year (FY) witnessed a remarkable economic turnaround, supported by unprecedented central bank policy and government intervention, fostering a more robust rebound from the first wave of Covid than even the most optimistic forecasters predicted.

The last set of financial results (August 2021) now stands as the peak in post-Covid expectations for earnings, as a Covid outbreak in three states along the Eastern Seaboard, marked the first half of 2022.

Growth rates have continued to roll over as the consumer, spooked by the fast spreading Omicron variant, went into voluntary lockdown pre and post-Christmas, providing another hurdle for reopening reality.

Also thrown into the mix, supply-chain disruption as Omicron forced workers into home isolation. This left inventory levels low, compounded by unseasonal weather that affected the fresh food supply.

At the same time, wage and price pressures have become more persistent. Following recent hot employment and inflation data, the RBA will likely follow other central banks and lift cash rates in 2022, thereby putting further pressure on earnings momentum.

The trend to higher interest rates has supported growth stocks over value globally. According to U.S. investment bank Morgan Stanley, here in Australia, value has outperformed growth by ~13% since December 1. Elsewhere Consumer Discretionary and Staples sectors have underperformed the ASX200 by 5.4% and 9.1%, respectively, since the start of December.

The key dates to watch this reporting season will be Week 2 (February 7 – February 11), when the action begins to hot up with reports from companies including the Commonwealth Bank of Australia (CBA) and ASX Limited (ASX).

Week 3 (14th to 18th of February) will see reports from companies including mining heavyweights BHP Group Ltd (BHP), Fortescue Metals Group (FMG), as well as JB Hi-Fi Ltd (JBH) and CSL Limited (CSL).

Week 4 (21st to 25th of February) will see reports from companies including the a2 Milk Company (A2M), Rio Tinto (RIO), Flight Centre Travel Group (FLT), and Qantas Airways Limited (QAN).

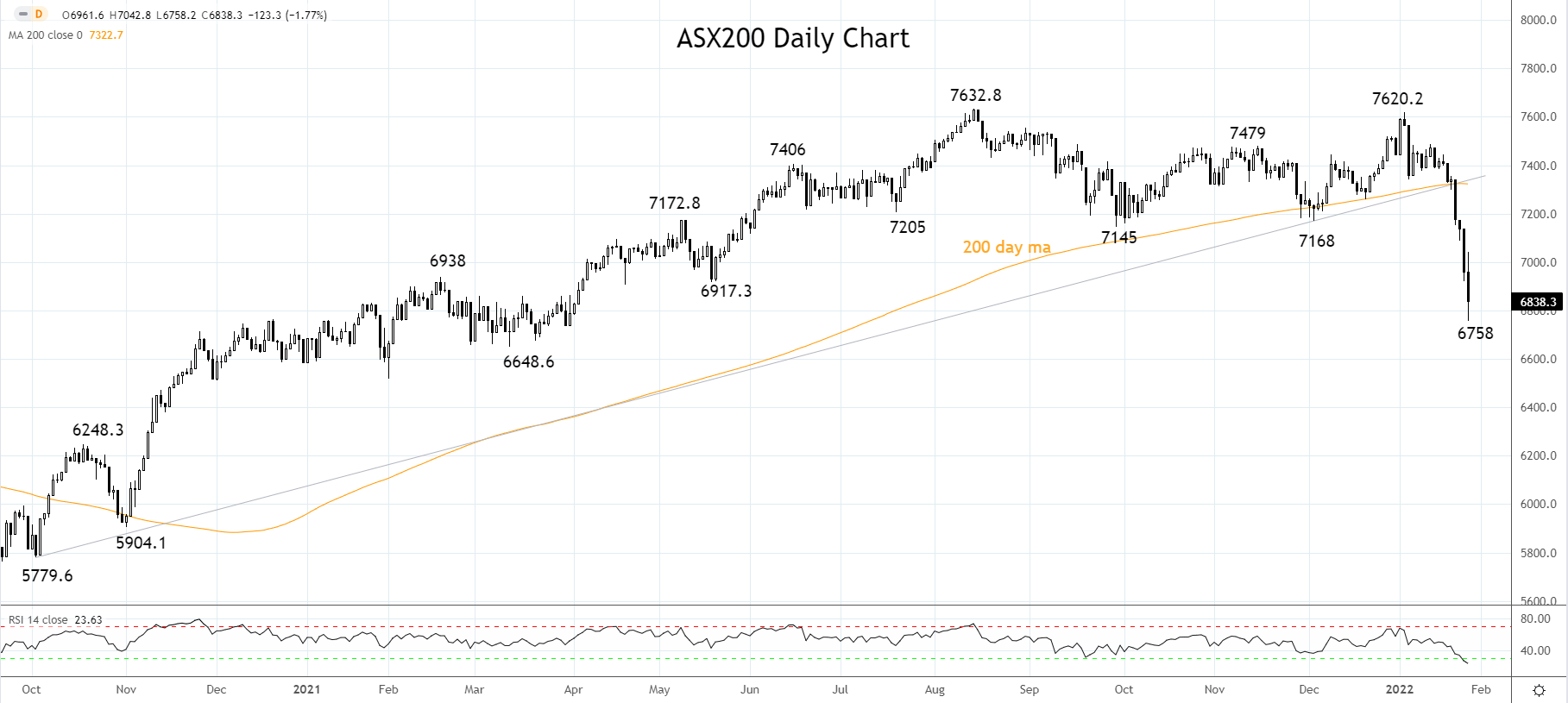

Australia's benchmark index, the ASX200, has fallen over 10% below the 2021 peak Index level. The bulk of the fall came after the ASX200 broke below critical support last week at 7300, consisting of the 200 day moving average and uptrend support from the October 5779 low.

Whether the savage repricing of the ASX200 to the end of lower interest rates and quantitative easing (QE) is complete for now remains to be seen. However, with reporting season just around the corner bringing with it earnings risk, the volatility episode of January looks set to extend into February.

Source Tradingview. The figures stated areas of January 27, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade