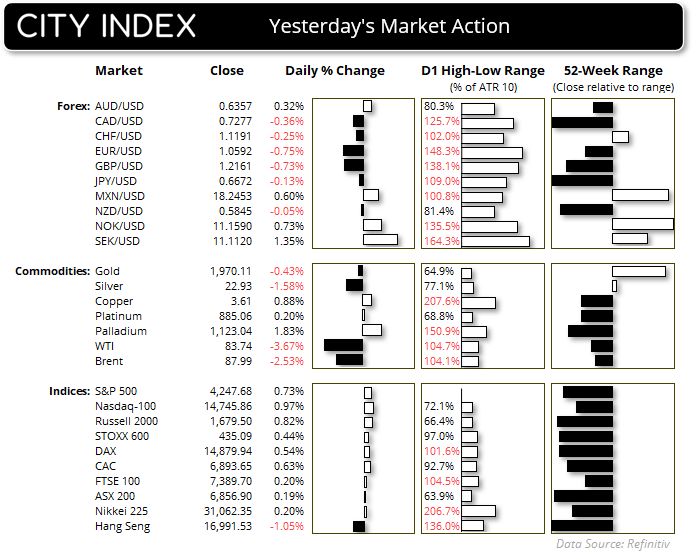

The Nasdaq 100 led Wall Street indices higher for a second day thanks to decent earnings and upbeat forecasts. Negative sentiment was also given a reprieve as US yields above the 10-year tenor retraced for a second day, helped by comments that Bill Ackman had closed his short positions against bonds and Bill Gross was long bonds as he expected a recession by year end.

Economies continued to slow across Europe, UK, Japan and Australia according to flash PMIs. Whilst this likely helps with calls that the BOE and ECB will hold rates at their next meetings, there are growing expectations that the RBA’s next meeting could be live (for a potential hike) and that the BOJ may tweak or abandon YCC.

The US services sector avoided a contraction, with S&P Global flash PMI rising 50.9 compared to 50.1 prior and 49.8 expected, helping to lift the US dollar index from its 22-day low and form a bullish engulfing day. The 2-eay yield way also higher with Fed policy expectations.

Events in focus (AEDT):

- CPI is expected to rise 1.1% q/q (0.8% prior) but slow to 5.3% y/y (6% prior)

- Weighted mean is expected to slow to 5% y/y (5.5% prior) yet remain flat at 1% q/q

- Trimmed mean CPI is expected to rise 1.1% q/q (0.9% prior), or 5.3% y/y (5.2% prior)

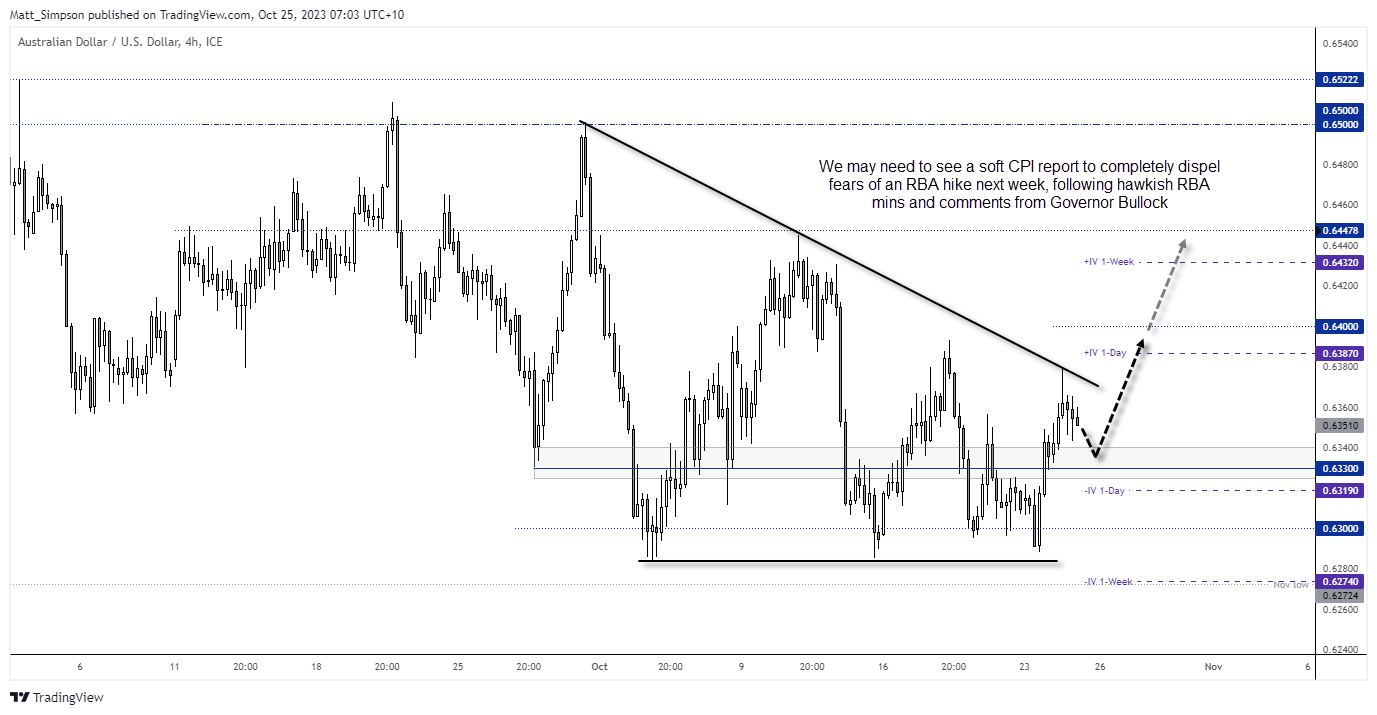

The importance of today’s Australian inflation report has only increased following last week’s relatively hawkish RBA minutes and comments from the Governor on Tuesday. Whilst Michelle Bullock said it is possible that inflation could return to target with the current cash rate, she warned that the RBA have a low tolerance for it returning to target too slowly and that the RBA will not hesitate to raise rates again if needed.

We might need to see trimmed and weighed mean CPI fall below 5% y/y to fully dispel concerns of another hike. But with trade data, producer prices and updated economic forecasts to be released ahead of next Tuesday’s meeting, it leaves plenty of opportunity to sway opinion of the RBA’s decision, which leaves the ASX and Australian dollar vulnerable to further pockets of volatility. And that’s just on the domestic front.

- 11:30 – Australian CPI (monthly and quarterly reports)

- 16:00 – Japan leading index, coincident indicator

- 19:00 – German Ifo business sentiment

- 22:00 – US building permits

- 01:00 – BOC interest rate decision

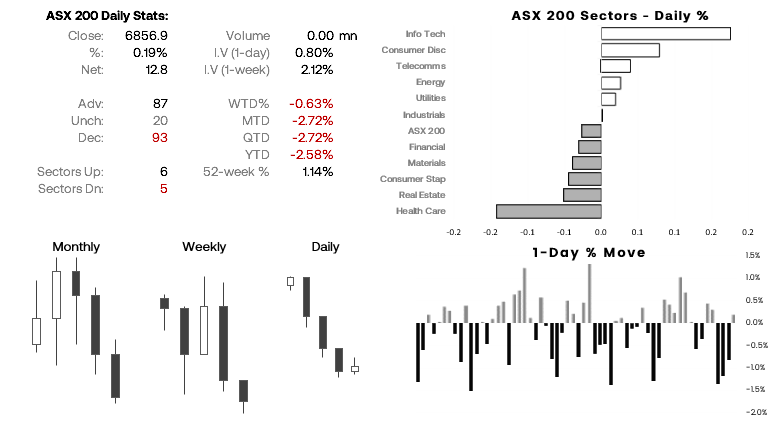

ASX 200 at a glance:

- The ASX 200 produced a small bullish inside day, just above its 11-month lows on Tuesday

- A positive lead from Wall Street and SPI futures overnight are expected to see the cash market open higher today

- The ASX needs to break above 6904 to see it back above its 200-week EMA, likely making the 6900 area a pivotal area and initial resistance level

- The ASX will likely be influenced by today’s CPI report; a soft set of figures could diminish bets of an RBA hike and send the ASX higher, whist strong figures are likely to weigh on the domestic market

AUD/USD technical analysis (4-hour chart):

I have previously noted that AUD/USD has done well to hold above 63c and the November low, despite negative sentiment and geopolitical tensions. And with hawkish tones from the RBA only increasing, an uptick for sentiment or, say a hot CPOI report today, could be the catalyst the Aussie needs to finally rally. Also note that the area around 0.6330 has been a pivotal level in recent days, so any pullback towards it ahead of the inflation report may appeal to bullish eyes. 0.6400 seems like a feasible minimum target, a break above which brings the 0.6440 highs into focus, near the 1-week implied volatility band.

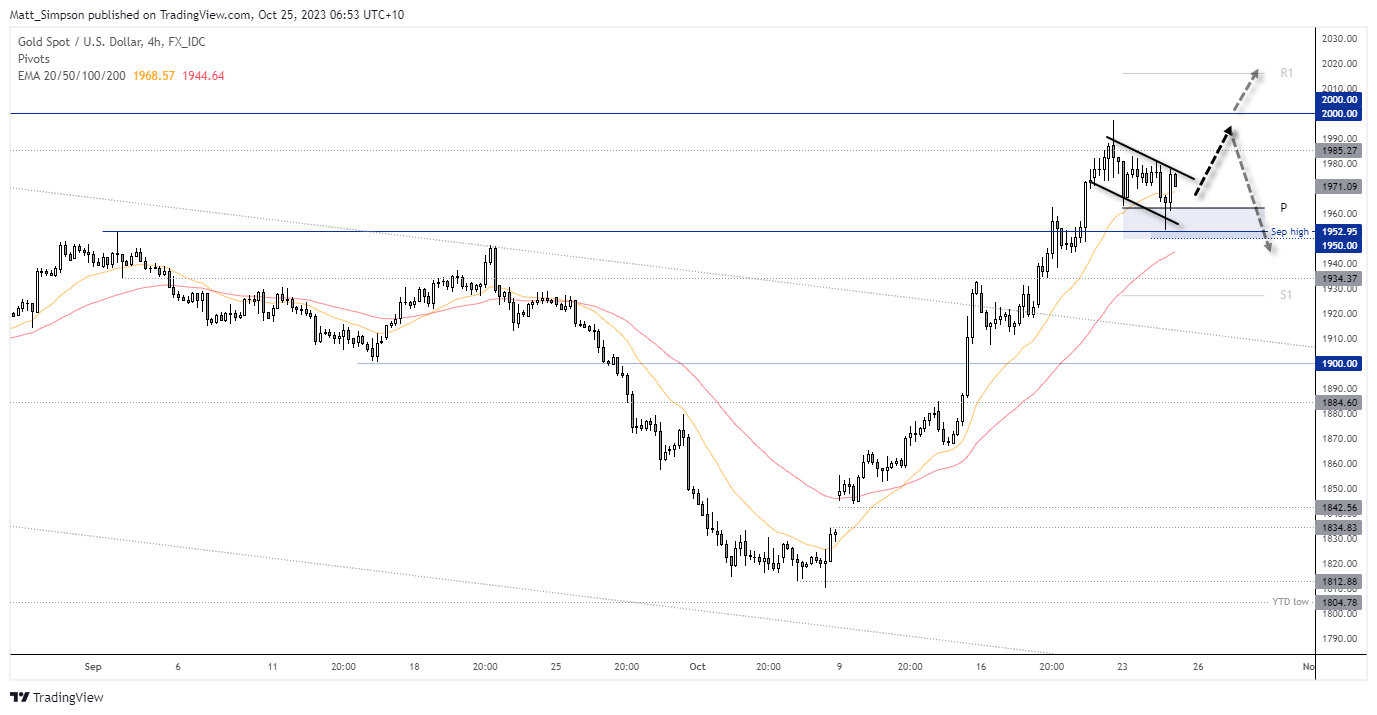

Gold technical analysis (4-hour chart):

Spot gold prices have remained in a strong uptrend on the 4-hour chart, and the retracement to the 1950 area has been satisfied (it is rarely fun entering longs around cycle highs, near major resistance levels). A potential bull flag is forming on the 4-hour chart, and a 3-bar reversal (morning star) pattern has formed to suggest a swing low is in place. Also note that the most recent bullish engulfing candle found support at the weekly pivot point, and prices are now retracing within its range. If confident a breakout is imminent, bulls could enter around current levels with a stop below 1960 with an initial target around 1990 or 2000. If the bull flag is successful, it projects a target around 1930.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade