The People’s Bank of China (PBOC) surprised markets in early Asian trade, unexpectedly cutting two key wholesale interest rates following the release of soft inflation and credit data last week. The move came ahead of fresh data on retail sales, industrial production and fixed asset investment, all of which undershot expectations by some margin, reinforcing the view that private sector demand remains incredibly weak.

Chinese economic data continues to disappoint

Retail sales grew 2.5% from a year earlier, below the 4.5% pace expected by economists. Industrial production rose 3.7% over the year, seven tenths below forecasts, while fixed asset investment lifted 3.4% between January and July compared to a year earlier, down on the 3.8% growth expected.

PBOC reacts by cutting key wholesale interest rates

With recent data uniformly weak, the PBOC moved to lower borrowing costs in the hope of spurring demand, reducing the one-year medium-term lending facility (MLF) rate by 15 basis points to 2.5%. The 7-day reverse repo rate was also reduced by 10 basis points to 1.8%. While further stimulus measures were widely expected, the adjustment to wholesale funding costs was largely unexpected, pointing to the potential for private sector borrowing rates to follow suit next week when the PBOC loan prime rate resets.

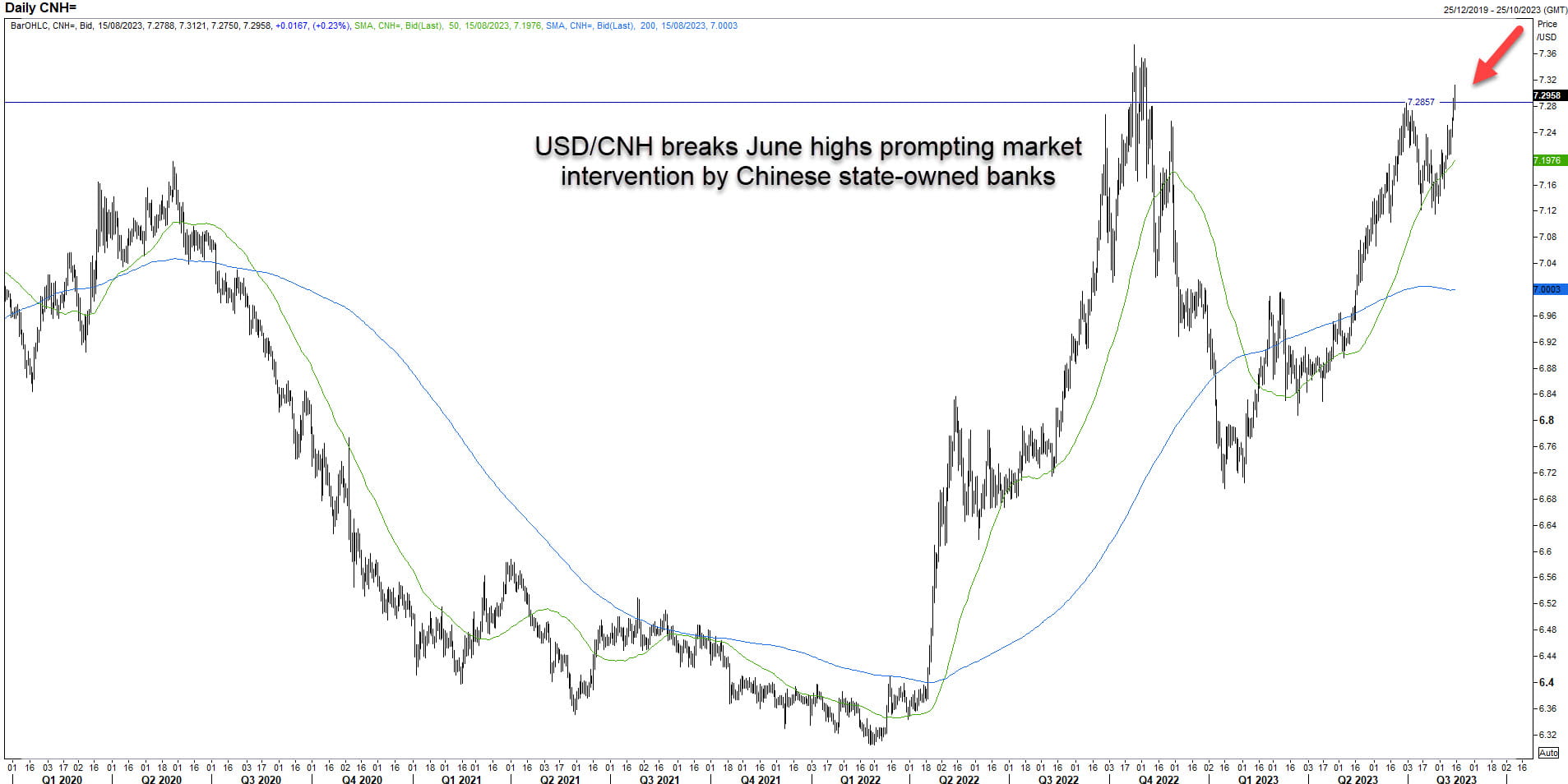

Chinese yuan breaks key technical level, AUD rebounds on stimulus hopes

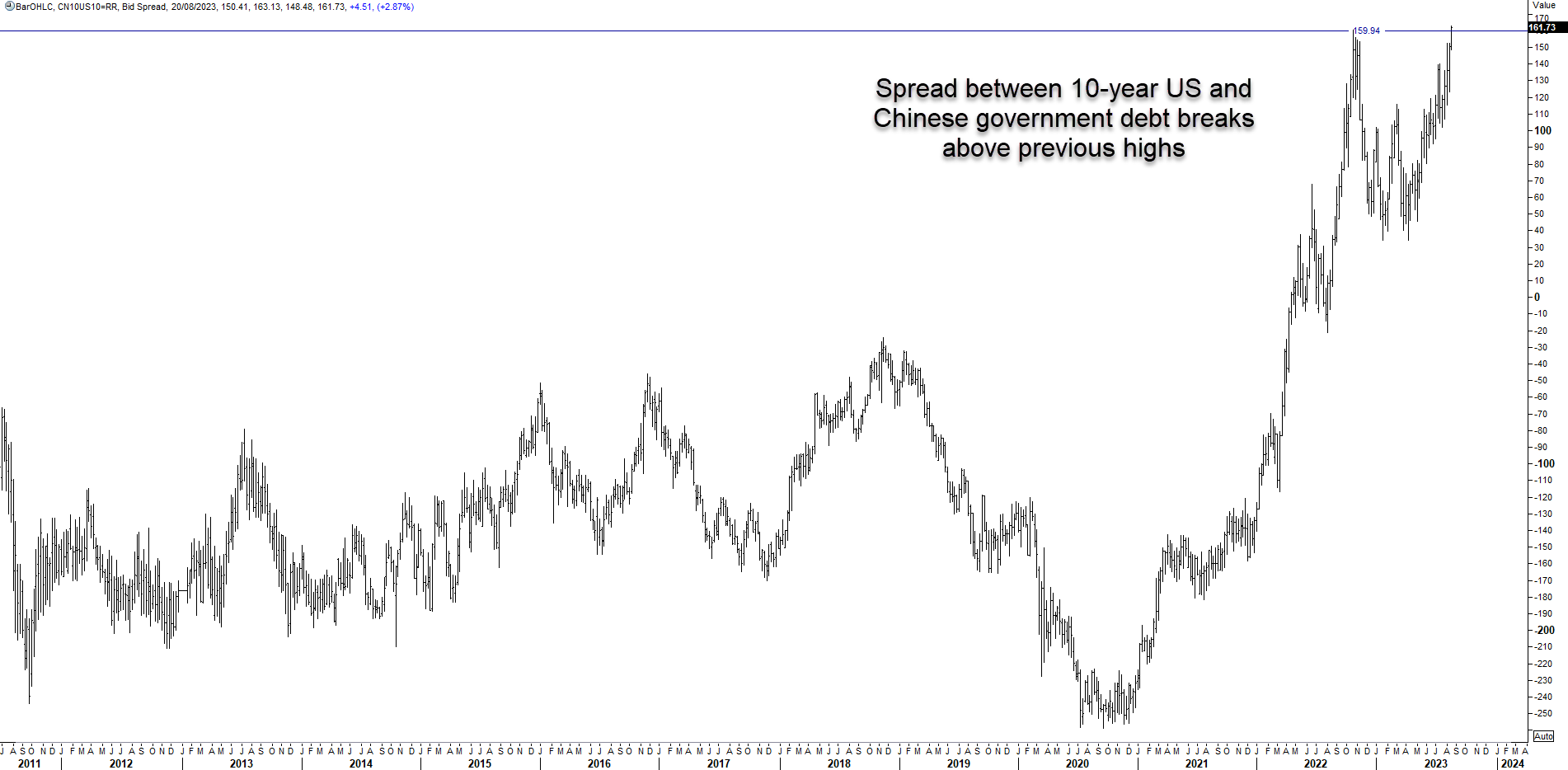

The PBOC move saw the USD/CNH break above its June highs, resulting in the central bank stepping in to support the yuan by instructing state-owned banks to sell US dollars into mainland Chinese markets. But whether that will be able to prevent further weakness remains questionable with yields on benchmark 10-year Chinese government bonds sliding to the lowest level since early 2020, resulting in the spread with equivalent US Treasuries blowing out to fresh highs.

The AUD/USD was also whipsawed on the news, weakening in unison with the CNH before rebounding as traders reacted reassessed the outlook for China’s economy in the wake of the latest stimulus measures. While the Aussie continues to be largely influenced by offshore factors, the domestic news flow offered headwinds to further gains with the June quarter wage price index coming in weaker-than-expected. The minutes of the RBA’s August interest rate decision also suggested there is a credible path to return inflation to the bank’s 2-3% target with the cash rate remaining at its present level of 4.1%, dimming the prospect for further increases to the cash rate.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade