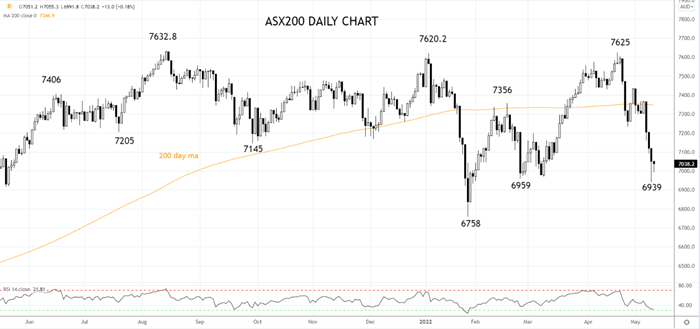

The ASX200 is trading 12 points lower at 7039 at 2.45 pm, in nervous trading ahead of crucial U.S CPI data due out at 10.30 pm this evening.

Headline inflation is expected to slow to an annual rate of 8.1% in April, down from a 40 year high of 8.5% in March. The core inflation rate is expected to fall from 6.5% to 6%, still significantly above the Fed's target of 2% inflation.

Providing the number moderates as expected, it will indicate that inflation has peaked and bring some comfort to a jittery market and the Fed.

However, there is little margin for error. If tonight's number is much stronger than expected, then talk of an inflation-busting 75 bp rate hike will return. More so after Cleveland Fed President Mester cautioned overnight that a 75bp rate hike should not be ruled out "forever."

Crude oil has fallen below $100 p/b overnight on concerns over weaker demand from China's lockdowns, higher interest rates and SPR releases. Woodside Energy (WPL) fell 1.7% to $30.25. Santos (STO) fell 0.38% to $7.90. Finding support Beach Energy (BPT) added 1.55% to $1.64, and Origin Energy added 0.3% to $6.85.

The IT sector fell despite a rally in the tech-heavy Nasdaq index overnight. Sezzle (SZL) fell 1.24% to $0.80c. ZIP (ZIP) fell 3.37% to $1.00, Megaport (MG1) fell 1.92% to $7.16, Tyro Payments (TYR) fell 2.05% to $1.07. Bucking the trend, Life 360 (360) added 4.57% to $3.43, and EML Payments (EML) managed to claw back some lost ground by adding 3.82% to $1.50.

The ASX200 Financial Sector is trading 6.5% below its late April high and has struggled again today. National Australia Bank (NAB) has fallen 4.12% to $30.47 after going ex-dividend. ANZ fell 1.36% to $25.44, Westpac (WBC) fell 1.08% to $24.40, Commonwealth Bank (CBA) fell 1.03% to $101.45. Macquarie (MQG) added 0.57% to $181.07.

Mining stocks recovered some lost ground after their whipping yesterday. Mineral Resources (MIN) added 3.21% to $54.40, Rio Tinto (Rio) added 2.40% to $105.45. Fortescue Metals (FMG) added 1.15% to $19.34, BHP Group (BHP) added 0.7% to $45.37.

The Health Care Sector is today's best on ground. Bio-Tech Behemoth added 2.42% to $277.19, Resmed (RMD) added 1.94% to $28.40, Cochlear lifted by 1.65% to $213.94 while Sonic Healthcare (SHC) added 1.10% to $35.15.

A mixed day for stocks in the Lithium space. Iluka Resources (ILU) fell 1.23% to $10.05, Liontown Resources (LTR) fell 0.4% to $1.24, and Galan Lithium (GLN) fell 0.34% to $1.47. Lake Resources (LKE) added 2.47% to $1.46. Allkem (AKE) added 2% to $11.17.

Elsewhere Link (LNK) entered a trading halt after its share price fell 12.4% this morning. Canadian company Dye & Durham proposal to acquire Link appears to have caught the attention of the competition watchdog, the ACCC.

Last week's break of uptrend support and recent lows at 7230 resulted in a short-term bearish stance on the ASX200, targeting a test of support at 7000/6950. The target was achieved reached yesterday morning, and we favour selling bounces towards resistance at 7150/7200.

The AUDUSD has consolidated its break below .7000c to be trading at .6956. With global growth under question, stagflation risks rising, and Australian consumer confidence falling today for the sixth month in a row, downside risks remain for the local unit.

Source Tradingview. The figures stated are as of May 11th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade