Ethereum trading

Trade Ethereum’s high volatility with a CFD account, and benefit from both rising and falling prices.

-

Spreads from 5 points

-

Award-winning tools

-

Margin from 50%

Trade Ethereum with CFDs

CFD trading is a popular way to trade Ethereum.

If you’re not ready to trade with real money, why not open a demo trading account and practise risk free.

Competitive spreads

† May change due to market conditions.

‡ trading hours on cryptocurrencies are 09:00 Mon - 09:00 Sat (AEDT)

You can trade Ethereum at City Index as a CFD.

When you trade Ethereum at City Index you do not own any underlying Ethereum assets. You are speculating on the price movements between Ethereum and USD.

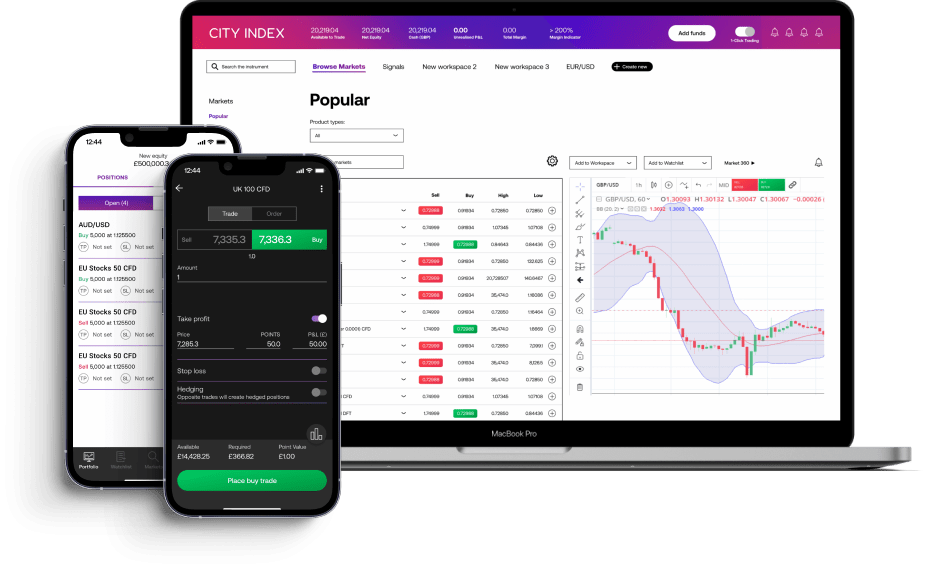

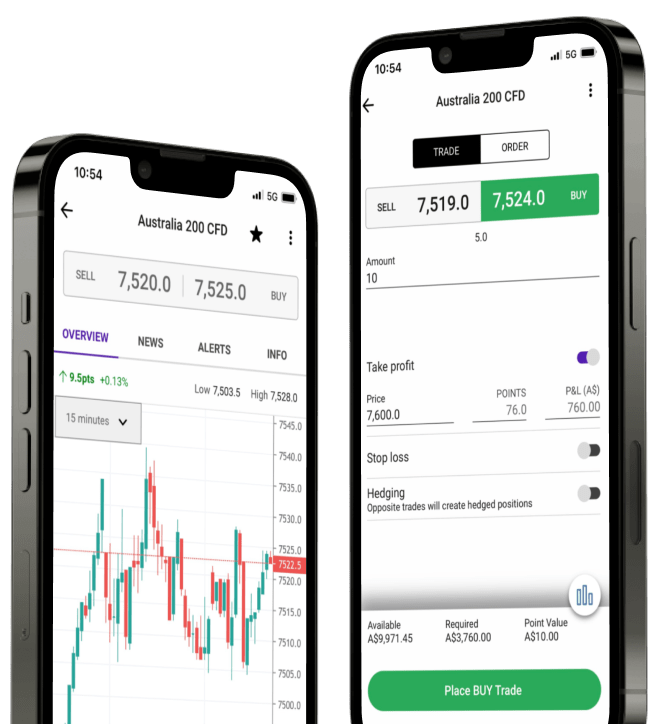

Add a stop-loss order to protect your position, should the market suddenly move against you.

Once you have placed your trade your profit and loss will update in real time and you can close your trade by clicking "Close trade".

Go long or short

Short the market to profit from falling prices

Go long to profit from rising prices

Trade Ethereum volatility

Without a digital wallet

Multi-exchange pricing

Reliable multi-exchange pricing with competitive financing

Trade on leverage

Trade Ethereum with a small initial investment

Here's why traders choose City Index.

- 40 years’ experience in forex and CFD Trading

- Regulated in Australia since 2006

- Risk management tools to help protect your positions

- Trade on multiple platforms and devices

- Insightful market data from our research portal

- Fast, easy payments and secure withdrawals

Trade risk-free with a demo account.

FAQs

What factors impact Ethereum?

One of the main factors affecting Ethereum volatility is its mining and availability of coins. There is technically an unlimited supply of Ethereum. In 2014, 7 million Ether - around $2.2 million - was sold in the Ethereum presale within the first 12 hours. Up to 18 million new coins are mined every year.

As with other cryptocurrencies, it is important to understand that the ‘rules’ affecting the way Ethereum is mined and processed can be changed suddenly, and this can have a big impact on the price.

To this point, Ethereum is expected in 2022 to move away from its original Proof of Work system of mining to the Proof of Stake system, meaning contributors will stake their own cryptocurrency in exchange for a chance to validate new transactions, update the blockchain, and earn rewards.

Is Ethereum risky?

Ethereum is a volatile market and although this presents opportunities for traders it can also create risks whether buying or trading.

- Ethereum has high volatility and sharp price fluctuations are very likely

- Leveraged trading can magnify both your profits and losses

If you have further questions about trading Ethereum, please see our Crypto FAQs.

What is the difference between buying Ethereum vs trading?

Buying Ethereum requires the use of specialist cryptocurrency platforms, and it can be a cumbersome and time-consuming process, making it difficult to react to short-term price changes.

Trading Ethereum with a CFD account, however, allows you to take advantage of short-term volatility by responding quickly to price changes. It can also be done instantly and without taking full ownership of the token.

You don’t need to own Ethereum to be able to trade its price.

What is Ethereum (ETH)?

Ethereum is a virtual currency that is transacted via a blockchain network. Created in 2013 by Vitalik Buterin, Ethereum was intended to be used within financial services with multiple applications. Today, Ethereum is the second-largest cryptocurrency market after Bitcoin.