- Will the dollar continue pushing higher?

- US GDP, jobless claims coming up

- Core PCE due on Friday

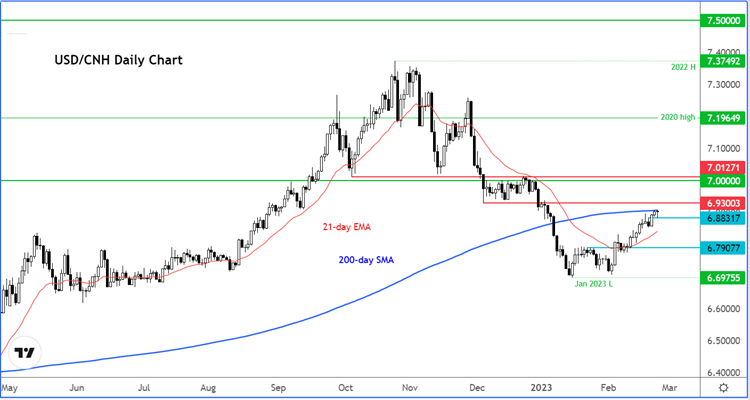

- USD/CNH testing 200-day average

FX markets have been fairly quiet so far in the day, but the dollar continues to find buyers on the dips thanks to the renewed hawkish rhetoric from the Fed. The focus will turn the upcoming publication of US GDP and jobless claims later and PCE Price Index on Friday. If we see continued strength in US data, this will further boost the hawkish Fed bets, and in turn support the greenback against some of her weaker rivals.

Will the dollar continue pushing higher?

A lot now also depends on whether the dollar will be able to go further higher. Much of the attention was on the FOMC minutes on Wednesday, which didn’t disappoint the dollar bulls as it revealed “a few” officials favoured or could have supported a 50bps rate hike, among other hawkish points. Despite Fed Chair Jerome Powell declaring that the 'disinflation process has started', the minutes of that meeting revealed that further rate increases were needed and there were no hints of a pause. So, the market is expecting at least two more 25bp hikes from the Fed over the March and May meetings and possibly another one in the June meeting. While the door also remains open for a 50 bp move in the future if the economy continues to grow rapidly, I agree with the market view that the next rate rises will be 25 basis points.

US GDP, jobless claims coming up

The FOMC will set new interest rate and economic projections at a meeting in four weeks, so we will soon find out exactly how hawkish they really are.

For now, attention will be on incoming data, with the focus today being on the US GDP data due at 13:30 GMT. This will be the second reading, which is expected to confirm the preliminary reading of 2.9% growth QoQ annualized, up from 3.2%. Stronger than forecast growth could fuel hawkish Fed bets but it is a backward-looking macro indicator.

Also due at the same time is the jobless claims data which could move the dollar given how the market reacted to the January jobs report a few weeks ago. If for example we see a significantly lower number than 200K, this would likely be bullish for the US dollar.

Core PCE due on Friday

The next set of meaningful US data is tomorrow's core PCE Price Index for January. Inflation figures remain the most important data for the markets as investors continually try to front-run the Fed and other central banks. The recent hawkish comments from several Fed officials has raised the possibility of a higher terminal interest rate in the US, causing the dollar to rebound strongly. We saw stronger-than-expected CPI and PPI data, but will the Fed’s favourite measure of inflation (Core PCE Price Index) also show strength?

USD/CNH testing 200-day average

Among the dollar pairs to watch is the USD/CHN which has risen for the fourth straight week to test its 200-day average around 6.90ish. If the USD/CNH starts to push back above its 200-day average, it may trigger follow up technical buying and in doing so, trigger a risk off response in the positively correlating Chinese equity markets. Most of the positivity about China re-opening has already been priced in. So, it would not come as surprise to us if we see renewed pressure on the yuan given the fact the PBOC is continuing to provide monetary support to the economy and remains in the dovish camp among the major central banks.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade