USD/CAD: Dueling jobs report disappointments, bears may target 1.21 next

Two jobs report duds

It was a proverbial “shootout at the 49th parallel” with both the US and Canada releasing their highly-anticipated monthly jobs reports this morning, but this time, both countries’ labor markets misfired.

As my colleague Joe Perry noted earlier today, the US Non-Farm Payrolls report showed disappointing jobs growth of only 266k jobs (vs. effectively 1M expected), and that was even before the -78k net revisions to past two months’ jobs reports. Nonetheless, the Canadian labor market also saw a setback, with Canada reporting a -207k decline in employment, taking the unemployment rate up to 8.1% in the Great White North.

Based on recent business surveys, the issue is more about labor market supply than demand; in other words, companies want to hire qualified employees, but many of those employees don’t yet feel comfortable (re-)entering the workforce due to a combination of safety concerns, childcare headaches, and generous government benefits. For a North American economy that was showing signs of turning the corner and reopening amidst widespread vaccine availability, it looks like we may have longer to wait before the labor market starts firing on all cylinders again.

USD/CAD Technical Analysis

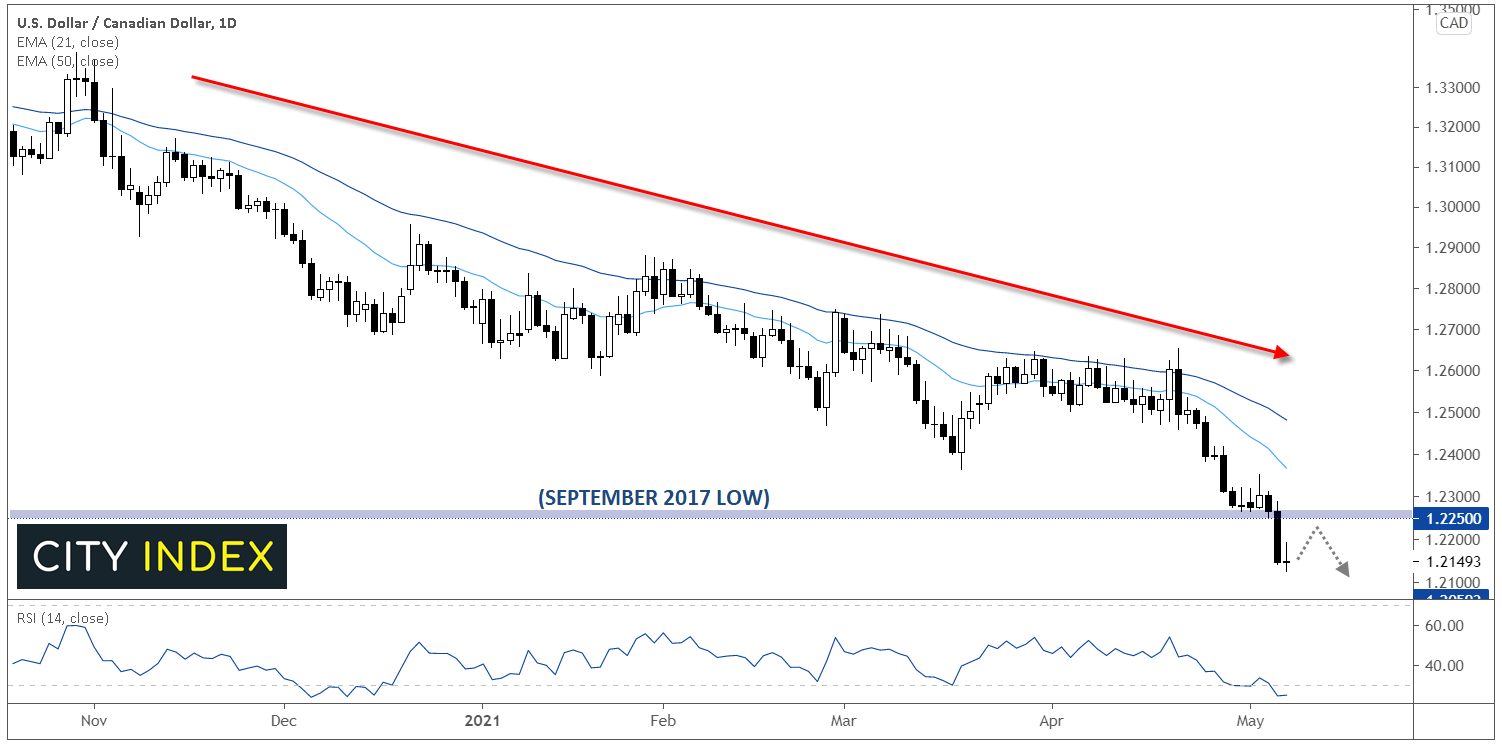

Looking at the USD/CAD, traders are still weighing which of the two abysmal jobs reports was worse. While today’s fundamental reports out of the US and Canada have largely offset one another, the technical picture is far clearer. USD/CAD broke down to a 3+ year low below 1.2250 yesterday, extending a downtrend that’s been in place for more than a year:

Source: TradingView, StoneX

While we could see an oversold bounce early next week given the oversold RSI indicator, the technical bias remains to the downside as long as USD/CAD holds below previous-support-turned-resistance at 1.2250. To the downside, the next support level to watch will be the 6-year low around 1.2100.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.