Market positioning from the COT report - as of Tuesday Jan 30, 2024:

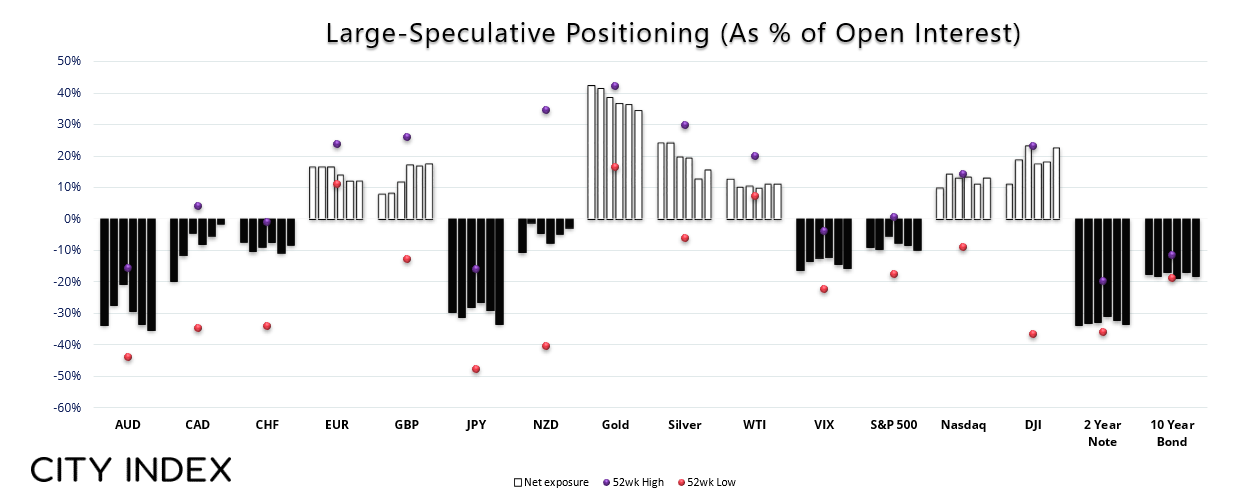

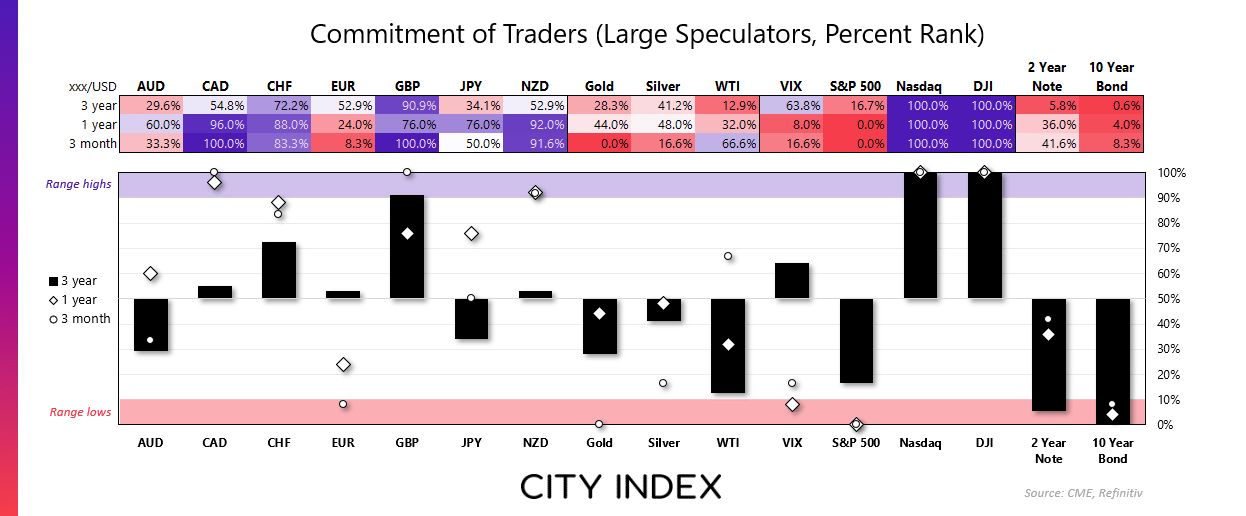

- Overall, the weekly change of net long and short exposure was on the light side for major markets

- Large speculators increased net-short exposure to AUD and JPY futures

- Net-long exposure to EUR and gold futures were trimmed

- CAD futures traders increased net-long exposure by 14% and trimmed shorts by -3%

- Net-long exposure to GBP/USD futures rose to a 20-week high

- Large speculators and asset managers trimmed long exposure to gold futures for a fourth week

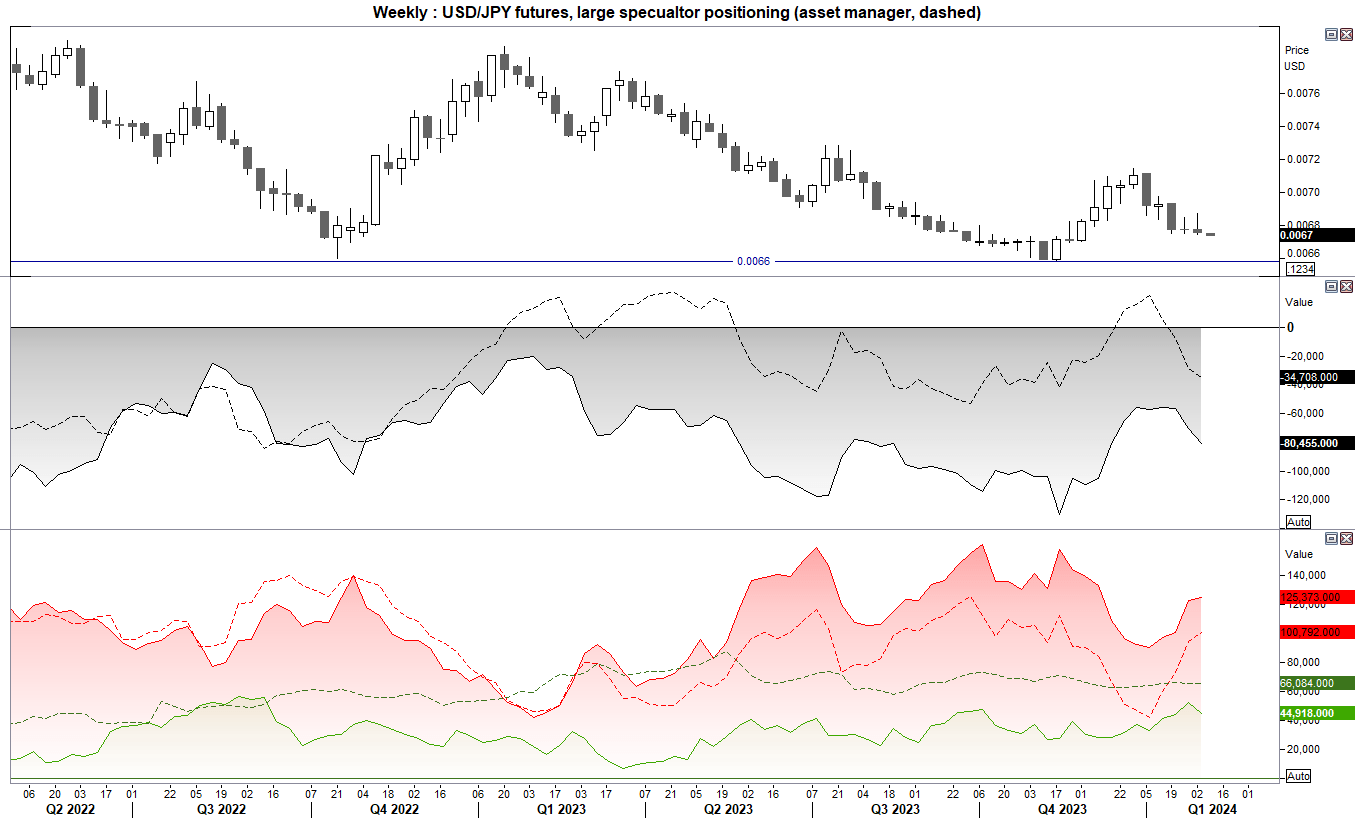

JPY/USD (Japanese yen futures) positioning – COT report:

I noted in last week’s COT report that asset managers had increased their short exposure to the yen by 28%. Whilst their appetite for new shorts has lost some momentum, it is worth noting that they have increased shorts and trimmed longs for four consecutive weeks. Large speculators also reduced their long exposure by 14%, which was their first week in four and at the fastest pace since nine. Net-short exposure among large speculators rose to an eight-week high, and shows the potential to rise further over the coming weeks, given the BOJ’s ultra-dovish policy and the Fed’s reluctance to cut rates as fast as the markets are pricing in. And that brings a move and potential break above 152 in focus for USD/JPY.

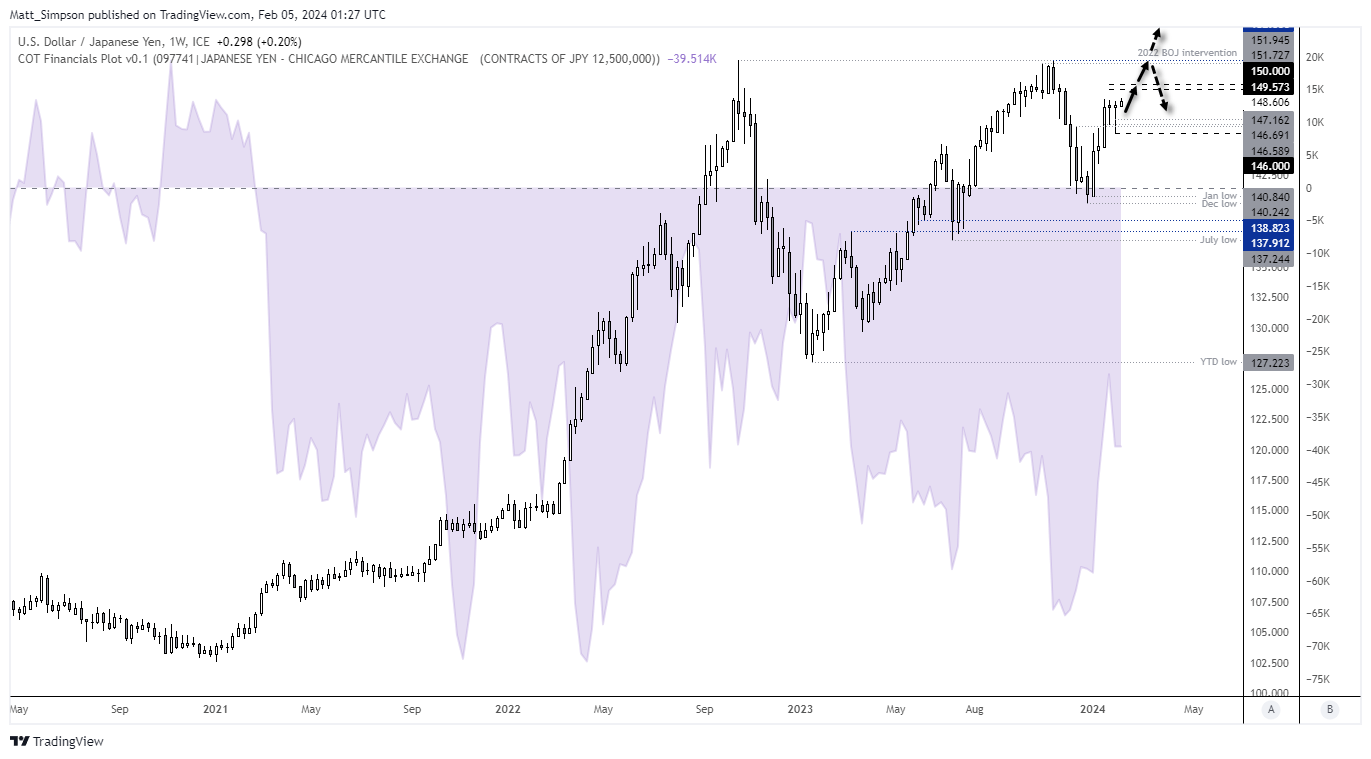

USD/JPY technical analysis (weekly chart):

The weekly chart shows that a bullish pinbar formed last week to show demand around 146. This week I’m looking for pullback within last week’s range to help increase the potential reward to risk ratio for longs. 150 is an obvious target, but given the Fed pushing back on five rate cutes and the BOJ’s ultra-dovish policies, my bias is now for a move to 152. Clearly this is a bog level as it wasn’t allowed to test it without a BOJ intervention, so I remain open minded to its potential to break above it or roll over once more.

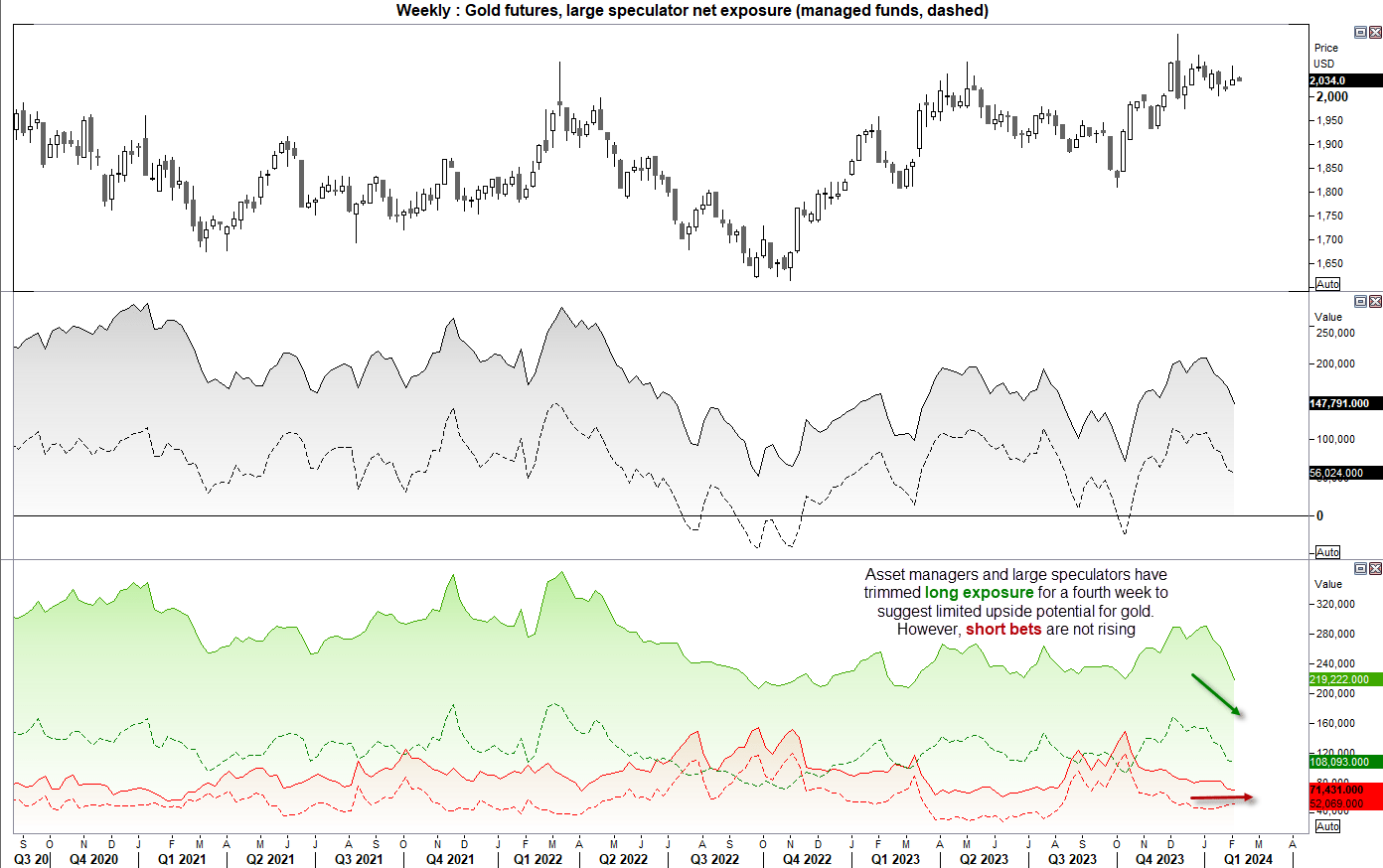

Gold futures (GC) positioning – COT report:

Large speculators and managed funds trimmed long exposure to gold futures for a fourth week, which has dragged net-long exposure to a 3-month low. Yet that is not to say gold is looking for a heavy selloff with short bets remaining relatively low and effectively flat. Perhaps gold will remain in a choppy range at elevated levels.

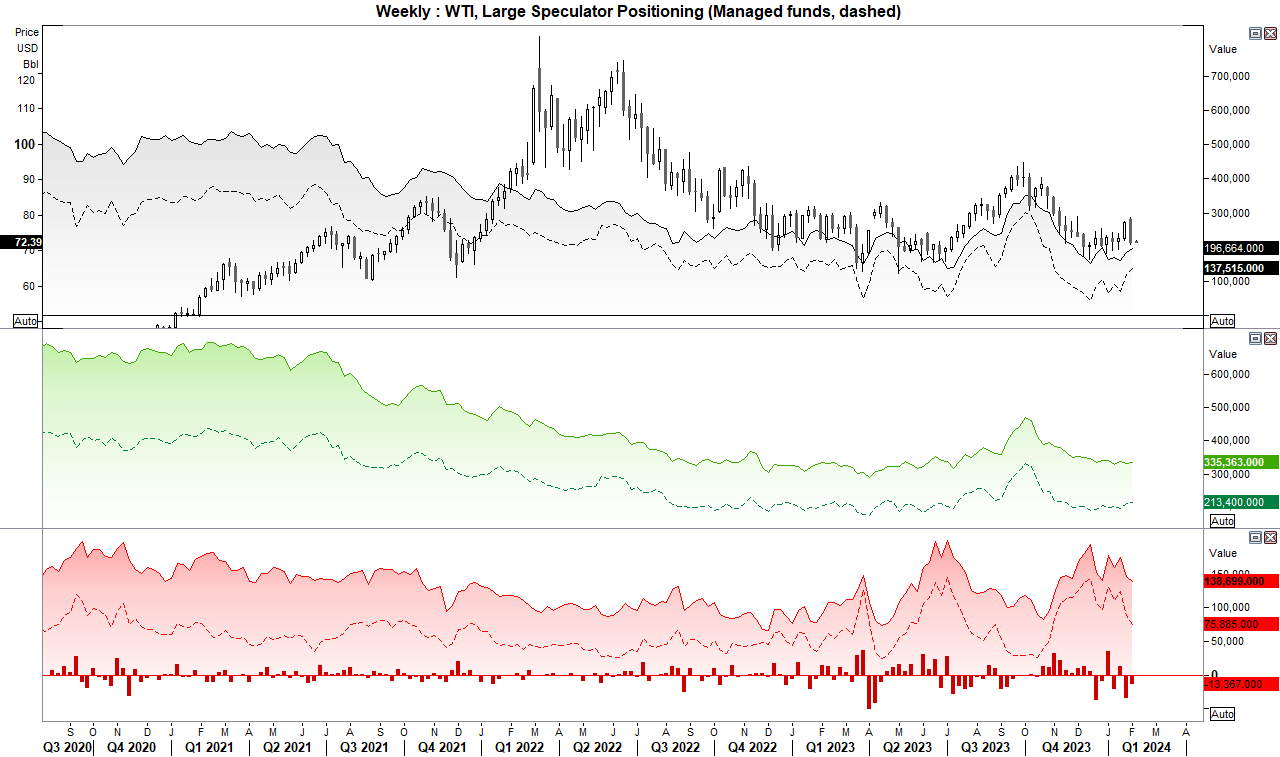

WTI crude oil (CL) positioning – COT report:

Reports of a ceasefire in Gaza saw crude oil fall for a third consecutive day on Friday, to mark its worst week since early October. Large speculators and managed funds had been trimming their short exposure during the short-covering rally, but we should assume many have returned since Tuesday – when the COT data was compiled. Think the big question is whether bears have enough appetite to drive crude oil prices sustainably below $70, and my assumption is that they do not. Besides, we’ve seen crude oil rally back above $70 each time is dips int the 60’s as OPEC come to the rescue. So perhaps the best course of action is to step aside and eek evidence of a swing low.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade