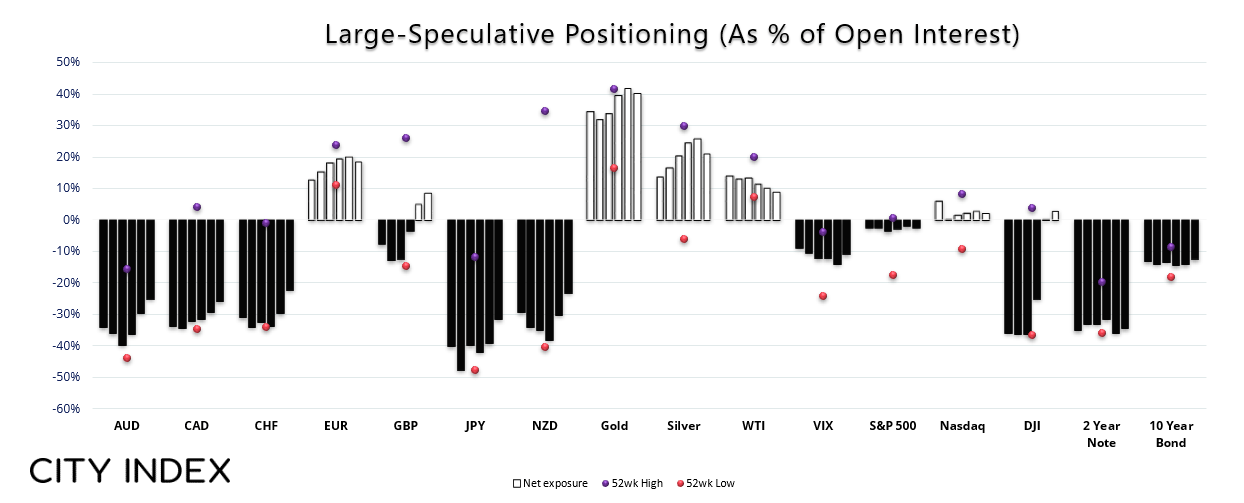

Market positioning from the COT report - as of Tuesday 12th December 2023:

- Large speculators increased their gross-short exposure to crude oil for a ninth week

- Net-short exposure to JPY/USD futures fell to a 19-week low

- Net-short exposure to AUD/USD futures fell to an 18-week low

- Large speculators were bullish on GB/USD futures for a second week

- Net-short exposure to the US 10-year bond note fell to a 37-week low

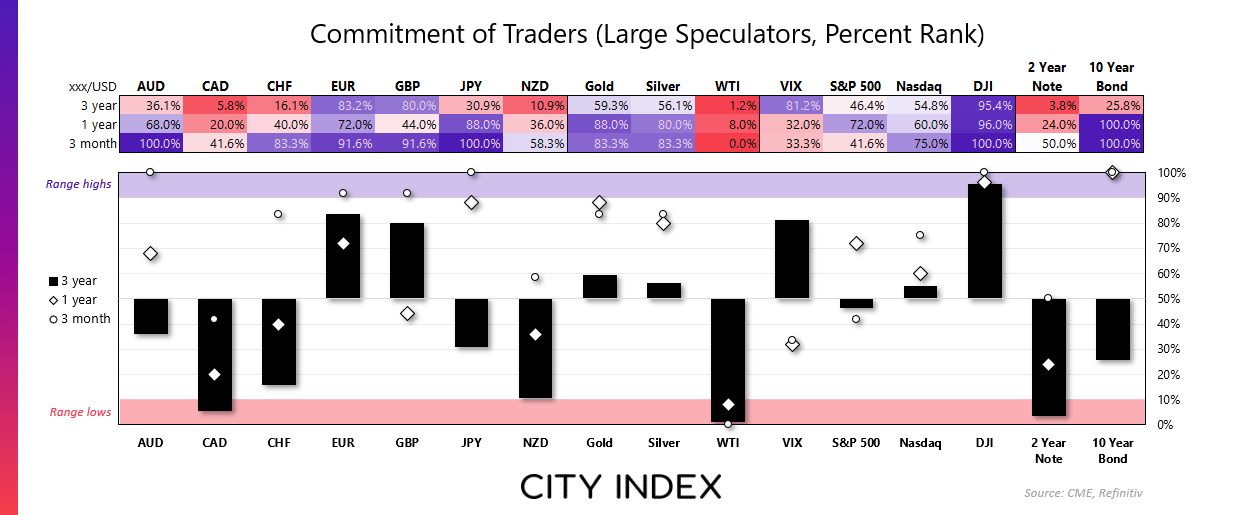

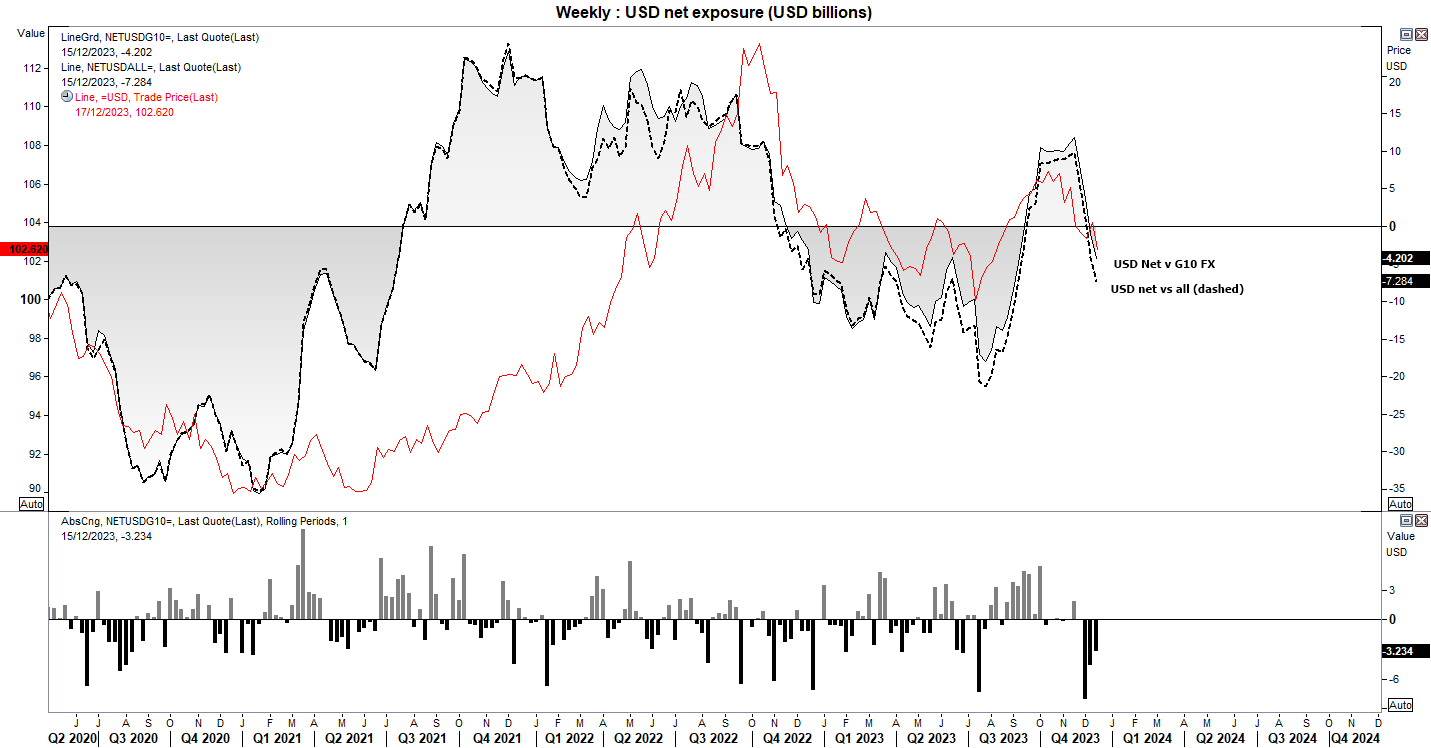

US dollar index positioning – COT report:

Traders were net-short the US dollar for a second consecutive week, according to data compile by IMM (International Monetary Market). They were also the most bearish on the US dollar in three months across all pairs and G10 currencies. The fact they flipped to net short before the Fed’s dovish pivot suggests there could be further downside for the US dollar, but when you consider it has fallen -3.8% over the past 10 weeks then one should be on guard for a technical bounce or two along the way.

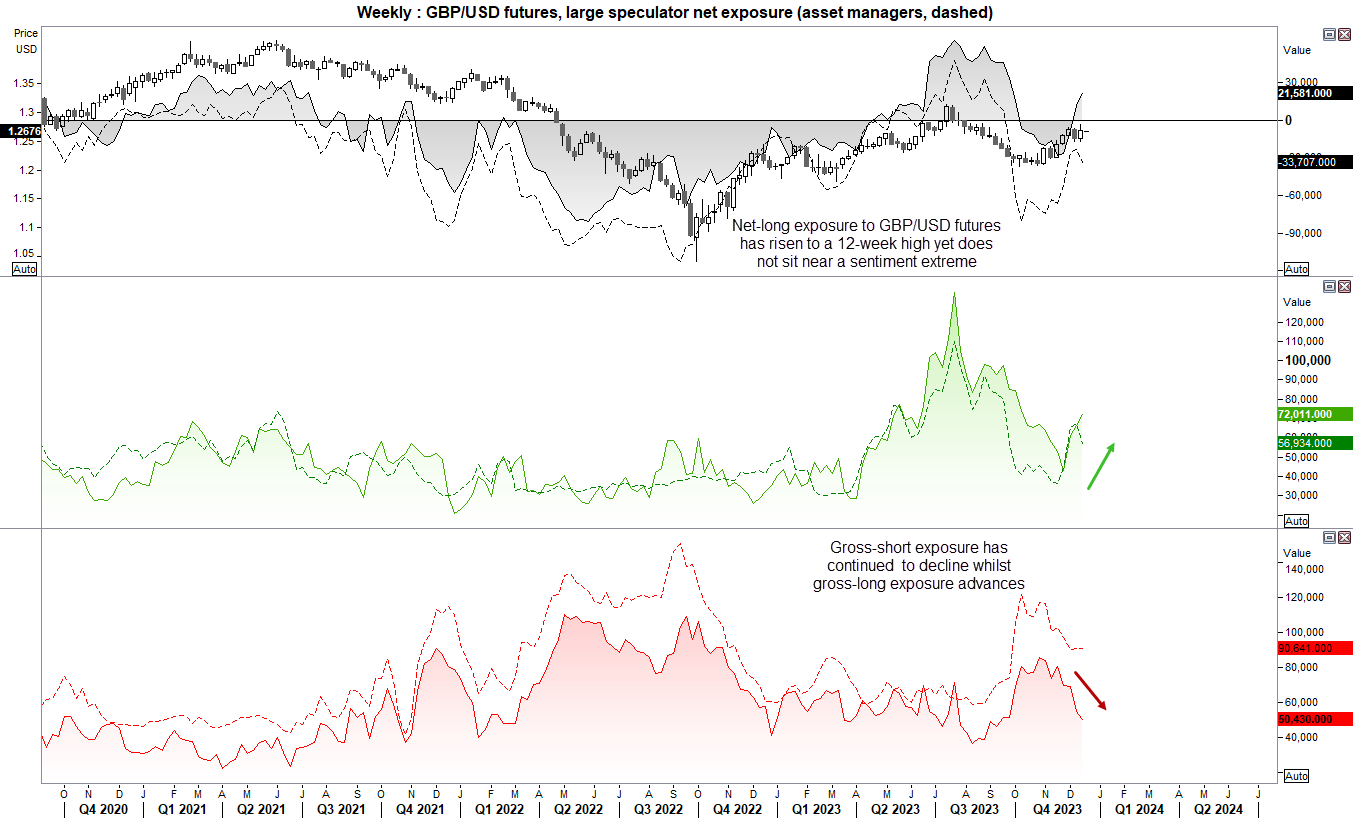

GBP/USD (British pound futures) positioning – COT report:

Large speculators were their most bullish on GBP/USD futures in 12 weeks last week. And that was before the BOE pushed back on hopes of an early rate cut. Short interest has continued to fall whilst long interest has perked up, which suggests there could be further upside for the British pound in the weeks ahead.

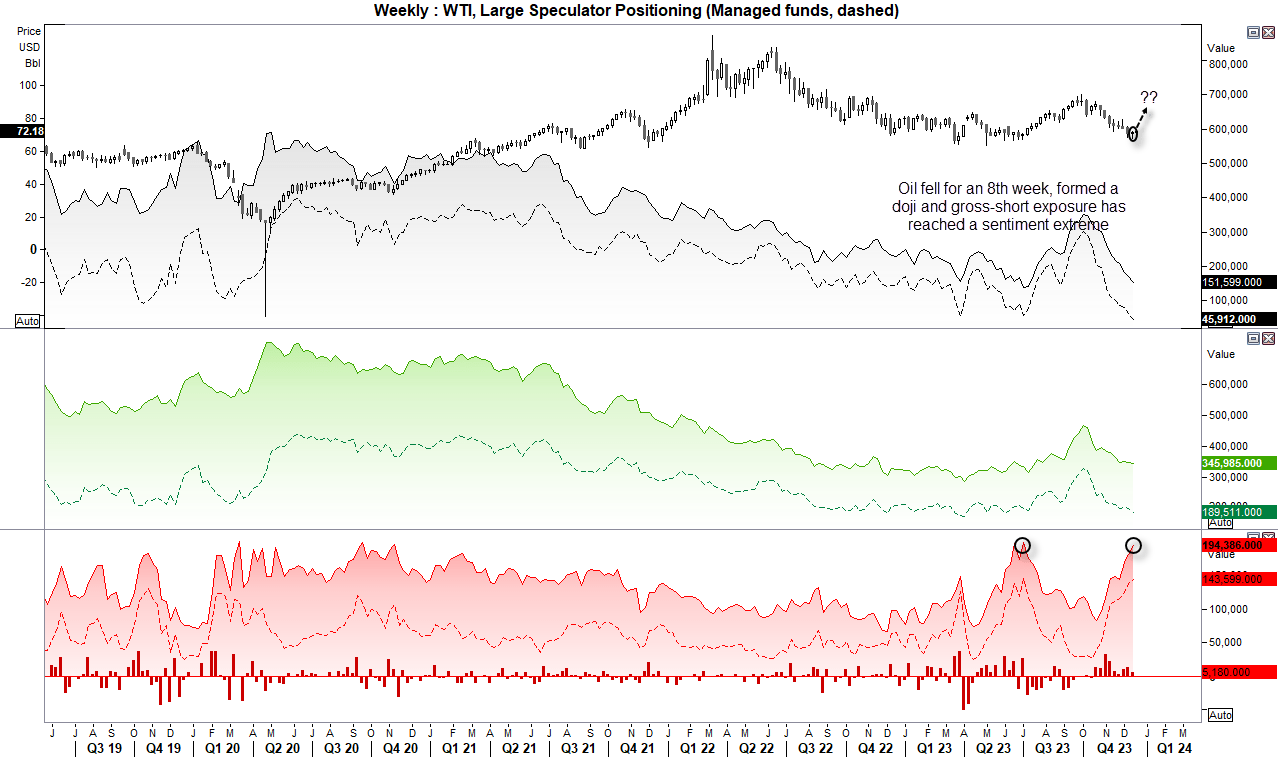

WTI crude oil (CL) positioning – COT report:

Crude oil has fallen nearly 30% over the pasty 11 weeks. That stat along should be enough to make one wary of shorting crude oil around current levels, but we also have the fact that large speculators increased their gross-short exposure for a ninth consecutive week and pushed their exposure to a level which could be considered a sentiment extreme. Add in the fact that oil has fallen for eight consecutive weeks and formed a doji week, then the case for a countertrend bounce becomes quite appealing.

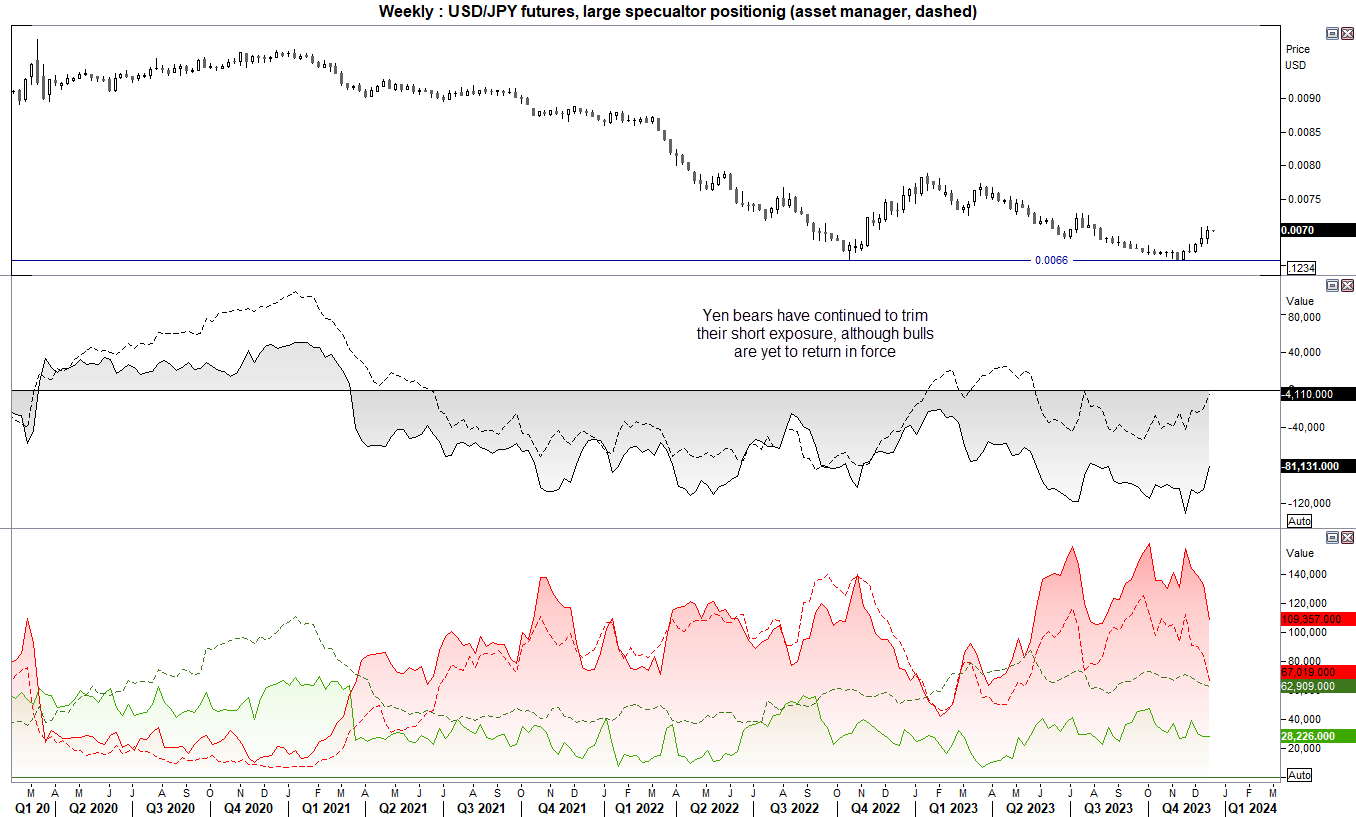

JPY/USD (Japanese yen futures) positioning – COT report:

Traders continue to trim their gross-short exposure to the Japanese yen, although it should be noted that bulls are yet to return in force. This has helped USD/JPY fall to a 4-month low and break beneath its 200-day average and suffer its worst week in five months. However, given it has fallen for five consecutive weeks, USD/JPY bears may want to be cautious around current levels and be on guard for a technical bounce – even if the bias is for a weaker pair in the months ahead.

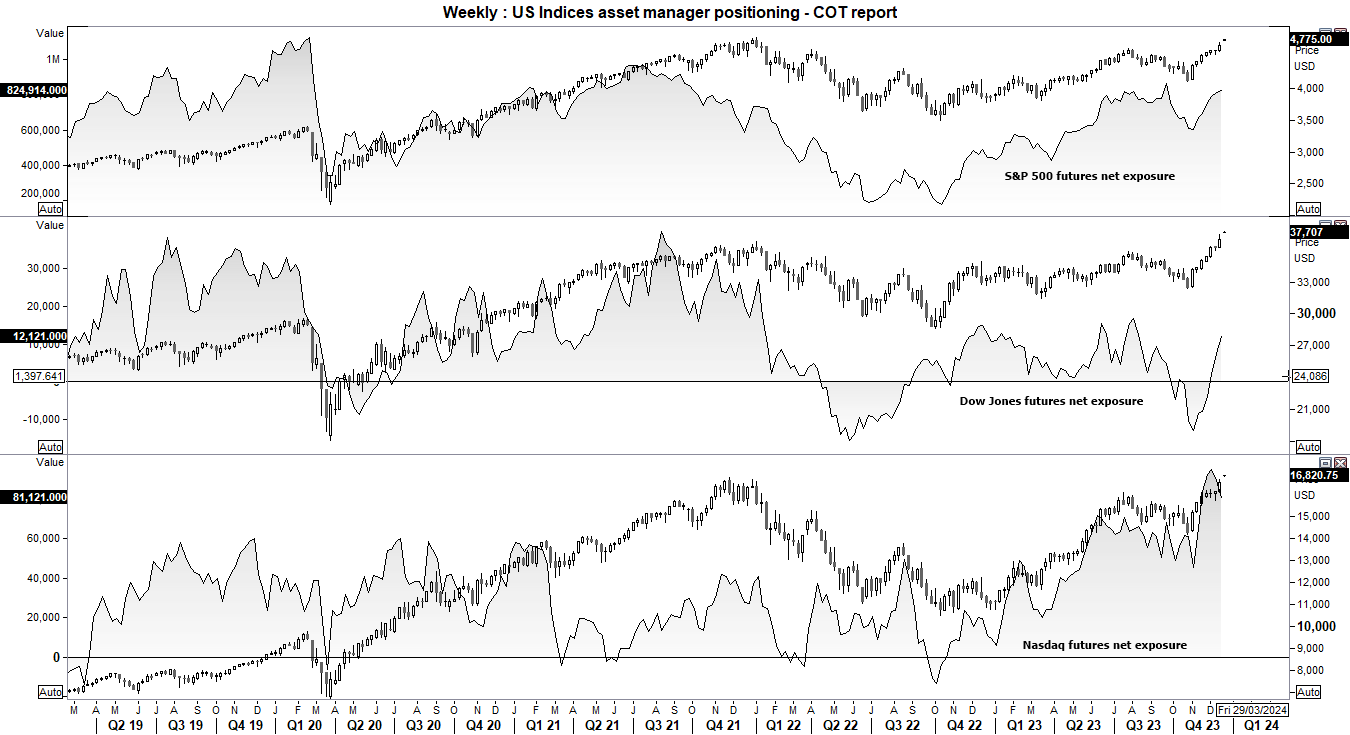

S&P 500, Nasdaq 100, Dow Jones positioning – COT report:

The relentless rally on US indices continues. The Dow Jones reached a record high last week and asset managers are now their most bullish in 19 weeks, yet do not appear to be at a sentiment extreme. We’re now in the second half of December, a time of year associated with strong gains. But will history repeat, given we have already seen a strong rally in the first half of the month? Futures markets have just opened for the week and have gapped higher, which indicates they have every intention of bidding the markets higher in line with their seasonal tendency. But traders would be wise to see how the S&P 500 and Nasdaq 100 react around their record highs, because a pullback from those levels also suggests a pullback on the Dow Jones.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade