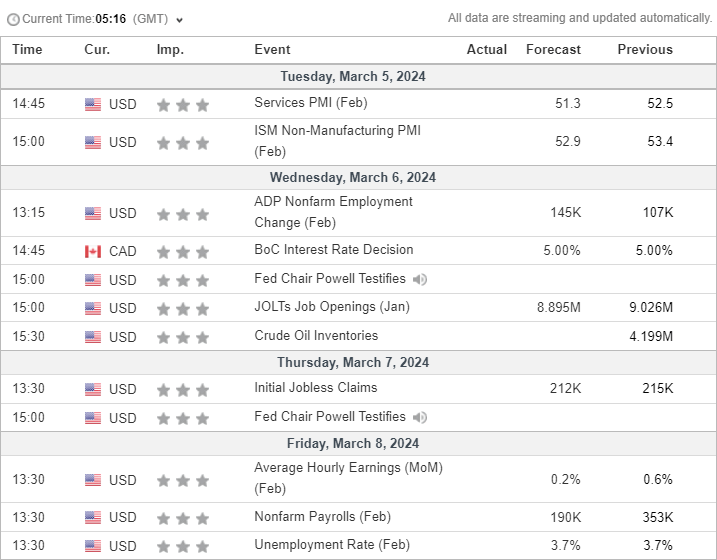

Looking through the economic calendar reveals a jam-packed list of potential market-moving events for USD/CAD. FOMC member Harker speaks on Monday, then on Tuesday the US release the ISM non-manufacturing survey, durable orders and the S&P Global final PMI figures. Fed vice chair Barr also speaks on Wednesday ahead of ADP employment figures, which can set the tone for NFP later in the week. The Bank of Canada (BOC) announce their interest rate decision, just before Jerome Powell testifies to the House Committee, just as JOLTS job openings are released alongside Canada’s Ivey PMI report. The BOC then hold their press conference, before Fed Daly speaks.

Later on Thursday, Challenger job cuts are also released ahead f jobless claim figures for the US. Building permits for Canada are then released ahead of Jerome Powell’s second day of testimony. Then on Friday attention shifts to the monthly nonfarm payrolls report. Also note that Canada release their employment data alongside NFP figures.

And this means that USD/CAD could be in for a volatile week. But for the data to provide a clean and directional move, a divergent theme must appear between the US and Canada. The Fed are continuing to push back on cuts, but if weak ISM manufacturing data is anything to go by, US data could potentially underperform this week, weigh on the US dollar and drag USD/CAD lower.

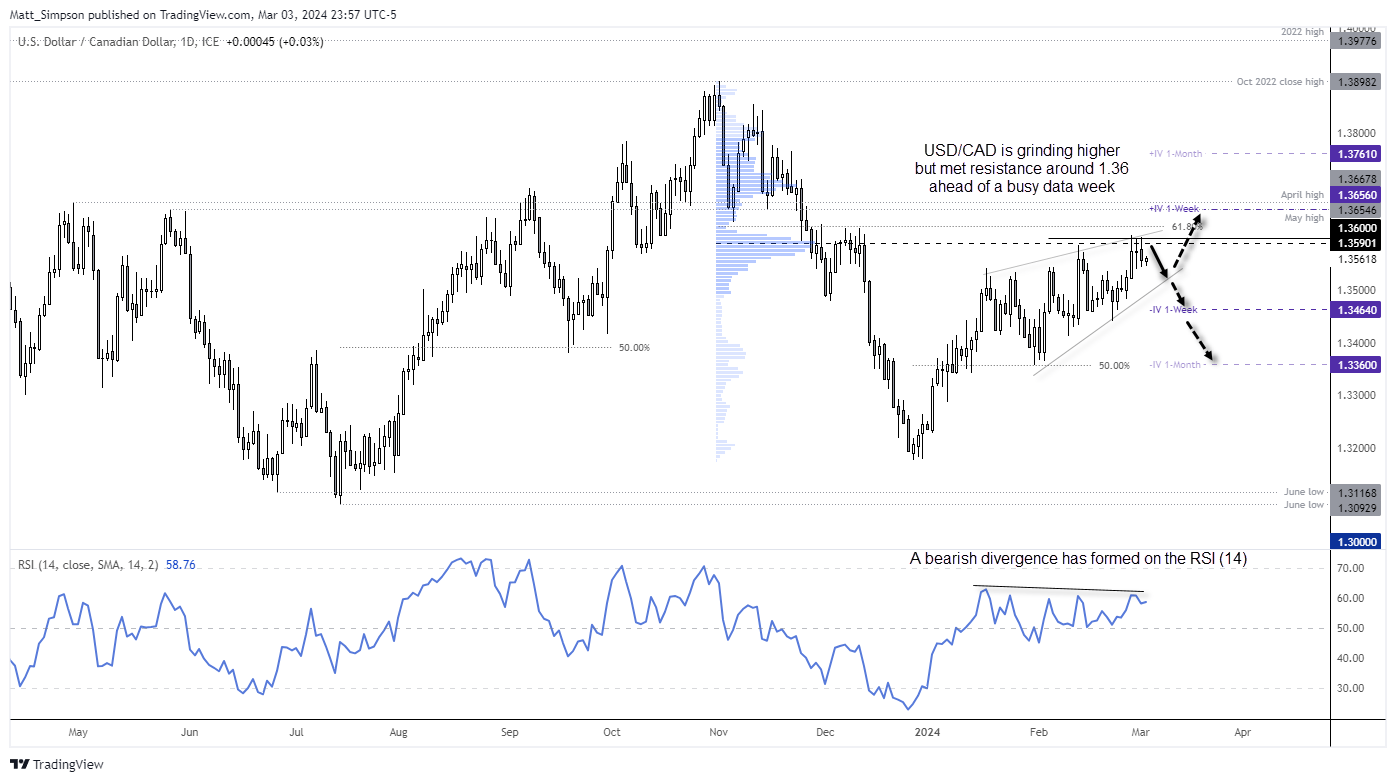

USD/CAD technical analysis:

The daily chart shows USD/CAD is in an uptrend, although it has been making hard work of gain since the middle of January. A bearish divergence between prices and the RSI (14) shows a loss of bullish momentum. It also appears that a rising wedge is forming - which is a bearish reversal pattern that projects a target near its base around 1.3366. Also note that this lands on the lower 1-month implied volatility band.

Even if prices remain within the rising wedge for a while longer and prices grind out a new high, it still leaves some wriggle room within the wedge and for prices to at least dip lower. Therefore, the bias at the beginning of the week is to fade into retracements towards Friday’s high with a stop above, for a near-term short position within the wedge. Should US data underperform and the BOC not deliver a dovish meeting, then a break below 1.350 is on the cards which would confirm the bearish wedge pattern and bring the lows around 1.3366 into focus.

Source: TradingView / ICE

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade