US futures

Dow futures +0.4% at 33900

S&P futures +0.5% at 4150

Nasdaq futures +0.85% at 13934

In Europe

FTSE +0.6% at 6976

Dax +0.18% at 15241

Euro Stoxx +0.3% at 3990

Learn more about trading indices

US stocks charge higher

A strong start to the US earning season is set to send stocks higher on the open. Yesterday US banks reported very strong results which has been replicated by Bank of America today. Citigroup are set to report before the open.

US banks are considered proxies for the US economy, therefore strong earnings boost sentiment lifting the broader market.

Upbeat earnings from PepsiCo and Blackrock are also boosting futures.

Retail sales & jobless claims smash forecasts

In addition to earnings there has been plenty of impressive data to digest indicating that the US economy is firing up. With a strong vaccine rollout in addition to fiscal stimulus and lose monetary policy the recovery is picking up pace.

Retail sales rebounded impressively in March after a weak showing in February. Retail sales jumped 9.8% MoM, up firmly from a -2.2% decline in February and well ahead of forecasts of 5.9%. Improved weather conditions in addition to the disbursement of stimulus checks underpinned sales.

After a disappointing jobless claims report last week this week’s jobs data was a significant improvement.

Jobless claims dropped to a fresh post pandemic low of 576k, against 769k from the previous week and better than the 700k forecast.

Despite the blowout data, US treasury yields are heading lower suggesting investors have bought into the Fed’s low rates for longer mantra.

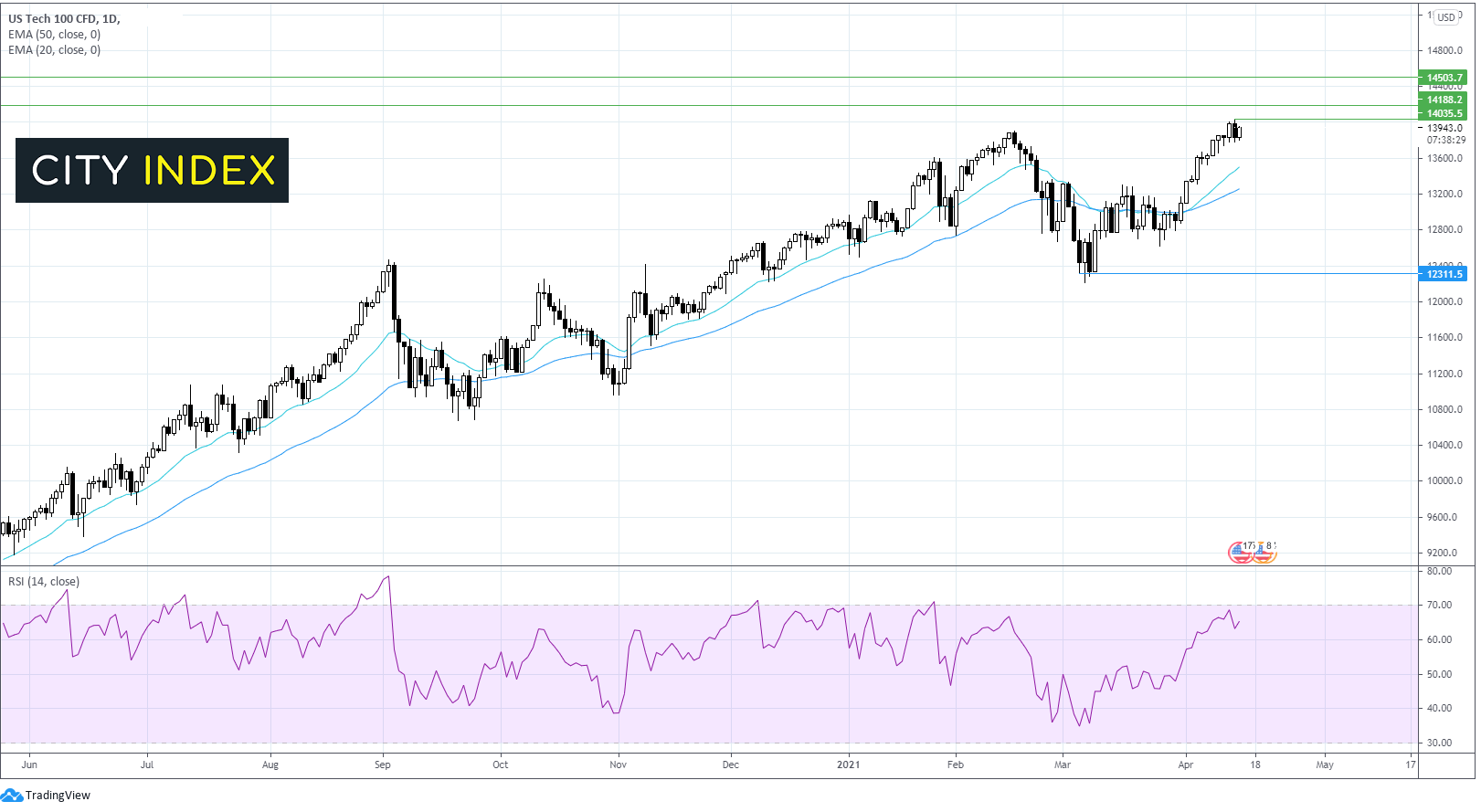

Where next for Nasdaq?

The Nasdaq is not trading on the edge of its all time high. The trend is clearly bullish, as it trades above its 20 & 50 EMA. The RSI is not in overbought territory so there could be more upside on the cards. Given that it trades at these levels there aren't many tech levels to watch. 14000 being a key resistance and then 14100 and 14200 round numbers.

On the flip side, 13590 offers support the 20 EMA on the daily chart, a break below here could negate the uptrend. Beyond here the 50 EMA comes into play at 13200.

FX – US Dollar flat post data, AUD out-performs

The US Dollar is edging lower, tracing yields southwards despite strong data. The Fed’s soothing dovish calls appear to be sinking in.

Both the Pound and the Euro are trading in a muted fashion amid a lack of fresh catalysts.

German inflation data printed in line with forecasts rising 1.7% YoY in March, up from 1.4% in February. CPI rose 0.5% MoM in March, down from 0.7% as the ongoing lockdown restricts price increases.

AUD/USD is outperforming peers boosted by a strong jobs report. Australian job creation beat forecasts in March and unemployment declined to a one year low.

AUD/USD +0.24% at 0.7742

GBP/USD +0.02% at 1.3781

EUR/USD -0.1% at 1.1965

Oil consolidates after strong rally

After surging over 4% in the previous session, oil is consolidating around monthly highs.

Stronger than forecast inventory data combined with demand outlook upgrades by both the EIA and OPEC in the previous session was music to the ears of oil traders.

EIA crude oil stock revealed a 5.9 million barrel draw a significantly deeper draw than the 2.9 million barrels forecast.

Expectations of a strong economic recovery in the US and UK is helping the growth outlook picture. Meanwhile news that Germany is still aiming to have 20% of the population vaccinated by the end of April adds to the positive picture.

US crude trades -0.25% at $63.04

Brent trades -0.2% at $66.24

Learn more about trading oil here.

The complete guide to trading oil markets

15:00 US business inventories Feb

03:00 China GDP