US futures

Dow futures +0.34% at 35870

S&P futures +0.35% at 4710

Nasdaq futures +0.25% at 16291

In Europe

FTSE +0.45% at 7352

Dax +0.8% at 15692

Euro Stoxx +0.7% at 4247

Learn more about trading indices

Omicron fear ease

US stocks are heading for a positive start as Omicron fears continue to recede and optimism surrounding the economic outlook builds.

All major US indices are set to end the week higher as an increasing number of studies show that fewer patients need hospital treatment with Omicron compared to Delta. This raises expectations that the Omicron variant won’t derail the global economic recovery.

Adding to the upbeat news, AstraZeneca confirmed that three doses of its COVID vaccine provides protection against Omicron, meanwhile Novavax has said that two shots of its COVID vaccine triggered an immune response to Omicron.

Data wise, investors had plenty to digest. US PCE index, the Fed’s preferred measure for inflation rose to 5.7% in November, up from 5% in October and ahead of the 5.7% forecast.

Initial jobless claims fell last week to 205k, down from 206k the previous week and in line with forecasts.

Furthermore US durable goods orders rose 0.8% MoM ahead of the 0.6% rise expected and up from 0.3% in October.

With inflation elevated and the labour market improving the data supports the more hawkish Fed that we saw in the latest Fed meeting.

The Fed in its December meeting accelerated the pace at which it tapers bond purchases and pointed to three interest rate rises in 2022.

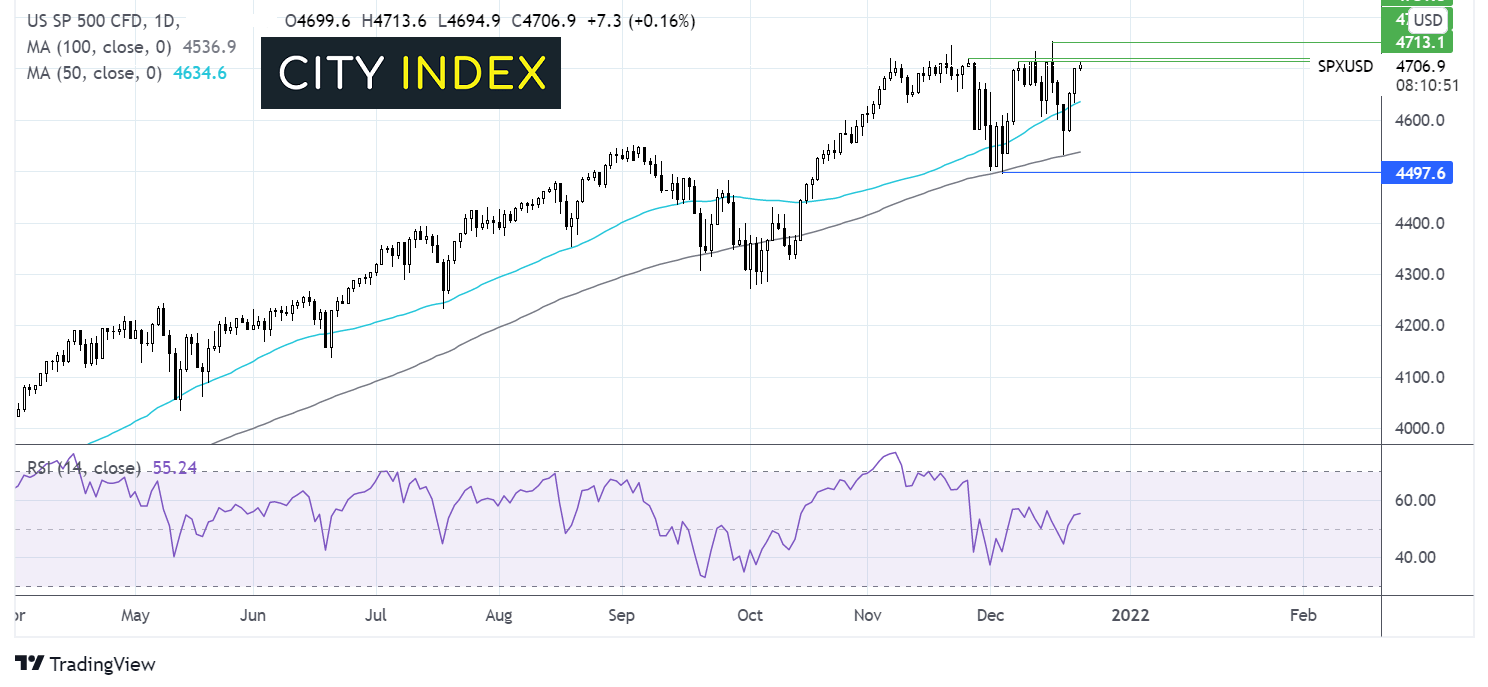

Where next for the S&P50?

The S&P500 is extending its rebound from the 100 sma reached hit on Monday. The move above the 50 sma plus the bullish RSI are keeping buyer’s hopeful of further upside. The price needs to overcome the resistance zone at 4713/20 in order to look towards 4750 and fresh all-time highs. Failure to push above this level could see the price head back towards the 50 sma at 4634, with a move below here negating the near-term uptrend. A move below 4530 the 100 sma could see sellers gain traction.

FX – USD rises, GBP retakes 1.34

The USD has traded under pressure across the week as the risk on mood has prompted investors to buy into riskier currencies. However, the greenback is rising after the US data drop supports a more hawkish Fed.

GBP/USD is trading at a monthly high on easing concerns of tighter COVID restrictions. A recent study conducted in England and Scotland showed that the Omicron variant is sending few people to hospital. Furthermore, the government agreed to hold off from announcing tighter restrictions.

GBP/USD +0.55% at 1.3425

EUR/USD -0.18% at 1.1306

Oil rises 7% in 3 days

Oil prices are moving higher for a third straight session on encouraging COVID news. Oil prices have jumped almost 7% in three days as the markets become more confident that Omicron won’t derail the economic recovery.

Upbeat news on vaccines and drug treatments for COVID is offsetting news that the Chinese city of Xian has imposed lockdown restrictions on its 13 million inhabitants.

Larger than expected drawdowns in oil inventories have also supported oil prices this week. According to the latest EIA report inventories declined by a larger than expected 4.7 million barrels.

Looking ahead the Baker Hughes rig count could provide further impetus for oil traders.

WTI crude trades +0.1% at $72.78

Brent trades +0.1% at $75.41

Looking ahead

15:00 US Michigan consumer sentiment

15:00 US New home sales

18:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.