US futures

Dow futures +0.9% at 32813

S&P futures +0.16% at 3830

Nasdaq futures -0.3% at 11400

In Europe

FTSE +0.16% at 7060

Dax -0.2% at 13144

Learn more about trading indices

GDP & jobless claims beat forecasts

After a mixed close yesterday, stocks are set to open in a mixed fashion today, with the NASDAQ still pressurized by weak big tech earnings while the DOW charges 1% higher.

Investors continue to digest a slew of earnings figures from the likes of Meta, Credit Suisse, Ford, and many other big names.

Meanwhile, the US economy grew at a faster pace than expected in Q3, growing 2.4% annualized after two straight quarters of declines. This was ahead of the 2.4% forecast. However, the headline figures mask what is happening beneath the surface. Wild swings in trade and inventories have been behind the technical recession in H1 and now this stronger-than-expected rebound.

The reality is that consumer growth, which accounts for more than two-thirds of the US economy, is slowing. The Fed is likely to pay more attention to tomorrow’s PCE data tomorrow than today’s GDP figures ahead of the next week’s FOMC meeting.

Separately jobless claims rose by less than expected at 217k, up from 217k, but less than the 220k forecast. The labour market continues to show resilience ahead of next week’s non-farm payroll.

Corporate news:

Meta trades 20% lower pre-market after disappointing earnings. The Facebook parent reported EPS $1.64, below forecasts of $1.80. Revenue also dropped across the quarter, and losses at Reality Labs widened, failing to convince investors of heavy investment in the metaverse project.

Credit Suisse trades 11% lower pre-market after reporting a huge $4 billion dollar loss, says it will slash 9000 jobs and launches a $4 billion Saudi-backed fundraising bid.

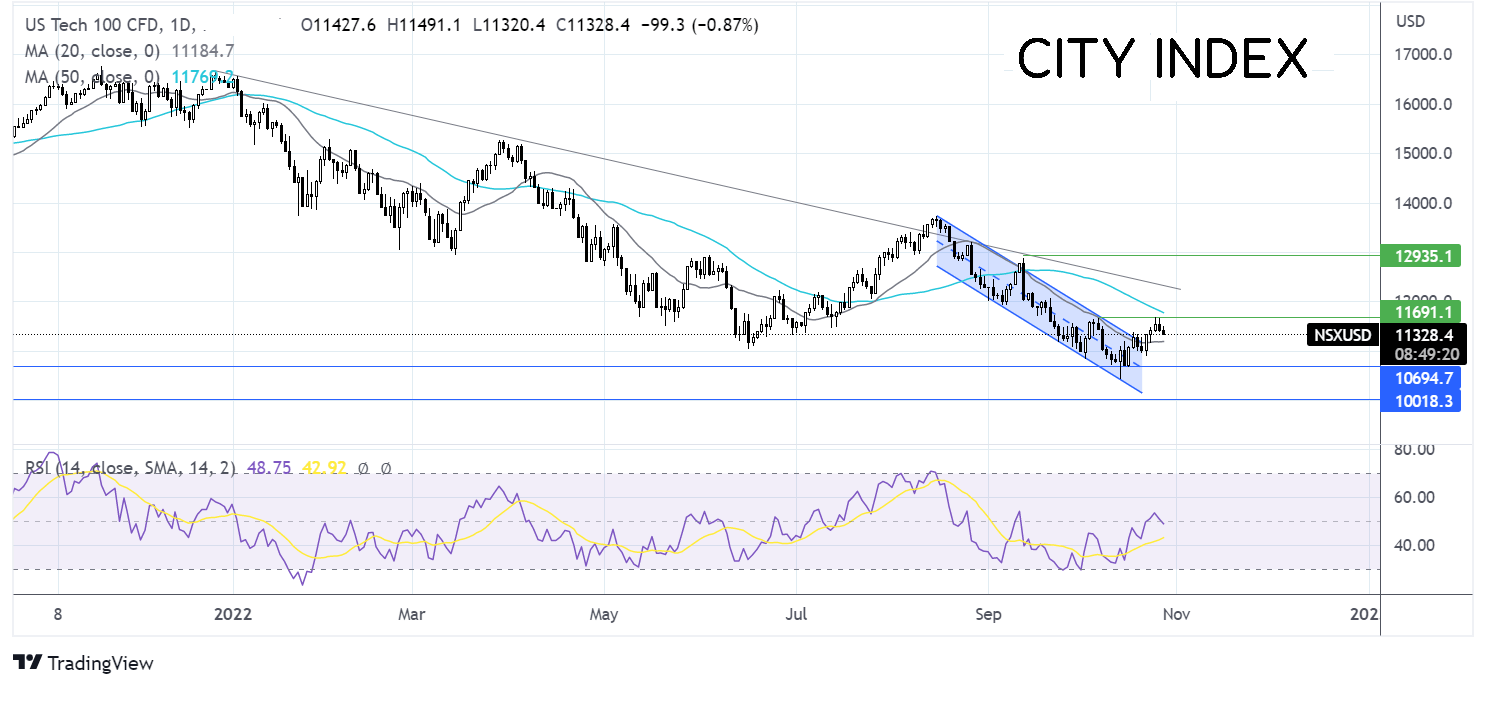

Where next for the NASDAQ?

The Nasdaq trades caught between the 50 and 20 sma, after the rebound from the 2022 low ran out of steam. The RSI is neutral. Buyers will look for a rise over the 50 sma and last week’s high around 11770 to attack the falling trendline resistance at 12450. Sellers will look for a move below the 20 sma at 11170 to open the door to a deeper selloff to 10700 and the 2022 low of 10430.

FX markets – USD falls, EUR falls

The USD is rising after five days of declines. Weak data across the week had fueled bets of a less hawkish Fed following the November meeting. However stronger than forecast Q3GDP is forcing investors to rethink. The fact is there are still few alternatives to the USD right now. The Fed is still hawkish, Europe has an energy crisis and geopolitical tensions which should boost USD demand.

EURUSD is falling after the central bank hiked interest rates by 75 basis points as expected and trimmed bank subsidies in a move to tighten monetary policy in the fight against record-high inflation. All in all, there were no surprises here; this is showing itself to be a case of buy the rumor sell the fact. Attention will now shift to Lagarde’s press conference shortly for further clues on where rate hikes could be heading in the coming meetings.

GBPUSD falling after reaching a 6-week high. The pair experienced a strong rebound following the election of Rishi Sunak and on the weaker USD. Sunak has now pushed back the UK fiscal plan to 17th November, which along with the mixed messages surrounding the plan has taken the shine off the pound.

GBP/USD -0.48% at 1.1560

EUR/USD -0.64% at 0.9998

Oil holds gains as US exports rise

Oil prices are holding steady on Thursday after strong gains in the previous session. Oil jumped 3% in the previous session, boosted by optimism over record US crude oil exports.

US crude oil export data is often considered an indicator of demand levels. High exports show higher demand which is encouraging and even overshadowed data that showed that crude oil stockpiles rose.

Plenty of questions still remain over demand in China. As the new five-year term for Xi Jinping begins, strict zero COVID policies are set to remain.

Attention will start turning to the OPEC+ meeting next week. The group caught the market off guard last month with a 2 million barrels-a-day output cut.

WTI crude trades +0.2% at $87.20

Brent trades +0.33% at $94.56.

Learn more about trading oil here.

Looking ahead

15:15 ECB Lagarde to speak