US futures

Dow futures -0.25% at 34650

S&P futures -0.07% at 4450

Nasdaq futures -0.19% at 14390

In Europe

FTSE +0.4% at 7435

Dax +0.2% at 14400

Euro Stoxx -0.09% at 3900

Learn more about trading indices

Risk aversion pulls on stocks, Fed Powell to speak

US stocks are pointing to a mildly lower start on Monday, with the Ukraine crisis in focus and as oil prices jump higher.

Ukraine defied a Russian demand for its forces to surrender in Mariupol, and peace talks continued without any tangible breakthrough. Hopes of a peace deal boosted market sentiment last week, and shares experienced their best weekly run since November. However, that optimism is fading as days progress and bombing in Ukraine intensifies.

The economic calendar is light today. Attention is on Federal Reserve Chair Jerome Powell, who is due to speak later. His speech comes after Atlanta’s Federal Reserve Bank President Raphael Bostic said that he has included in 6 rate hikes this year, saying that bringing inflation under control was a top priority.

In corporate news:

Boeing flies 6% lower premarket after a 737 crashed in China, killing all 132 people on board. This was not one of the trouble 737 MAX range. The plane involved in the crash has a good safety record, unlike the MAX.

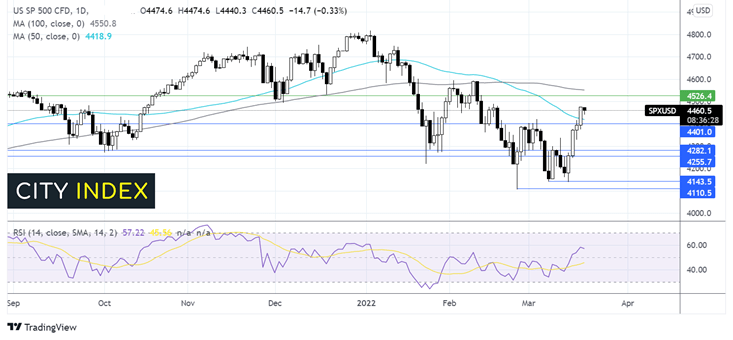

Where next for the S&P500?

The S&P extended its rebound from 4140 in mid-March, retaking some key points of resistance and the 50 sma. The rally has run into resistance at 4575 last week’s high, although the RSI suggests that there is more upside to be had. Buyers will want to see a move over 4475 in order to open the door to 4530 a level which has offered support and resistance on several occasions across the past 6 months, with a break over here exposing the 100 sma at 4550. On the flip side, it would take a move below 4400 to negate the near-term uptrend. A move below the 4280-60 zone could see sellers gain traction.

FX markets USD rises, EUR pares losses

USD is heading higher, with the focus still squarely on the Ukraine crisis. Federal Reserve Chair Powell is also due to speak later today and could fresh direction to the market. The Fed hikes interest rates 25 basis points last week and pointed to six more interest rate rises this year, although the US Dollar index fell across last week in a buy the rumor sell the fact move.

EURUSD is falling despite upbeat comments from ECB President Christine Lagarde who said that she doesn’t see signs of stagflation for now. Her comments come as inflation is expected to continue surging and growth slow following the Russian invasion. Lagarde said even in the bleakest scenario she still sees growth of 2.3%

GBP/USD -0.29% at 1.3137

EUR/USD -0.1% at 1.1040

Oil rallies on EU sanction concerns

Oil prices are on the rise, paring losses from the previous week as supply concerns return. With few signs of the conflict in Ukraine easing, fears are growing that the EU will consider sanctioning Russian oil. EU leaders and President Biden will speak to discuss a tougher Western response to the Russian war.

Separately, a Houthis attack on Saudi oil site, causing as temporary decline in output adding jitters to an already nervous market.

Separately the latest OPEC report revealed that producers are still failing to meet their output quota, which raises the question whether it is worth lifting output further if the production quotas can be reached.

WTI crude trades +3.5% at $107.21

Brent trades +3.4% at $110.21

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.