US futures

Dow futures -0.16% at 35552

S&P futures -0.2% at 4529

Nasdaq futures -0.27% at 15356

In Europe

FTSE -0.45% at 7213

Dax -0.07% at 15520

Euro Stoxx -0.23% at 4159

Learn more about trading indices

Supply chains issues reflected in results

US stocks are set to open lower on Thursday as investors digest the latest corporate earnings from Tesla and IBM and rising inflation concerns as treasury yields climbed higher.

Cost pressures and the impact of inflation is already proving to be a key theme in earnings. Concerns over higher prices appear to have stepped up recently and whilst they are not necessarily being reflected in this quarters numbers there are plenty of warnings that they in the coming quarter. So far 84% of S&P companies have seen earnings beat forecasts.

Tesla is set to open lower despite record sales and profits. Net profit beat forecasts at $1.6B. However, revenue came in slightly below Wall Street’s estimates. Tesla’s shares were priced for perfection and whilst record breaking, the numbers weren’t quite perfect, with revenue letting the side down -just. Whilst the EV maker managed to show supply chain resilience this quarter, doubts are growing that will be the case in the coming quarters. Upcoming factory and supply chain headwinds in addition to labour shortages are expected to start being reflect in numbers from this coming quarter.

Concerns surrounding Evergrande and the potential fallout across China’s property sector also plagued the market. The property sector, which makes up around 30% of the economy could experience some fallout as Evergrande appeared to take another step closer to default after the collapse of a $2.6 billion asset sale.

On a more upbeat note, US jobless claims unexpectedly fell to a new post pandemic low. However the market failed to react to the news.

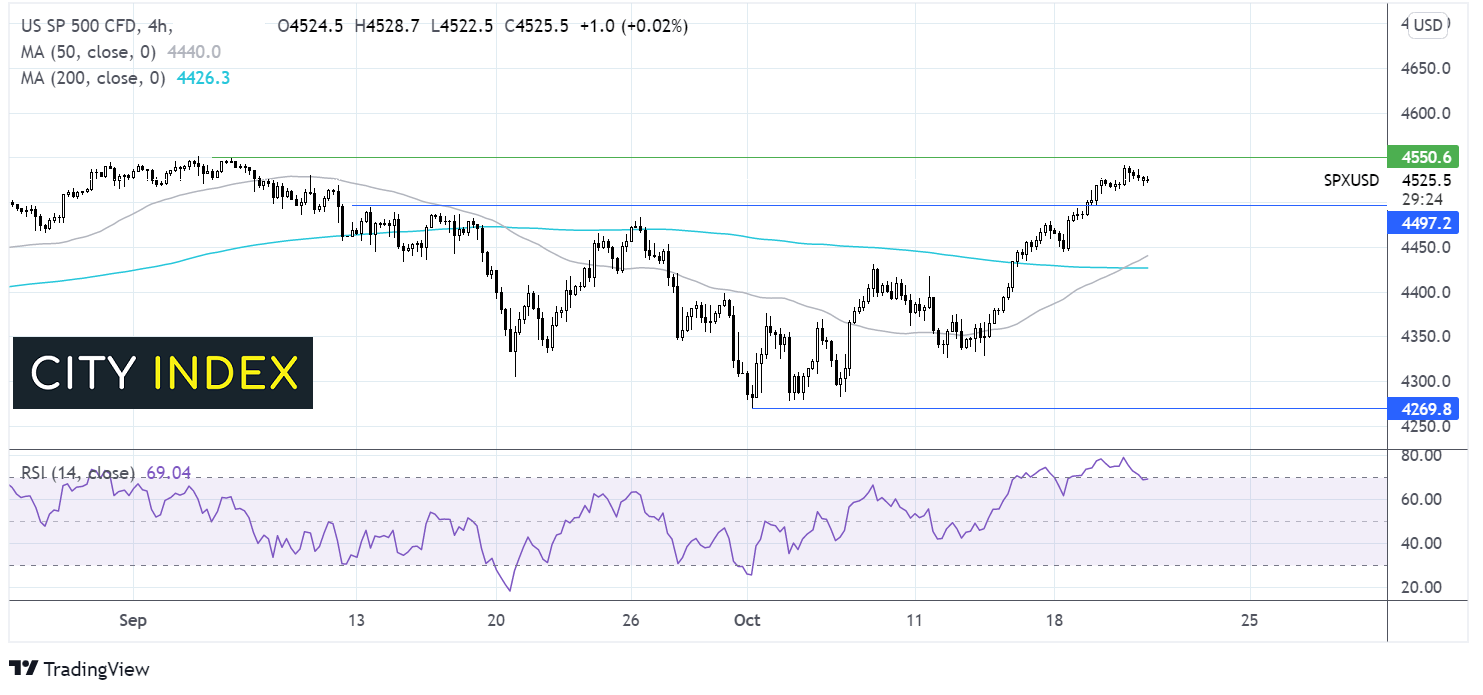

Where next for the S&P 500?

The S&P500 has rebounded off the October low of 4270 and has extended gains above the 50 & 200 sma and key resistance turned support at 4500. The 50 sma has crossed over the 200 sna in a bullish sign. The RSI is moving out of overbought territory suggesting today’s sell off could be technical. Support can be seen at 4500. Meanwhile buyers will be looking for a move over 4550 for fresh all time highs.

FX – USD rises, AUD falls on evergrande fears

The US Dollar is attempting to climb higher boosted by safe haven flows. US jobless and Federal Reserve speakers are in focus.

EURUSD slips lower, whilst Eurozone CPI rose to a 13 year high in September ECB members have been quick to talk down the prospect of any rate rise.

AUSUSD – China proxy the aussie is under performing after briefly hitting a 15 week high, on fears over the fallout of a collapsed Evergrande asset sale. There are still no guarantees that the Chinese property giant can meet its $305 billion debts, triggering a default.

GBP/USD -0.14% at 1.3804

EUR/USD -0.14% at 1.1634

Oil eases, uptrend remains intact

Oil prices hit a fresh multi-year high before easing back. Tight supply and the ongoing energy crunch keep oil prices elevated. The pull back is looking like a technical correction as prices have been overbought for some time, the rally is looking a little overstretched.

The latest EIA stockpile data revealed a surprise draw on inventories of 431k barrels compared to the almost 2-million-barrel build forecast. Inventories at the Cushing hub facility in US fell to a 3 year low.

Sentiment remains upbeat towards oil whilst OPEC keep output increases slow and demand outstrips supply.

An area to watch would be China’s plans to lower the price of coal. Coal prices tumbled 11% today. Further falls of this magnitude could help ease demand for oil as an alternative source of power generation.

WTI crude trades -0.7% at $82.79

Brent trades -1.0% at $84.47

Learn more about trading oil here.

Looking ahead

15:00 Eurozone consumer confidence

15:00 US Existing Home Sales

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.