US futures

Dow futures -0.4% at 34845

S&P futures -0.5% at 4448

Nasdaq futures -0.62% at 14523

In Europe

FTSE -0.3% at 7568

Dax -0.2% at 15352

Euro Stoxx -0.5% at 4126

Russia's next steps still unclear

US futures are set for a weaker start as investors continue evaluating the latest developments in eastern Europe. Whilst Russia said that some troops are moving back from the border, NATO said that they haven’t seen any de-escalation yet. The situation is still very fluid and very fragile, which is keeping investors on edge. The coming days will be crucial and could test the market’s nerve.

Riskier assets are once again out of favour, with safe havens such as the Japanese yen and Gold in recovery mode.

US retail sales smashed forecasts rising the most in 10 months in January, despite Omicron spreading. Sales jumped 3% MoM, after dropping -1.9% in December. The data shows that supply chain disruptions and 40-year high inflation didn’t stop consumers spending, a point that the Fed will no doubt take note of. Strong sales have done nothing to calm inflation fears and will keep the Fed focused on the path to normalization.

Looking ahead the minutes to the latest Fed meeting will be released. However, they could be considered out of date. The meeting occurred before the 7.5% inflation print and before the stellar jobs market report. Even so, investors will be scrutinizing the minutes for clues over the likelihood of a 50-basis point rate hike in March. In the press conference following the meeting Fed Chair Powell said that he was open to hiking rates at ever meeting this year, so the minuets could still have a significant hawkish tilt.

In corporate news:

Airbnb has proved to be one of the few travel firms that has benefitted from the pandemic. Airbnb reported a record quarterly revenue as City travel is back to pre-pandemic levels. Growth is expected to continue.

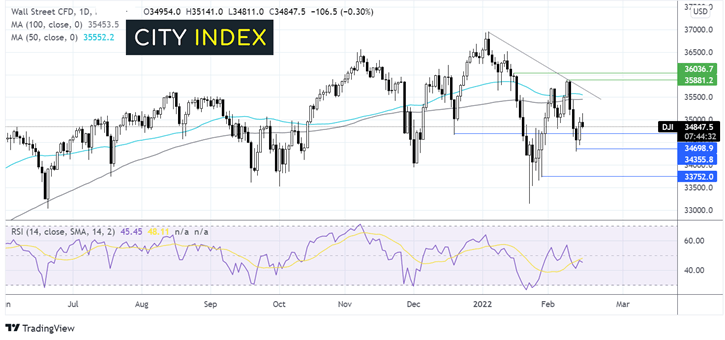

Where next for the Dow Jones?

The Dow Jones trades below its 50 & 100 sma and below its falling trendline from the start of the year. The RSI is also showing bearish signals below 50 and pointing lower. Sellers would need to take out support at 34700 to test 34300 the Feb 14 low. On the flip side buyers would need to re-take the 50 & 100 sma to break at 35450 & 35550 in order to test 35900. A move above here could change the bias to a bullish trend.

FX markets USD falls, GBP rebounds

The USD is falling but has picked up off session lows, as investors continue assessing developments in eastern Europe. US retail sales helped to lift the US dollar.

GBP/USD is rising after UK inflation rose to 5.5% YoY in January, ahead of 5.4% forecast and up from 5.4% in December. High inflation, which is rising at a faster pace than wages is starring to hit UK households. The BoE could be tempted to raise interest again after a rate hike in December and February.

GBP/USD +0.12% at 1.3552

EUR/USD +0.07% at 1.1367

Oil rebounds

Oil prices are on the rise, recouping some of yesterday’s 3.5% losses. Russia said that it had pulled some troops off the Ukraine border yesterday, cooling tensions and sparking a selloff in oil. Today, reports from NATO say that it has not seen any de-escalation. Biden also warned yesterday that an invasion was still very likely.

Separately, oil supply remains tight, which has supported prices since the start of the year. API data revealed that inventories declined last week. EIA stockpiles are due to be released shortly. Expectations are for a 1.5-million-barrel draw.

WTI crude trades +1.3% at $91.50

Brent trades +1.3% at $93.10

Looking ahead

14:15 US industrial production

15:30 EIA crude oil stockpiles

19:00 FOMC minutes

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.