US futures

Dow futures -0.44% at 34700

S&P futures -0.5% at 4494

Nasdaq futures -0.8% at 14553

In Europe

FTSE -0.3% at 7480

Dax -1.4% at 14350

Euro Stoxx -1.56% at 3886

Learn more about trading indices

Stocks pare yesterday’s gains

US stocks are pointing to a softer open as investors continue digesting the more hawkish stance adopted by the Fed and ahead of President Biden’s trip to Europe to discuss more sanctions on Russia.

Fed speakers across the spectrum, from the typically more dovish leaning officials to the hawks, support a more aggressive path to hiking interest rates. The bond market bore the brunt of the more hawkish Fed outlook yesterday, with a record selloff in treasuries. Instead, investors are putting their money into stocks, resulting in the three leading indices on Wall Street posting substantial gains.

Today the sell-off in the bond market is stabilizing, and yields are rising; stocks are falling. Fed speakers will remain in focus amid a relatively light economic calendar.

President Biden is also due to meet with his European peers to discuss further measures to pressurize Moscow as the Ukraine war continues.

Oil prices are climbing again, which is adding to concerns over already high inflation, hurting market sentiment.

In corporate news:

Tencent ADR’s trade lower after reporting 8% revenue growth, the slowest growth since its listing as it grapples with a regulatory crackdown.

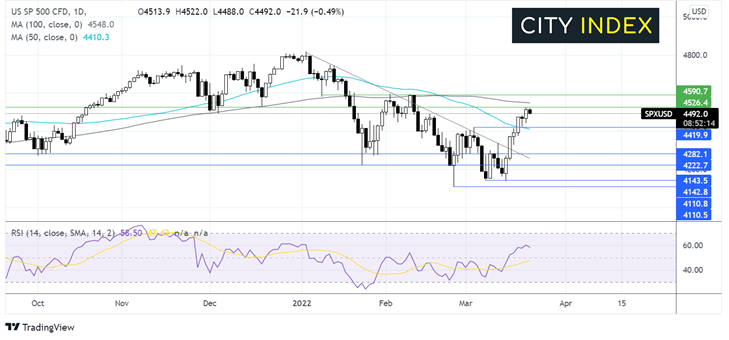

Where next for the S&P500?

The S&P 500 has been extending its rebound from 4150 the March 15 low, breaking above the 50 SMA but ran into resistance at 4530, the December 20 low. The RSI remains in bullish territory, suggesting that there could be more upside to be had. Buyers would need to break above 4530 to expose the 100 sma at 4550 before looking to 4590, the February high. Meanwhile, support can be seen at 4420, March 3 high, and 50 sma, a move below here could negate the near-term uptrend, opening the door towards 4280, the October & late January low.

FX markets USD rises, GBP drops.

USD is heading higher for a fourth straight session on rising expectations of a more hawkish Fed. Fed speakers this week have been clear that they are on a mission to tame rising inflation. The market is now pricing in a 70% probability of a 50 basis point interest rate rise in the next FOMC meeting in May.

GBPUSD is falling after data showed that UK CPI jumped to 6.2% YoY in February, well above the 5.5% recorded in January and above the 6% forecast. The 30-year high inflation will add pressure to the BoE to hike rates again for a fourth time in May. The pound is falling on fears that higher rates could hit the UK, the growth outlook hard.

GBP/USD -0.4% at 1.3171

EUR/USD -0.16% at 1.0999

Oil rises on supply concerns, falling inventories.

Oil prices are rising on Wednesday as concerns about oversupply continue to haunt the market. Not only is the market concerned about the ongoing supply hit from the Russian war, but now Kazakhstan’s crude exports via the CPC pipeline are also under the spotlight.

Oil supply through the CPC pipeline on Russia’s Black sea coast has stopped completely after damage caused by a storm. Repairs are expected to take around six weeks. The pipeline carries about 1 million barrels per day, equating to around 1% of the global oil supply.

Less supply in an already tight market is a recipe for higher oil prices. Add into the mix the latest API crude oil stockpile data, which shows that inventories fell by 4.3 million barrels well below the estimated 100k barrel rise, and it’s easy to see why oil trades over $115 per barrel.

EIA crude oil inventory data is due later today.

WTI crude trades +2.5% at $112.06

Brent trades +2.58% at $115.87

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.