US futures

Dow futures +0.04% at 34825

S&P futures -0.26% at 4444

Nasdaq futures -0.86% at 15197

In Europe

FTSE -0.03% at 7050

Dax +0.3% at 15570

Euro Stoxx +0.15% at 4165

Learn more about trading indices

Stocks are set to open mixed with Fed speakers in focus this week.

US stocks are set for a mixed open on Monday, as futures pared earlier gains and investors questioned whether global growth can survive a slowdown in Chinese growth, an energy crunch and the Fed tapering support.

US treasury yields have jumped to a three month high ahead of Fed speeches and expectations that the Fed will look to rein in bond purchases before the end of the year. As a result, investors are rotating into cyclicals at the expense of the high growth tech stocks, keeping the Dow Jones in the red which the tech heavy Nasdaq slumps on the prospect of tighter policy from the Fed. Industrials such as Caterpillar and 3M tend to benefit from an economic rebound are on the rise,

US durable goods orders came in better than forecast, rebound by 1.8% MoM in August, up from -0.1% in July. The upbeat data supports the view that the US economy is recovering well and ready for bond purchases to be tapered.

Energy stocks are also firmly in demand as oil trades at a 3 year high.

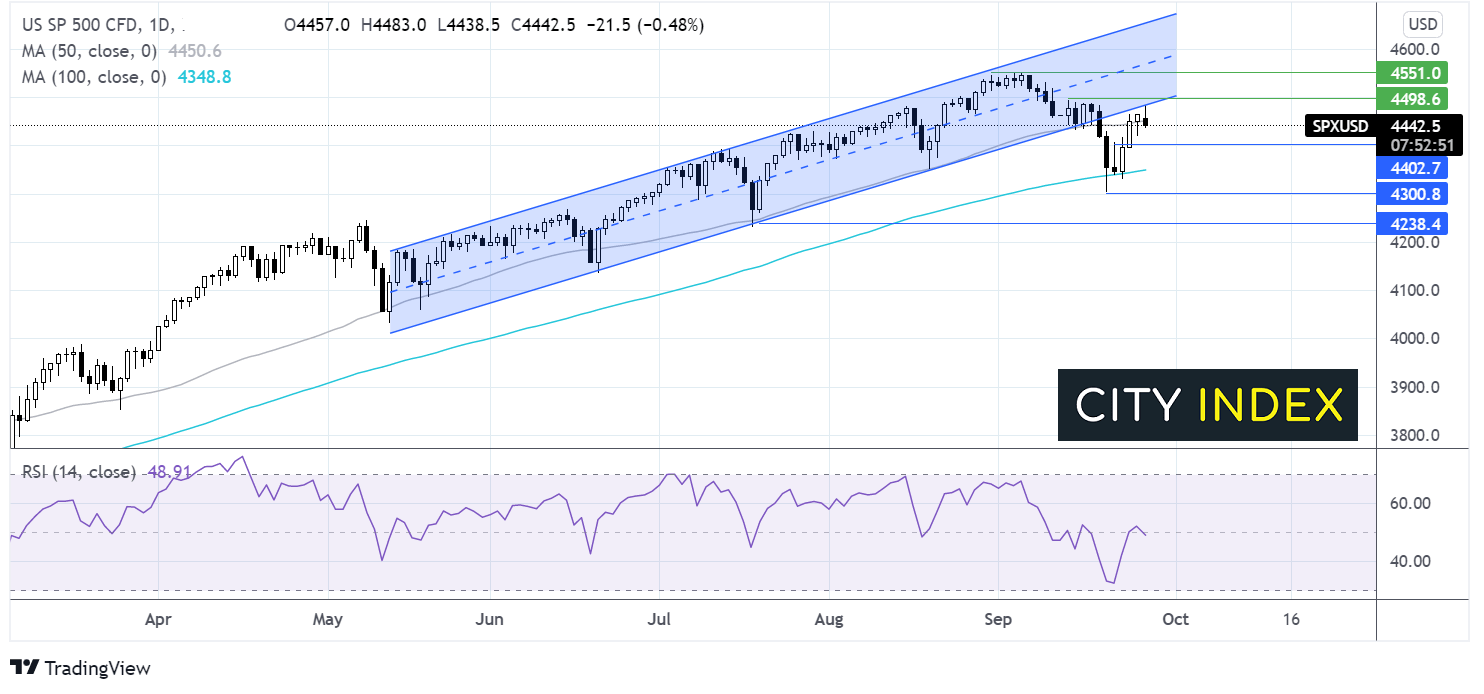

Where next for the S&P

The S&P broke out of the rising channel within which it had been trading since mid-May. The price found support on the 100 sma and pushed higher retaking the 50 sma. The RSI is neutral. However, the shooting star candle suggests that reversal could be on the cards. Immediate support is being tested at 50 sma 4450. A break below here could see 4400 horizontal support tested before exposing the 100 sma at 4350. Any move higher would need to retake 4494 last week’s high to target 4550.

FX – USD rebounds, EUR slips post election

The US Dollar is trading higher despite the upbeat mood in the market. The greenback is tracing treasury yields higher after last week’s FOMC.

EUR/USD – The Euro is struggling to rise after the German elections. The SPD centre left party narrowly won the elections. However, coalition talks are starting and could go on for some time. The prospect of lengthy coalition negotiations is weighing on demand for the Euro. A speech by ECB President Christine Lagarde is eyed later today.

GBP/USD +0.2% at 1.3704

EUR/USD -0.15% at 1.1706

Brent trades at 3 year highs

Oil prices are rising for a fifth consecutive session and trading at fresh three year highs amid supply tightness and draws on inventories. US inventories are at the lowest level for over two years.

Surging gas prices are also driving oil prices higher as oil becomes a comparably cheaper alternative for power generation.

OPEC members are also struggling to raise output owing to under investment or maintenance delays from the pandemic.

Goldman Sachs has upwardly revised its oil outlook to $90 per barrel.

WTI crude trades +1.05% at $74.79

Brent trades +1.05% at $78.28

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.