US futures

Dow futures +0.01% at 34409

S&P futures +0.1% at 4260

Nasdaq futures +0.15% at 14050

In Europe

FTSE +0.4% at 7187

Dax +0.46% at 15767

Euro Stoxx +0.57% at 4153

Learn more about trading indices

Mixed data shrugged off, all eyes on the Fed

Stocks are pointing to a flat start, hovering around record high as the Fed’s two day policy meeting kicks off and as investors digest the latest retail sales and PPI numbers.

Retail sales dropped by a more than expected -1.3% in May. Expectations had been for a -0.8% decline. However, April’s sales were upwardly revised from 0% to +0.9%. The net effect across the two months was positive.

Meanwhile wholesale inflation as measured by PPI rose a larger than expected 0.8% MoM in May.

The mixed data hasn’t raised any eyebrows in the market. The market has barely responded with few brave enough to take big positions ahead of tomorrow’s Fed announcement. The big question is whether the Fed will start, very slowly, introducing taper talk and the debate surrounding reining in ultra-lose monetary policy.

Equities have rallied to record highs and bond yields have eased to three month lows creating a good runway for the Fed to introduce taper talk. We could expect to see some volatility should the Fed start to talk taper.

Equities

Oracle will be in focus after reporting EPS $1.31 on revenue of $11.02 billion for Q4 ending May 31.

Boeing trades -0.5% lower and will be under the spotlight after the US and EU call a truce on the 17 year dispute over aircraft subsidies to the plane manufacturer.

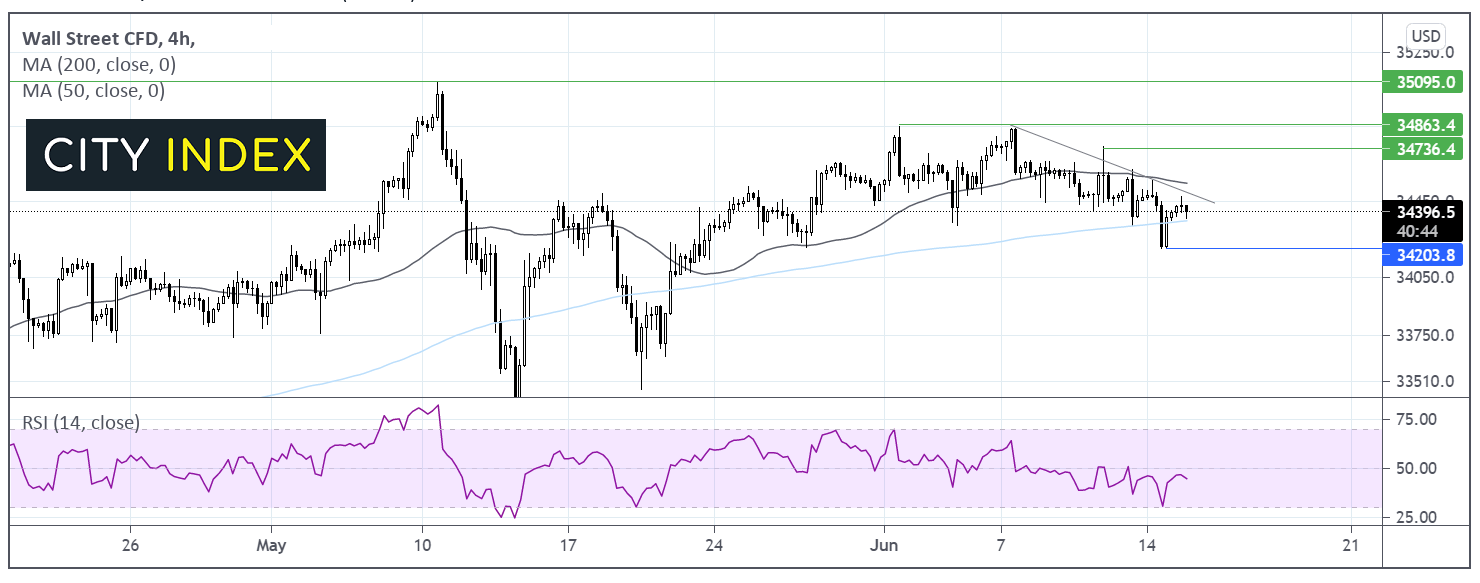

Where next for the Dow Jones?

The Dow has been trending lower over the past week. Despite attempting to tick a few points higher today, it remains below the week old descending trendline. The Dow also trades below it 50 sma on the 4 hour chart. However, it is finding support on the 200 sma. Any move higher would need to retake the ascending trend line resistance at 34500 and the 50 sma at 34550. It would take a move above 34730 for the bulls to gain traction and attach 34850. Any move lower would need to break below the 200 sma at 34350, bringing 3422 into view. A breakthrough this level could prompt a bigger sell off.

FX – USD edges lower, GBP declines despite strong jobs data

The US Dollar is on the rise as the FOMC meeting begins and investors weigh up the possibility of the Fed starting to talk about tapering its asset purchases.

GBP/USD trades under pressure despite upbeat UK jobs data. Unemployment ticked lower to 4.7% in the three months to April, in line with forecasts and down from 4.8% in March. The number of people joining the payroll also surged to a record high in May of 197,000 as indoor hospitality re-opened. Still after Boris Johnson delayed the final lifting of restrictions the Pound remains under pressure. Brexit is also a drag.

GBP/USD -0.1% at 1.4103

EUR/USD +0.1% at 1.2118

Oil jumps to fresh multi year highs

Oil prices are bounding higher recouping mild losses in the previous session. Oil trades at multi year highs amid a strong demand outlook as vaccine programmes have reopened enable economies to reopen. The EIA now sees demand returning to pre-pandemic levels by the end of 2022. This is sooner than anticipated. The EIA also urged OPEC+ to increase supply in order to meet rising demand.

One major concern for the market has been the prospect of Iranian oil returning to the market in the event that the 2015 Iran nuclear deal is revived. However talks with the US are progressing slowly and now Iranian presidential elections later this week are another disruption to that process. In short, the threat of Iranian oil flooding the market soon, has dwindled.

US crude trades +1.4% at $71.64

Brent trades +1.07% at $73.34

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:15 US Industrial Production

21:30 API Crude Oil Stock Inventories

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.