US futures

Dow futures -0.86% at 30679

S&P futures -0.97% at 3863

Nasdaq futures -1.12% at 11790

In Europe

FTSE -0.35% at 7264

Dax -1.82% at 12740

Euro Stoxx -1.26% at 3490

Learn more about trading indices

Consumer confidence data due

US stocks are pointing to a lower open, extending losses from the previous session, and are set to book steep losses across the week.

Stocks have tumbled to a two-month low following a profit warning from bellwether FedEx, which has spooked the market. The warning comes when investors are already fretting over the economic outlook amid expectations that the Fed will need to hike interest rates more aggressively to bring inflation under control.

The Fed is widely expected to raise rates by 75 basis points next week after data this week has shown that inflation remains stubbornly high, that consumers are still spending and that the jobs market is showing signs that it can still absorb more aggressive rate hikes.

Bets have been rising that the Fed could hike rates by 100 basis points. However, that could look like too much of a knee-jerk reaction from the US central bank. The Fed will likely prepare the market for more outsized rate hikes by the end of the year.

Looking ahead, US consumer confidence data is expected to show that morale rose, most likely owing to falling gasoline prices. However, improving consumer confidence is often linked to higher spending, so a stronger reading today could intensify aggressive rate hike fears.

Corporate news:

FedEx falls almost 20% pre-market after issuing a profit warning. The parcel delivery service cited the bleak economic outlook for withdrawing full-year guidance. The firm will close offices and freeze hiring to help offset falling parcel volumes.

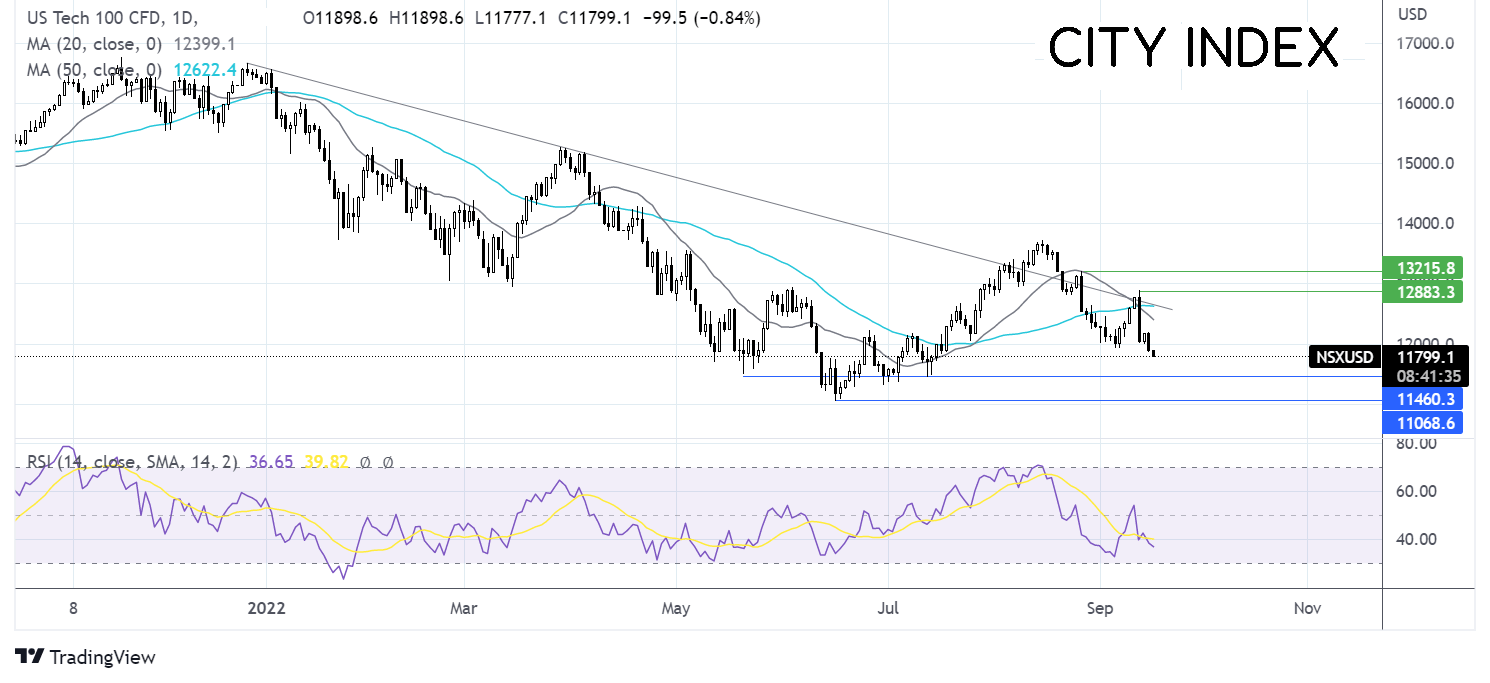

Where next for the Nasdaq?

The Nasdaq failed to close over the falling trendline resistance, falling below the 20&50 sma, and took out last week’s low of 11900. This, combined with the 20 sma crossing below the 50 sma and the bearish RSI, suggests that there is more downside to come. Sellers will look towards support around 11430 ahead of 11036, the 2022 low. On the flip side, a rise above 12650, the falling trendline resistance, would open the door to 12900, the weekly high.

FX markets – USD rises, GBP tumbles.

The USD is rising, boosted by a combination of hawkish Fed expectations and safe haven flows. The USD index is set to increase over 1% across the week as it pushed towards 110.79, last week’s high

EUR/USD is falling versus the stronger USD, despite inflation confirming the record high of 9.1% YoY. On a monthly basis, CPI was revised higher to 0.4% MoM. Comments from ECB’s Villeroy that the ECB is attentive to the exchange rate could help limit the selloff.

GBP/USD fell to a 37-year low after weaker than expected retail sales. Sales plunged -1.6% below the -0.5% decline forecast. Sales have tumbled as inflation rises, and the squeeze on households has intensified. The market considers that the BoE is more likely to hike by 50 basis points rather than 75, which sent the pound lower.

GBP/USD -0.4% at 1.1404

EUR/USD -0.3% at 0.9975

Oil rises but set for weekly declines

Oil prices are holding steady but are due to record declines across the week as expectations of slowing growth hurt the demand expectations for oil, and the price has slipped lower.

This is the second straight week of losses for oil, which come as the USD has extended gains higher. A stronger USD makes oil more expensive for buyers with other currencies, contributing to the price decline.

So far this quarter, oil has dropped 20%, the worst quarterly decline since early 2020 when the pandemic hit.

WTI crude trades +0.6% at $85.33

Brent trades 0.8% at $91.00

Learn more about trading oil here.

Looking ahead

15:00 Michigan consumer confidence

18:00 Baker Hughes