US futures

Dow futures +0.05% at 33900

S&P futures +0.11% at 4228

Nasdaq futures +0.18% at 14162

In Europe

FTSE +0.3% at 7087

Dax +0.2% at 15620

Euro Stoxx +0.1% at 4114

Learn more about trading indices

All eyes to Fed Powell

After solid gains in the previous session, US stocks are pointing to a mildly stronger start as investors weigh up the prospects of further economic growth against inflation concerns. Whilst the Dow gained an impressive 1.8% in the previous session trading ahead of Fed Powell’s testimony before Congress today is likely to be subdued.

In pre-released remarks, Powell once again reassured those inflationary pressures will be transitory whilst also expressing optimism surrounding the outlook for the economy. These comments sound familiar but they come against a backdrop of a surprise hawkish shift in the Fed seen last week.

The Fed now expects 2 interest rate hikes before the end of 2023.

Equities

Gamestop trades +8.4% pre-market after raising $1.1 billion in an offering of 5 million shares as the troubled video game retailer cashes in on the surge in its stock price this year.

Torchlight Energy trades 4.1% higher pre-market, adding to 50% gains yesterday as it becomes the latest stock to catch the attention of retail investors.

Where next for the Nasdaq?

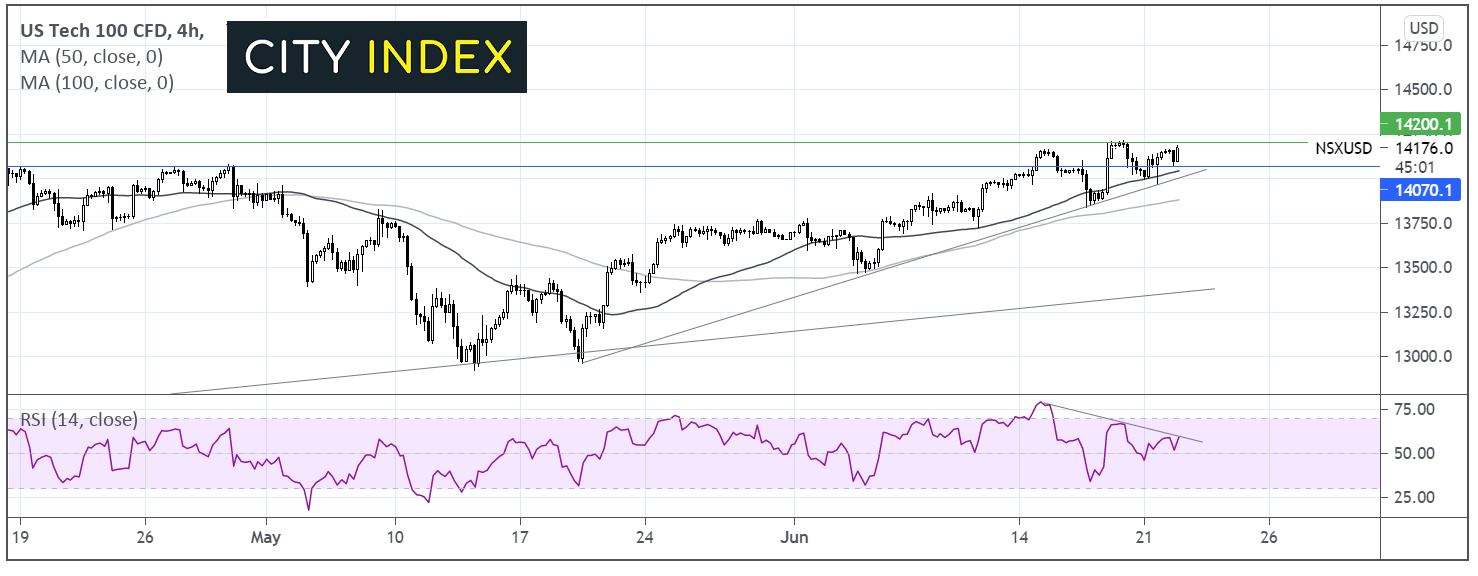

The Nasdaq trades above its 50 & 100 sma on the 4 hour chart. It also trades above its month old ascending trendline in a bullish trend. After slipping briefly below the 50 sma in the previous session, the fact that the Nasdaq has broken back above resistance at 14077 adds to the suggestion that there could be more upside to come. A break above 14209 would bring fresh all time highs. Its worth noting the RSI bearish divergence could suggest that the move higher is running out of steam. 14077 offers support now and a move below 14000 could negate the near term uptrend.

FX – USD rises, GBP eases despite better than forecast gov borrowing data

The US Dollar is one the rise, clawing back some of yesterday’s losses. US Dollar price movement has been volatile since the Fed’s hawkish surprise last week when it suggested that there could be two interest rate rises in 2023. All eyes are now on Fed Powell for further clues as to how transitory the spike in inflation might be.

GBP/USD is paring gains from the previous session. Sterling trades under pressure despite the public sector finances improving. Public sector net borrowing came in at £24.3 billion in May, down from £31.7 billion in April and better than the £26.1 billion forecast. The reopening of the economy means that tax receipts have picked up, furlough number have declined and government spending on supporting the economy slowed slightly. Whilst this is an improvement it is still the second highest level of net borrowing in May since record began.

GBP/USD -0.3% at 1.3893

EUR/USD -0.2% at 1.1897

Oil eases lower on USD strength

Oil prices are edging lower on Tuesday after booking solid 2% gains in the previous session. Oil rallied following comments from the newly elected Iranian President which suggested that he could put the brakes on the US – Iranian nuclear talks. As a result, the prospect of the US lifting sanctions on Iranian oil and it flooding back to the market faded.

A strong demand outlook continues to under pin the price of oil as economies reopening and travel picks up. However US Dollar strength is just taking the edge off demand for the black gold.

API inventory data will be in focus later after big draws on stocks piles were recorded last week.

US crude trades -0.7% at $72.56

Brent trades -0.6% at $73.73

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 US Existing Home Sales

15:00 Eurozone Consumer Confidence

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.