Gold rises ahead of Michigan consumer confidence

- Gold boosted by easing Fed bets

- US Michigan confidence expected at 67

- Gold closed above $1919, February 3 high

Gol is rising for a second straight day, thanks to a falling USD and rising expectations and rising expectations that the Federal Reserve will adopt a less aggressive approach to rate hikes given the cracks that have appeared in the US banking sector.

The worsening economic conditions are expected to avoid a less hawkish measure from the Fed when they meet next week. A week ago, expectations had been for a 50 basis point rate hike now, the market is pricing in a smaller 25 basis point hike.

Attention will now turn to US Michigan confidence data which is expected to hold steady at 67 a 13-month high. data comes after US jobless claims by more than expected yesterday, and housing starts jumped to a five-month peak.

Banking sector developments will continue to be closely followed, as well as U.S. dollar valuations and weekend flows.

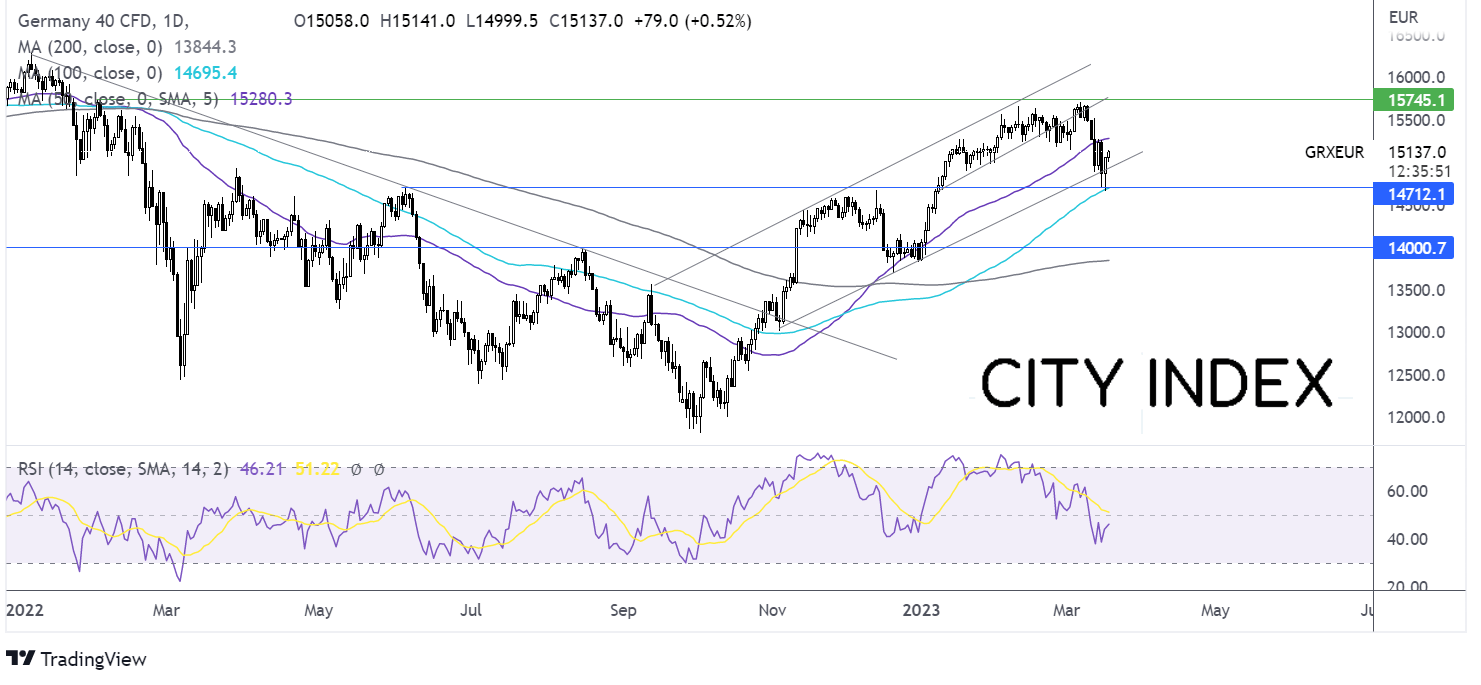

Where next for Gold prices?

After breaking out of the symmetrical triangle and rising above the 50 sma gold managed close above the February 3 high of 1919, paving the way for further gains. This, along with the RSI above 50 is keeping buyers optimistic of further upside. Immediate resistance can be seen at 1937, the weekly high I'm beyond here buyers will look towards 1960, the 2023 peak.

On the downside, support can be seen at 1908 Thursday's low, and a break below here could test support at 190,0 the round Number. It would take a move below 1895 to challenge the bullish bias.

DAX rises but is set for a steep weekly loss

- DAX rising as CS & FRC lifelines lift the mood

- Eurozone inflation to confirm 8.5%

- DAX re-enters rising channel

The DAX is pointing to a stronger start adding to gains from the previous session. However, the index is still set to full around 3% across the week.

The market mood has improved considerably following the lifeline from the SNB to Credit Suisse and after the US major banks clubbed together to provide a $30 billion lifeline for First Republic Bank, which had looked to be next on the list of failing banks.

This week has been a chaotic week for the market and one which is highlighted the cracks which are appearing in the financial sector owing to the steep interest rate rises from central banks.

Yesterday the ECB went ahead and raised interest rates by 50 basis points to 3.5% despite some market players believing that they could pause hikes owing to the stress in the banking ecosystem. While the ECB acknowledged the stress, they said that they didn’t consider contagion to be a problem right now. With inflation still very high, the fight to bring it back towards 2% goes on.

Investors will look to the release of the final eurozone inflation print, which is expected to confirm 8.5%.

Banks will remain in focus amid hope for a calmer end to the week for the rattled sector.

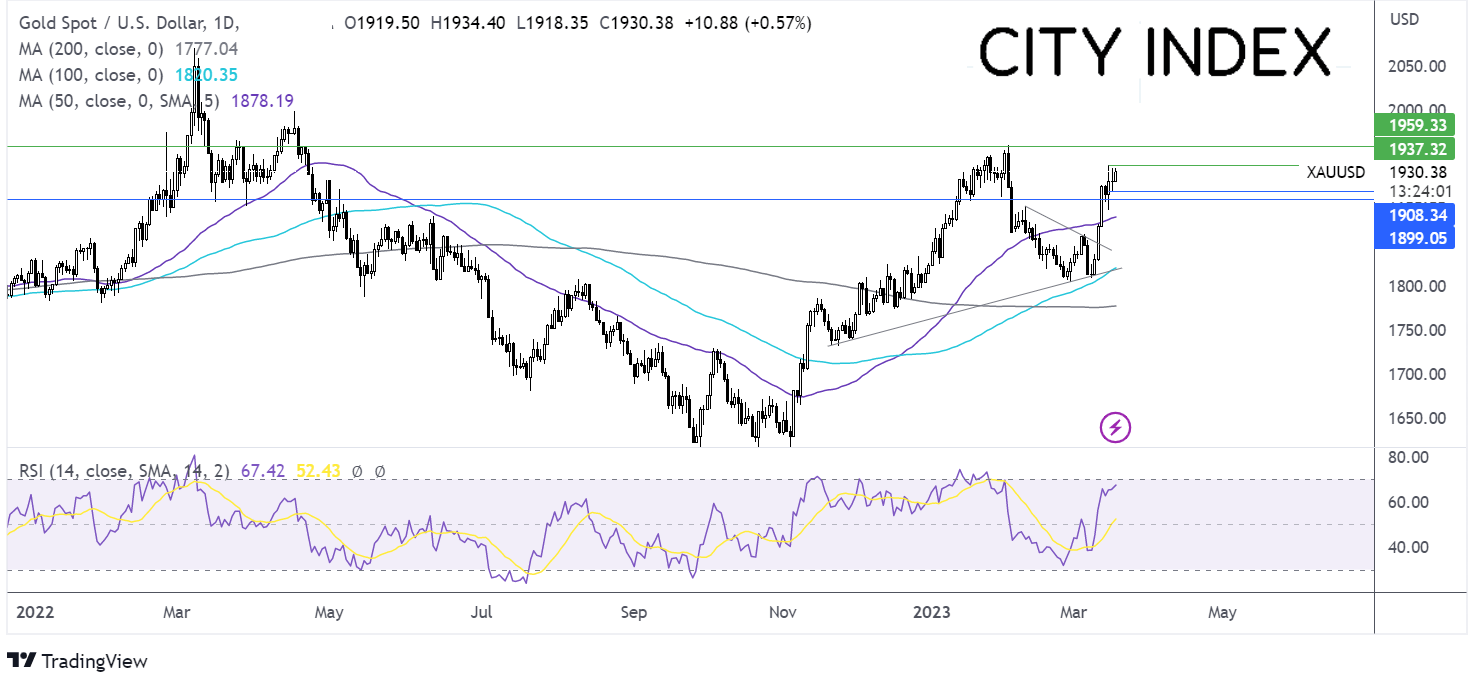

Where next for the DAX?

After rebounding off 14700, me 100 sma the prices re-entered the multi-month rising channel. The long lower wick on the candle indicates that appetite was weak at the lower price. However, the price appears to be struggling around the 15,000 psychological mark.

Buyers will need to put beyond 15,000 in order to expose the 50 sma at 15275, which was also, a key support in February. a rise above her brings 15,700 45 the 2023 high back into focus.

Should sellers successfully defend 15000, the price could test the rising trendline at 14920 before bringing 14700 back into focus. A break below here creates a lower low.