EUR/USD rises ahead of ECB rate decision

- SNB lends $54 billion to CS, averting a crisis

- ECB to hike rates by 50 bps – then what?

- EUR/USD in a holding pattern between the 50 & 100 sma

After falling 1.5% yesterday, EUR/USD is rising, reversing some of those losses. The power is being helped higher by an improved market mood after the Swiss National Bank offered a $54 billion lifeline to Credit Suisse. The move has helped com fears of a financial crisis in Europe.

Attention is now swinging to the ECB interest rate decision. The central bank is expected to raise interest rates by 50 basis points to 3.5%. Although in light of the cracks appearing in the financial sector, the hike is not as certain as it was a week ago.

Also, investors will be keen to see the future path for rate hikes. The market had been pricing in a terminal rate of 4%, but this has since been reined back to 3.5% amid fears over the health of their banks. But with inflation in the region at 8.5% in February, stickier than expected pressure is still on the central bank to tackle inflation. Any sense that the ECB could pause hikes could drag on the euro.

The USD is falling as safe haven flows slow. Cooler than expected PPI and falling retail sales support a smaller move by the Fed.

US initial jobless claims are in focus after posting the largest rise in 5 months last week.

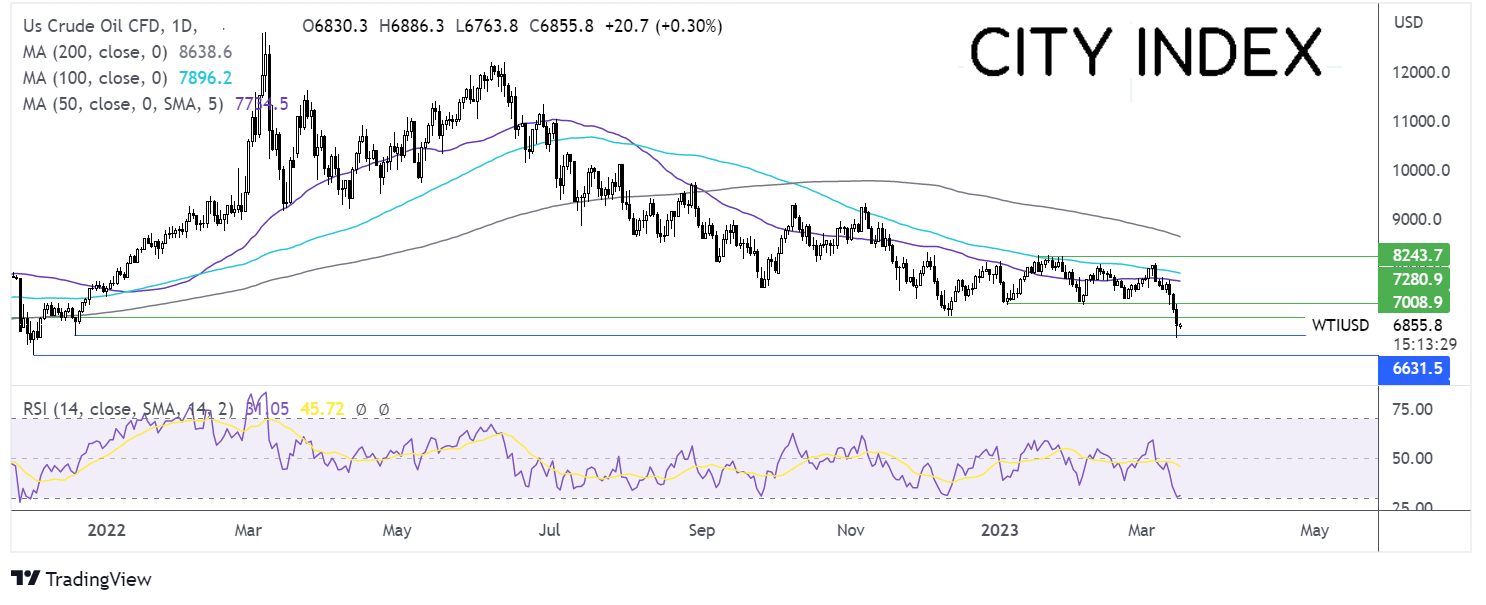

Where next for the EUR/USD?

EUR/US trades caught between the 50 and 100 sma. A breakout trade would see buyers looking for a rise above 1.0760 the 50 sma and weekly high, to bring 1.08 the February 14 high into focus. Beyond here 1.0930 the January high is the target.

On the flip side, sellers could look for a fall below 1.0560 the 100 sma and 1.0516 the weekly low, to bring 1.0480, the 2023 low into focus.

Oil rises but remains below $70 per barrel

- Oil rises from 15-month low as financial crisis fears ease

- Inventories rose by more than expected

- Oil steadies after break out

Oil prices are clawing back some of yesterday's losses which saw the Black Stars slide to a 15-month low

Oil dropped below $70 a barrel amid fears of a second financial crisis hurting the demand outlook. Today the market mood has improved, and investors are after Credit Suisse was thrown a financial lifeline by the Swiss National Bank.

market sentiment remains fragile, and any with oil remaining below $70 a barre.

Meanwhile, supporting the price, OPEC upwardly revised its demand forecast for 2023, as the IEA did earlier in the week.

However, oversupply remains a concern after the IEA reported that commercial oil stocks in developed OECD countries hit an 18-month high. Oil prices also remain weighed down by higher-than-expected inventories. The EIA posted a 1.6 million barrel rise in stockpiles last week, well above the 1.2 million forecast.

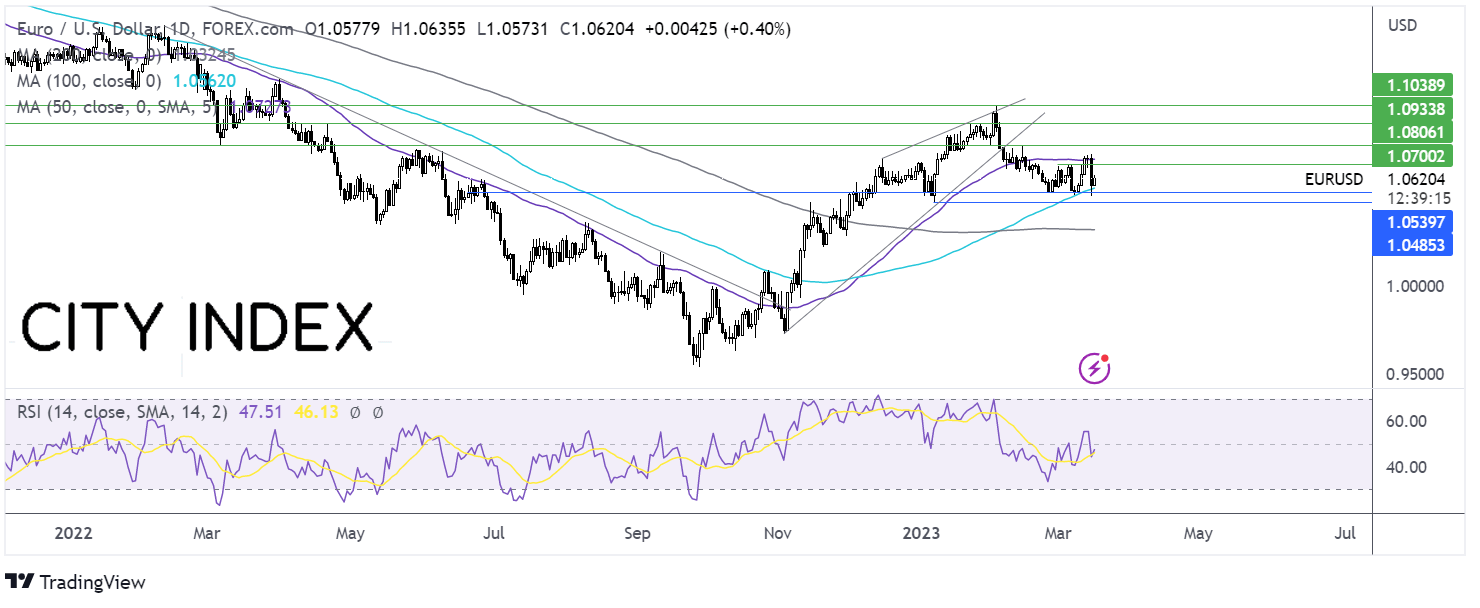

Where next for oil prices?

Oil broke out to the downside from a holding pattern, dropping to a low of $65.78, which is now the level that the sellers need to take out to extend the selloff towards 62.25 the December’21 low. The RSI supports further downside while it remains out of the oversold territory.

Meanwhile, buyers will look for a rise above 70.40 the December ‘22 low. A rise above here brings 72.90 the January low to bring oil back into the holding pattern.