EUR/GBP falls after UK jobs data

- UK unemployment stays at 3,7%

- Pay excluding bonuses cools to 6.5% from 6.7%

- EURGBP falls for a 5th day

EURGBP is falling for a fifth straight day as investors digest the latest UK jobs data and look ahead to the ECB meeting later in the week.

UK unemployment stayed steady at 3.7% defying expectations of a rise to 3.8%. Vacancies decreased for the eighth time in a row falling by 51,000 to 1.124 million.

The slowing pay growth and falling vacancies suggest that tightness in the labour market could be easing slightly. That said, pay growth was still well below inflation, showing that the cost-of-living crisis is still alive and kicking

The easy being well announces an interest rate decision on Thursday and is widely expected to hike rates by 50 basis points taking the rate to 3.5%. in light of the SVB fallout, investors are less convinced now that the ECB will raise rates much further.

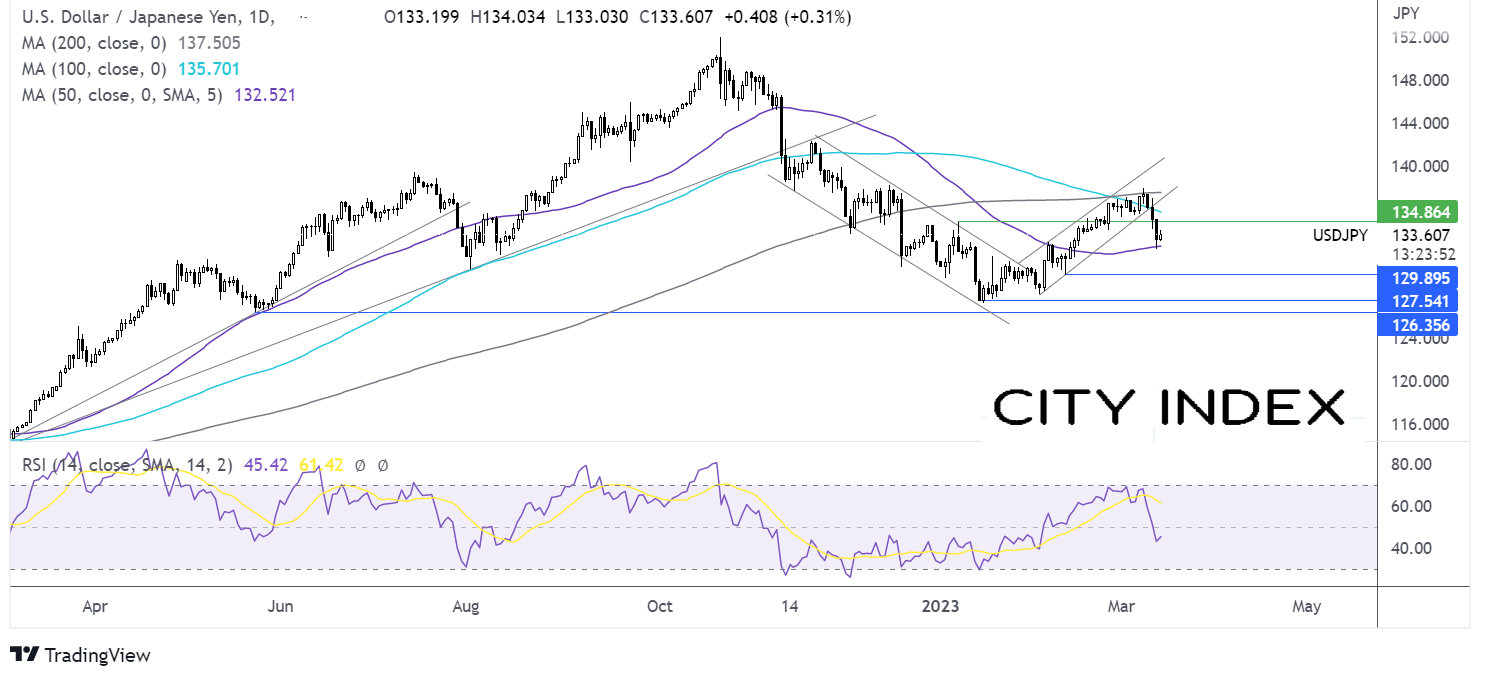

Where next for EUR/GBP?

The pair ran into resistance at 0.8920 and rebounded lower, falling below the 50 sma and is testing a multi-month rising trendline. The RSI suggests that there could be more downside to be had.

Sellers could look for a break below the 100 sma at 0.8767 to bring 0.8720, the 2023 low into focus. A move below here exposes the 200 sma.

On the flip side, if buyers successfully defend the rising trend line support, the 50 sma at 0.8840 could be the next hurdle. A move above 0.8920 is needed to create a higher high.

USD/JPY rises ahead of US inflation data

- US CPI is expected to cool to 6%

- Could hot inflation revive aggressive rate hike bets

- US/JPY finds support on 50 sma

USD/JPY Found me yesterday dropping 2 and monthly low amid the ongoing fallout from the Silicon Valley bank. fears over crack in the financial system have seen investors rein in rate hike expectations.

The market is now expecting a 25 bps Like in March, down from 50 basis points previously there are some market participants who believed that the Fed might not hike at all this month.

The final piece to the puzzle will be today's inflation data. CPI is expected to cool to 6% YoY, down from 6.4% in January. Core inflation is expected to call Tim 5.5% down from 5.6%.

While inflation is expected to keep cooling the process could be long and slow.

A hotter-than-expected inflation print could raise bets of a larger rate hike, boosting the USD.

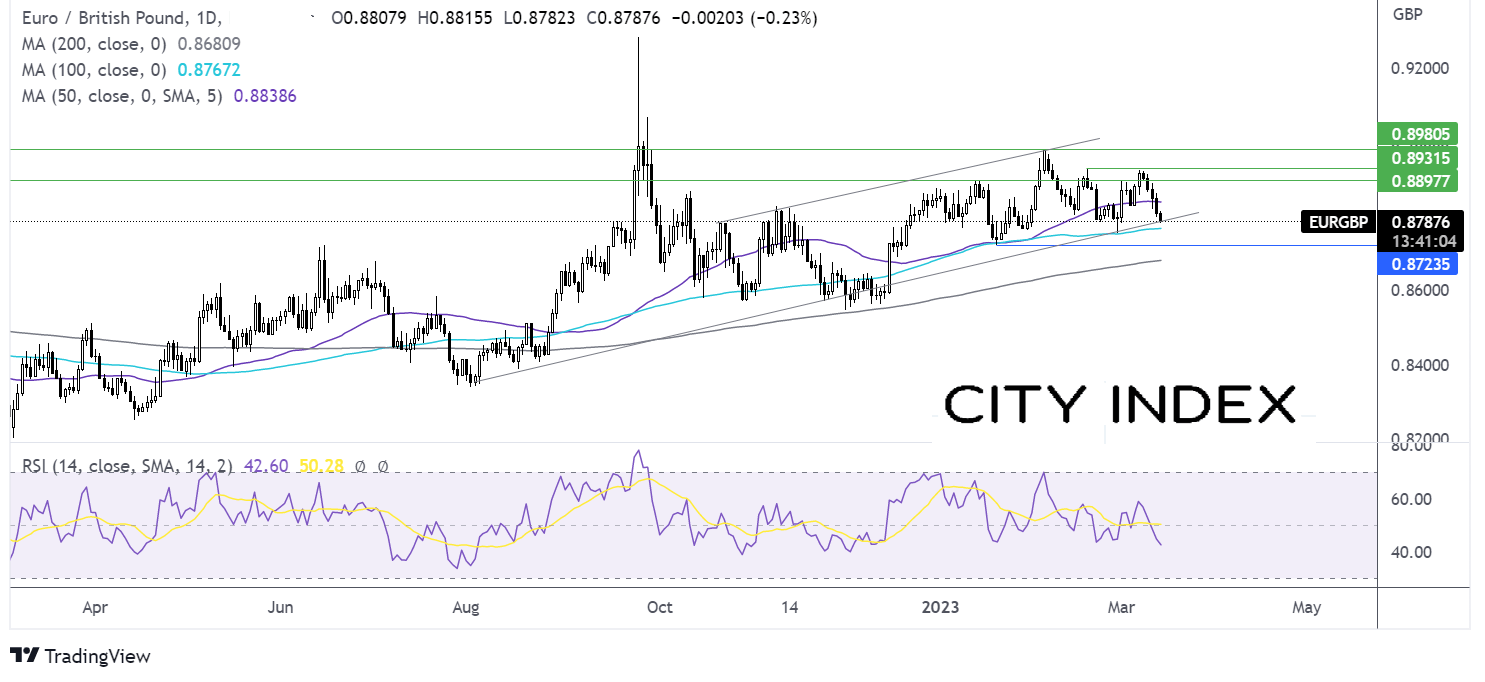

Where next for USD/JPY?

After failing to rise above the 200 sma, USD/JPY rebounded lower, breaking below the 100 sma and the multi-week rising channel before finding support on the 50 sma at 132.30 a monthly low. The RSI supports further downside.

Sellers could look for a break below 132.30 to extend the bearish trend, bringing 130.00 the psychological level into focus ahead of 129.80 the February 10 low.

Buyers could look for a rise above 134.80 the January high to expose the 100 sma at 135.75 bringing tge 200 sma at 137.40 back into target.