Your trading strategy and style will influence everything from how much time you’ll spend on the markets to how much risk you’ll take on. Learn seven key trading strategies – plus the differences between strategies and styles.

- What is a trading strategy?

- Trading strategies vs trading styles

- The best trading strategies

- Choosing a trading strategy

- How to build a trading strategy

Every trader will have an idea of what they want to achieve when trading on the markets. The most obvious goal is to make a profit, but some traders are just looking for excitement or enjoy the pastime.

Whatever your motivations are, you’ll need a trading strategy that works for you and a style that suits your aims. With that said, let’s take a deeper look at strategies and styles.

What is a trading strategy?

A trading strategy is a set plan that is designed to help you achieve consistent, profitable returns. Your strategy will lay out rules for what and when you’ll buy and sell.

Trading strategies are a core part of your overall trading plan, which will outline your broader goals. You can learn more about building a trading plan in our beginners’ course.

The aim of a strategy is to find the most advantageous points to enter and exit your trades. If followed, your strategy can help reduce your risks and increase your profits, as you’ll be trading based on your set or rules rather than emotions such as fear and greed.

By employing a consistent strategy, you can identify tweaks to improve your results over time.

Most trading strategies are based on technical or fundamental analysis.

Technical traders will use indicators and price charts as the building blocks of their strategy. They might say ‘I’ll execute my trade when a short-term moving average crosses above or below my long-term moving average’.

Meanwhile fundamental traders lean into the news, macroeconomic data and company earnings. For example, they might only buy shares in a company once it’s reached a certain level of revenue growth or profitability.

Trading strategies vs trading styles

The terms strategy and style are often used interchangeably, but the main difference is this: your strategy is a very specific set of rules for how you’ll enter and exit each trade you make, while your style is more of a general guideline.

A trading style is likened to your personality as a trader. It’s the way you trade, how often you place a position and how long you’ll keep each running for.

For example, longer-term traders will open fewer positions but will keep them open for significantly longer periods of time. In contrast, shorter-term traders can take multiple positions within a comparatively short window, such as minutes or hours.

4 common trading styles

The four main trading styles are position trading, swing trading, day trading and scalping.

Your choice of style will be dependent on factors like how much money you have, how much time you can spend on markets and what your risk appetite is.

Position trading

Position trading is the longest-term style, and the closest to traditional investing. Position traders look for opportunities that will deliver a return over months or even years, typically buying and holding an asset that they believe with appreciate in value.

You can target long-term short trades too, however. The key is to try and capture major trends, ignoring the short-term price volatility that can arise over hours, days or even weeks.

Position traders often use fundamental analysis to find trades.

Pros of position trading

- You don’t have to dedicate too much time to the markets

- Suitable for investors

Cons

- Higher risk on each given position

- You can’t target short-term profits

Swing trading

Swing trading is a medium-term style, and involves targeting profits from the smaller trends that can take hold in prevailing bull and bear markets. These trends can be up or down, so swing traders tend to use a mix of long and short positions.

Take a look at a long-term price chart for a strongly trending market, can chances are you’ll still see lots of price action against the overall trend. These oscillations are how swing traders earn profit, buying when a market looks set to grow and selling when a retracement is on the cards.

Pros of swing trading

- Lots of opportunities to trade

- Can work alongside a full-time job

Cons

- Can require a lot of research

- You’ll still pay overnight funding

Day trading

Day trading has one simple rule to follow: you never keep a position open overnight. Trades are only ever open for a few hours at a maximum, meaning that day traders rely on mini trends to make money.

Technical analysis and leverage are both key to day traders, since the margins at play are so small. Day trading successfully requires a lot of focus, so most participants do it as a full time job, opening and closing lots of positions each day according to a strict strategy.

Pros of day trading

- No overnight funding to pay

- Can return short-term profits

Cons

- Losses can add up quickly too

- Requires a lot of time, dedication and focus

Scalping

Scalpers operate like day traders, but on even shorter timeframes. They look to take profits from the smallest of price movements, sometimes closing positions just minutes after opening them. Because of this, scalpers will open lots of different positions each session.

The idea behind scalping is to hop onto an ongoing trend, then exit your position at any sign that the trend might be losing momentum. Like day trading, you stick to a strict set of rules that govern when you enter and exit trades, as any single large loss can wipe out several trades’ profits.

Pros of scalping

- Low risk from each position

- You can trade on your own schedule

Cons

- Requires complete discipline

- You need to be completely focused when you’re trading

The best trading strategies

- Trend trading

- Range trading

- Breakout trading

- End of day trading

- Mean reversion

- Momentum trading

- News trading

1. Trend trading strategy

Trend trading is the strategy of identifying the direction of market movement and holding a trade until the tide turns.

Ever heard the saying ‘the trend is your friend’? Well, this is the basis of it.

In trend trading, you’d find an entry point as early in a trend as possible and take an exit after a certain level of profit has been achieved. A trend can be either bullish or bearish.

You wouldn’t take notice of retracements – temporary changes in direction – but you would close out a position if a complete reversal occurred and you started to take on too much loss.

Your trend trading strategy could have either technical or fundamental analysis at its heart.

For example, you might decide that Company ABC has been profitable for four quarters in a row, so believe its share price will continue rising while it achieves consistent returns. You’d hold your position until it consistently failed to do so – this could be months or years in the making.

Or, you might take a technical route, using indicators like moving averages and the Relative Strength Index to find entry and exit points.

Trend trading is usually a medium- to long-term strategy, which makes it most popular among position or swing traders, who don’t mind letting a trade run for as long as it takes a move to finish.

As a relatively low-maintenance strategy, it’s used most by those who don’t want to spend all day on the markets.

Trend trading overview

| Suitable for: | Position trading, swing trading |

| Pros: |

|

| Cons: |

|

| Uses: |

|

Trend trading tips

- Consider using trailing stops. Letting profits run is key to trend trading – but you don’t want to risk heavy losses if the market turns against you. Trailing stops can help mitigate this, by following your position as it earns a profit then locking in if it turns. Learn more about stop losses

- Monitor ongoing trends with indicators. Tools like RSI and the stochastic oscillator can offer insight into whether a trend is losing momentum, at which point you might want to consider exiting your position

2. Range trading strategy

Range trading is the strategy of finding entry and exit points within consolidating markets – that is, a market trading between lines of support and resistance.

If you wanted to take a long position, you’d enter the market near a known level of support and exit near a known level of resistance. The opposite would be true for a short position.

A range trading strategy is based on technical indicators that provide overbought and oversold signals, giving guidance on when market sentiment might turn. The most commonly used tools are the Relative Strength Index (RSI) and stochastics.

It’s common to use limit entry and exit orders to automate this strategy, placing them around these price levels. Learn more about orders in our introduction to trading course.

This strategy is most popular among those that subscribe to short-term styles such as scalping and day trading. That’s because it’s more focused on short-term profits taken from volatility rather than an overarching trend.

It’s also a common strategy for forex traders, who look to take advantage of the small and fast price changes in exchange rates.

Range trading overview

| Suitable for: | Day trading, scalping |

| Pros: |

|

| Cons: |

|

| Uses: |

|

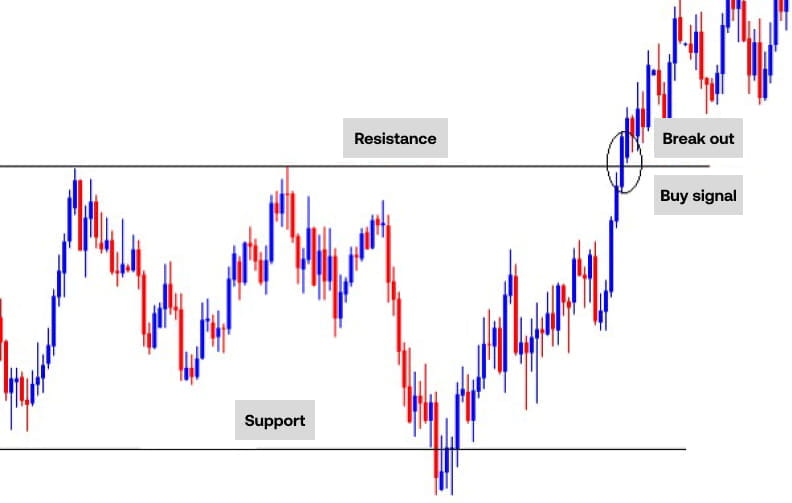

3. Breakout trading strategy

A breakout trading strategy is the practice of entering a trend as early as possible, ready to take advantage of the bulk of the move.

Traders use support and resistance lines as their entry points for trades. The theory is that once a level is breached, the price will continue moving in that direction. It’s common to use stop-entry orders to do this automatically.

To find the best exit point for a breakout strategy, traders often use volume indicators. The volume of trade usually increases as a support or resistance level is broken and decreases as the trend loses strength.

This strategy is most commonly employed by day traders and swing traders, as it’s focused on short- to mid-term price moves.

Trend trading overview

| Suitable for: | Day trading, swing trading |

| Pros: |

|

| Cons: |

|

| Uses: |

|

Breakout trading tips

- Look at candlestick patterns. Candlestick patterns can offer useful insight into an impending breakout, and can even help you identify when the resulting trend might stall. Learn more about candlestick chart patterns

- Plan your trade ahead of time. Choose a profit target, and where you’ll place your stop loss. It’s best to put your stop loss just below the support or resistance line, as if the market returns here then it’s likely that the breakout has failed

4. End-of-day trading strategy

End-of-day trading is the strategy of only opening positions just before the market closes for the evening. Don’t confuse it with day trading. In this strategy, you’re speculating on just the last few moments of price movement.

The reason this is popular is due to what’s known as ‘power hour’ – the idea that a vast number of trades occur during the final market hours, and the high volume can create opportunities.

Other than the timing, end-of-day trading isn’t all that different from another strategy. You’ll still need to identify buy and sell signals – whether that’s using technical or fundamentals is up to you.

Most traders that use this strategy are scalpers, looking to hold positions for incredibly short periods of time. However, some end-of-day traders might opt to leave their trades open overnight – taking this from a scalp or day trade to a swing or position trade.

It’s a popular strategy for those who don’t have much time to allocate toward trading – you’ll only need to be available when the market closes and when it opens (depending on whether you leave positions overnight).

End-of-day trading overview

| Suitable for: | Scalping, swing trading |

| Pros: |

|

| Cons: |

|

| Uses: |

|

5. Mean reversion trading strategy

Mean reversion is the theory that suggests that prices oscillate around a mean or average. So, after an asset’s price experiences extreme volatility, it will eventually return to that mean price.

A trading strategy that’s based on mean reversion will attempt to profit from swings in the market price, believing that the extreme price moves are difficult to maintain over time. They’re essentially taking a position in the expectation of a correction.

So, if a share price has a mean of £50 and suddenly rises to £70, mean reversion strategies would enter a short position to capitalise on a potential correction back to £50.

To calculate mean reversion, you take the average price over a given number of data points. On your trading chart, you can do this with a simple moving average (SMA). When the price breaks out from a SMA, you’d assume it will eventually return to it.

If you choose to employ a mean reversion strategy, it’s important to note that the mean can change over time, so you’ll regularly need to update your data.

Mean reversion trading overview

| Suitable for: | Position trading, day trading, scalping |

| Pros: |

|

| Cons: |

|

| Uses: |

|

6. News trading strategy

Unsurprisingly, news trading involves making decisions based on the latest headlines. Instead of watching charts to see when trends form or markets move away from their mean, you wait for major volatility-causing events, and take your position.

A news trader, for example, might decide to buy and sell EUR/USD around the non-farm payrolls report’s release each month. If you think NFP is going to boost the dollar, you’d sell the pair. If you think USD is in for a fall, you’d buy the pair.

It’s worth remembering that news traders need to take their position well ahead of anticipated events. If the markets are expecting NFP to come in high, then a high figure should already be priced into EUR/USD – so it won’t move the pair much on the day itself.

News trading overview

| Suitable for: | Swing trading, day trading, scalping |

| Pros: |

|

| Cons: |

|

| Uses: |

|

News trading tips

- Choose your events carefully. There are countless economic releases each trading day, so news traders have plenty of options. However, some will move markets more predictably than others

- Watch out for unexpected events. Headlines that no one saw coming can rock the markets, requiring you to switch up your strategy on the fly. Remember, if this occurs you can always exit your positions and re-evaluate

Choosing the best trading strategy for you

The best strategy all depends on your trading style, how much time you have, your knowledge level and more. It’s worth doing lots of research before you pick one to use for the long term.

One way of choosing the best strategy for you is to test a few out using a demo trading account. Demo accounts give you virtual funds to buy and sell live markets, enabling you to see whether your strategy is working without risking any capital.

Open your City Index demo account.

You don’t have to stick with just one strategy, either. Many traders work on several, for instance switching to range trading when markets are consolidating, and trend trading during strong bull and bear periods. It’s entirely up to you.

How to build a trading strategy

The strategies we’ve covered here are just starting points. Most of them don’t actually dictate how you find opportunities and when you execute trades. So, before you get started on the markets, it’s worth building a bespoke strategy that works for you.

It might just involve saying that when the market hits X price, you’ll enter your trade, and when it hits Y, you’ll close it. Or, it could involve a more complex system of technical indicators that generate trading signals for you to use.

But, building a trading strategy isn’t just a one-off process. Profitable trading strategies can take months, if not years, to develop. You’ll need to assess how well each trade performed against your goals, what you could’ve done better and how you’ll take steps to improve.

For more information, read our guide to building a comprehensive trading plan.

Put your trading strategy to the test

Ready to get started? Open your City Index account now by following these steps:

- Fill out our online application form

- Add some funds to your account

- Search for your chosen markets

- Apply your strategy