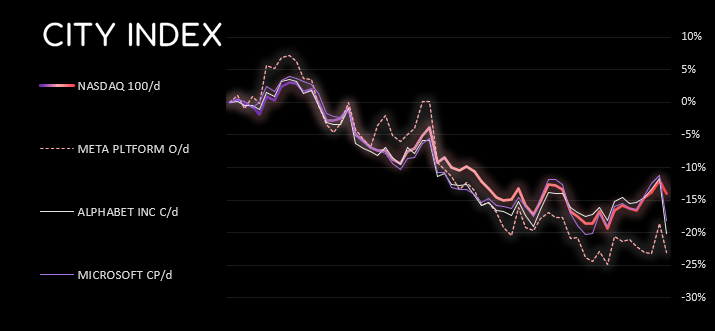

Despite a strong start, Wall Street indices snapped a 3-day winning streak on Wednesday and handed back early gains just before lunch. Weak earnings guidance from large tech companies weighed on sentiment and served as a harsh reminder that we’re in a bear market. Microsoft (MSFT) and Alphabet (GOOG) shares fell around –8% and -10% respectively, causing concerns that Apple (AAPL) will also report a gloomy outlook later today.

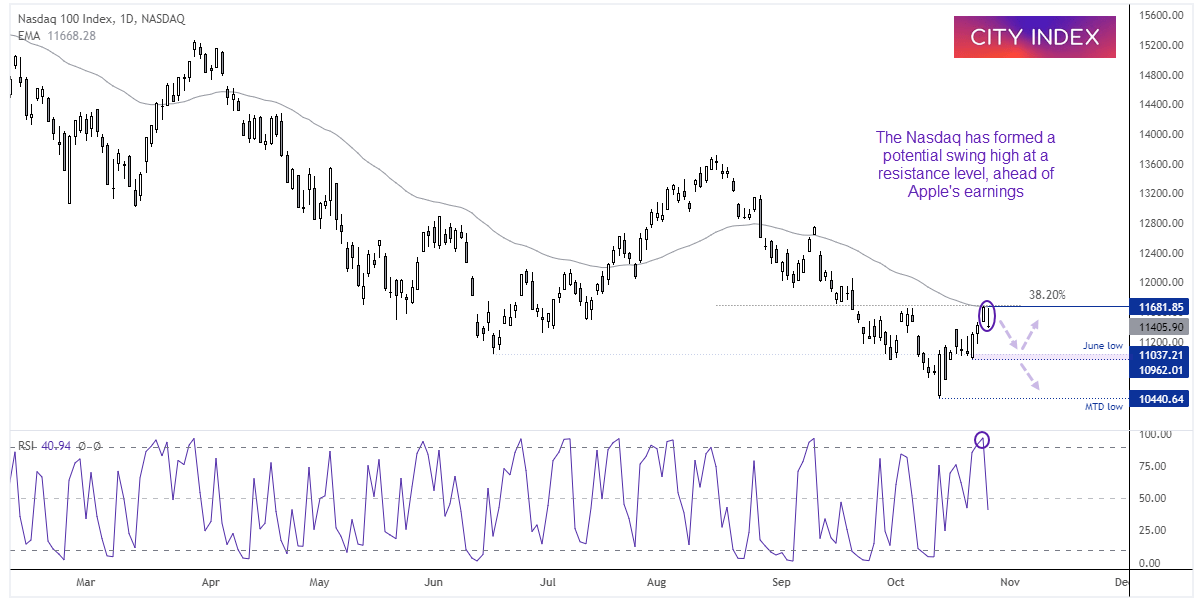

Nasdaq 100 daily chart:

The Nasdaq 100 has risen over 11% since its October low, but price action suggests a swing high may have formed. A resistance zone around 11,680 includes the 50-day EMA, 38.2% Fibonacci ratio and previous swing highs, and a bearish pinbar has formed on the daily chart.

Given we are amidst a busy earnings season, we’re not looking for an outlandish move and will be ready for markets to turn one way or another at short notice. But given the Nasdaq’s reluctance to break above resistance ahead of Apple’s earnings, the path of least resistance over the near-term seems to be lower. 11,200 makes a viable initial target ahead of the lows around 11,000 – which also coincides with the June low – a break beneath which brings the month to date (MTD) low into focus.

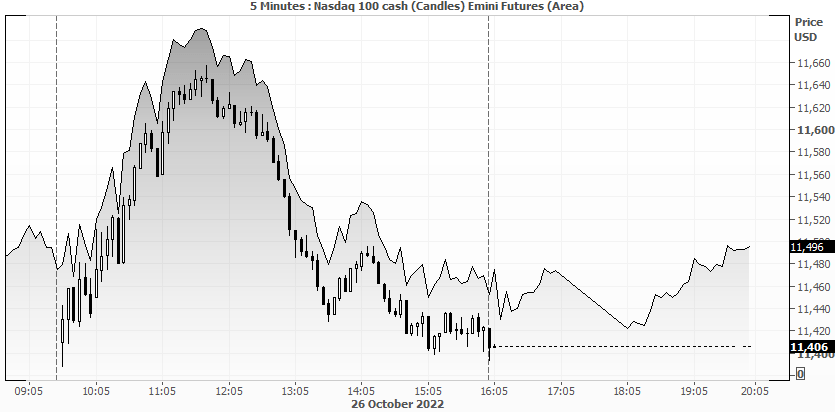

Nasdaq E-mini futures:

Despite the weak close, the Nasdaq 100 is currently set to open around 0.4% higher looking at price action on Nasdaq futures. Yet as prices are only drifting higher the current assumption is this is part of a retracement, and we anticipate a break of yesterday’s lows.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade