US futures

Dow futures +0.07% at 36117

S&P futures +0.05% at 4587

Nasdaq futures +0.04% at 15696

In Europe

FTSE +0.75% at 7522

Dax +0.64% at 16635

- NFP rise 199k vs 180k exp.

- Market pushes back rate cut bets

- Oil falls for a 7th straight week

NFP was stronger than expected

U.S. stocks are recovering from initial losses after a stronger-than-expected non-farm payroll report, which has seen investors rein in rate-cut bets for next year.

The November report showed that 199,000 jobs were added, up from 150,000 and ahead of the 180,000 forecast. Meanwhile, the unemployment rate slipped to 3.7%, unexpectedly down from 3.9%, and average hourly earnings rose 0.4%, up from 0.2% previously.

The data shows a slight strengthening in the US labor market, which doesn't match up with the very dovish Fed bets of recent weeks. Yield spiked to 4.7% following the data and the dollar gained as the market prices in less easing in 2024 than previously. The data supports the view of high for a little longer.

As a result, the focus is very much on the timing of when the Federal Reserve may start to cut interest rates, and the market will be hoping for more clues on this at next week's FOMC meeting.

The market has fully priced in that the Fed will leave interest rates on hold in December, and according to the CME Fed watch tool, the market is now only seeing a 50/50 chance of a rate cut in March, down from 65% earlier in the week.

Attention is now turning to US Michigan confidence data, which is expected to rise slightly to 62, up from 61.3 stronger consumer sentiment could lift the dollar higher.

Corporate news

DocuSign is set for a weaker open following the Q3 earnings release, which showed an EPS of $0.79, $0.16 ahead of forecasts, and revenue of $700.4 million, up from $690.26 million. Subscription revenue rose 9% year on year, and forecasts were ahead of expectations.

Microsoft will be in focus after Britain's antitrust regulator said it would review whether to launch a merger probe of Microsoft's multibillion-dollar partnership with chat GPT maker OpenAI.

Apple is in focus on reports that it, along with its suppliers, is aiming to move 1/4 of global production to India in a bid to reduce reliance on China amid strained relations between the US and Beijing.

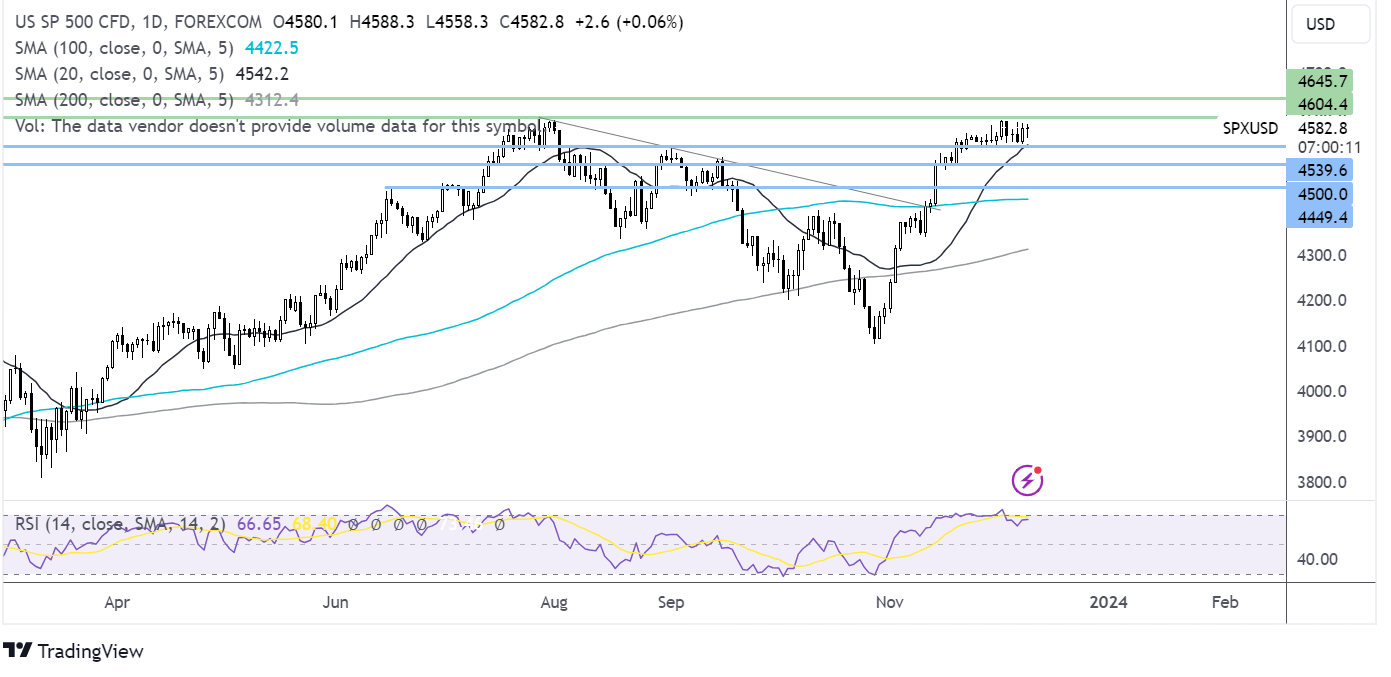

S&P 500 forecast – technical analysis

S&P 500 continues to grind higher towards 4600, with a rise above here bringing 4645, the March 2022 high, into focus. The RSI is approaching overbought territory. On the downside, support can be seen at 4540, the September high, ahead of 4500, and 4450, the June high.

FX markets – USD rises, EUR/USD falls

The USD rising firmly after the nonfarm payroll report which has seen investors reign in rate cut expectations.

EUR/USD is falling as it continues to struggle below the key 200 SMA after German inflation data cooled two 3.2% year on year as expected, adding to evidence that the easy baby could cut rates early next year. The euro is likely to struggle from here, given the dovish ECB outlook.

GBP/USD is drifting lower and is set to fall around 1% across the week after three straight weeks of gains. There's been little on the data front to lift starting this week. However, that changes with the Bank of England rate decision and UK labor market data due next week.

EUR/USD -0.5% at 1.0740

GBP/USD -0.5% at 1.2530

Oil falls for a 7th straight week

Oil prices are rising but are on track for a weekly decline, the seventh straight week of declines, which marks the longest bearish run and over five years.

Concerns over excess supply and weak Chinese demand have dragged prices lower, although today's rebound comes as Saudi Arabia and Russia look to gain support for output cuts.

Oil slid to its lowest level since June yesterday, reflecting beliefs that the oil market is oversupplied. Both oil contracts are trading in contango, where the front month trades at a discount to prices further out.

The market has fallen over doubts over support from OPEC+ after the voluntary cuts, which, combined with record non-OPEC production and weak Chinese crude oil import figures, points to an abundance of oil in the market.

Given the fundamentals, today's bounce is likely a correction and little more.