- S&P 500 analysis: Apple earnings in focus following mixed tech results

- NFP and ISM services PMI to come Friday

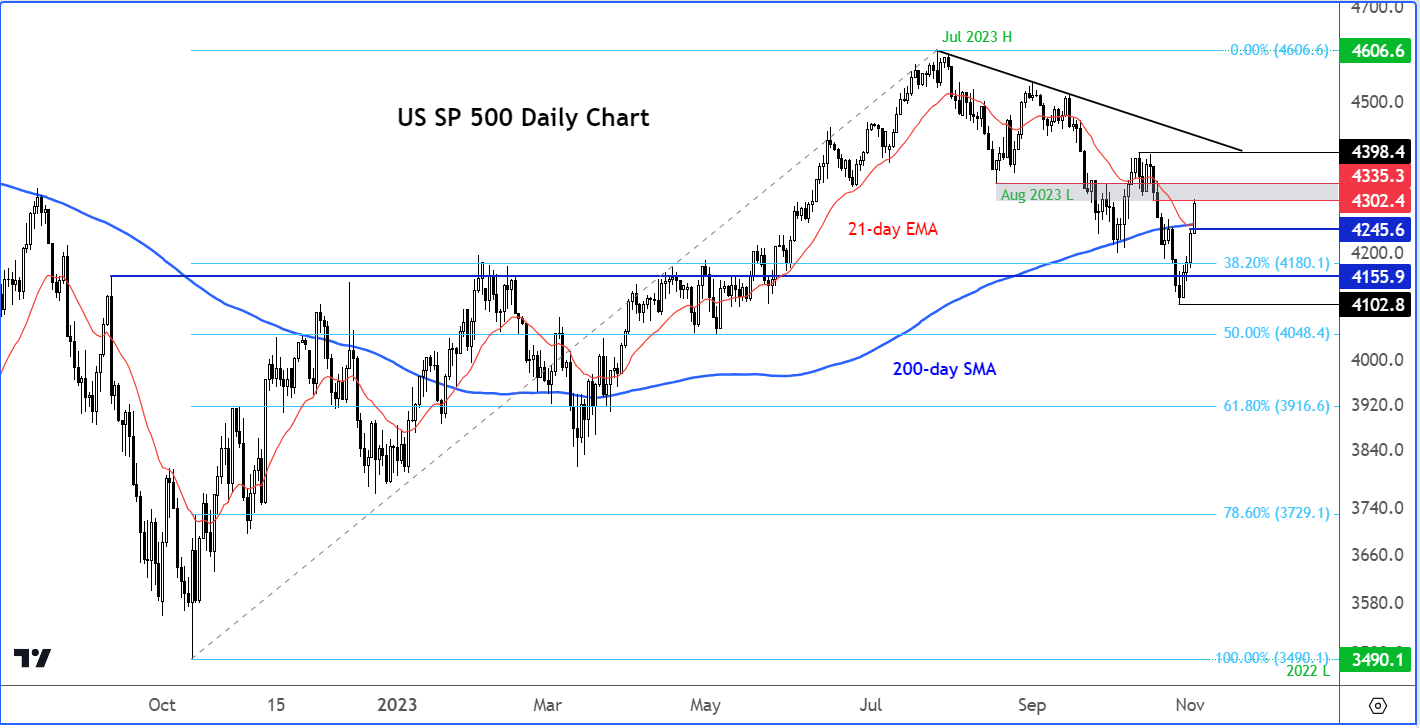

- S&P 500 technical analysis: Break above 200 day is positive if it can hold

Global stock indices continued to make strong gains, extending recovery from the previous session. Bets that the Fed is done with rate hike is what’s driving markets higher, while mixed technology earnings have reduced fears about overstretch valuations in the sector. Middle East concerns have moved on from the forefront, too, although the situation remains tense. All told, much of the macro concerns that had held back the markets are still prevalent. Therefore, I wouldn’t be surprised if the markets turned volatile again. It may be far too early for investors to become optimistic. The Fed’s rate cuts could be several quarters away. Monetary policy is also going to remain tight for a long period of time in other important economic regions like the Eurozone and the UK.

S&P 500 analysis: Apple earnings in focus following mixed tech results

In this earnings season, we have seen some sizeable moves in shares of tech giants. Heavy falls in the likes of GOOG, META and TSLA following their results, were offset by the likes of AMZN and MSFT which rose following their results. But even those that fell post their results have made back at least some of their losses by now.

Tonight’s the big one on the earnings calendar: AAPL. If Apple’s results fail to beat expectations, then this could trigger the next potential down leg in stocks. Expectations are for revenue to fall for a sixth straight quarter, dropping by 1% to $89.27 billion, and EPS is seen rising to $1.39 up from $1.29. The key area of focus will on iPhone sales, which make up the bulk of Apple’s profit. Sales of the iPhone are expected to have risen 2.3%. Will iPhone sales and service growth offset the expected weakness in sales of the wearables, the Mac and the iPad?

NFP to come Friday

On a macro front, the focus is now back to data with the Fed, ECB and BoE all out of the way. Jobs data will be in sharp focus and there are some signs to suggest the US labour market is starting to cool, as indicated by the weekly jobless claims data rising more than expected and ADP figures, released the day before, showing a smaller rise in private payrolls.However, separate data has shown that job vacancies rose more than expected last month, which brings an additional dimension of uncertainty about how Friday’s official jobs report is going to look.

Here's our NFP Preview article written by my colleague Matt Weller.

S&P 500 analysis: Technical levels to watch

Source: TradingView.com

The S&P 500 was back above the 200-day average at the time of writing. If it can close above this, it would be the first significant bullish signal. The bulls will then need to reclaim more broken levels for further confirmation. The series of lower highs remain intact. The most recent high at 4398 made on October 12 remains intact. So, a move above that levels is required to signal a complete reversal in the trend. Standing on the way of that target is the key 4302-4335 resistance range (see grey shaded area on the chart). The bears must defend their ground here if they are to maintain control. In terms of support, the 200-day at 4255 is the first level to watch, followed by Wednesday’s high at 4245. A move back below 4245 would be a bearish outcome.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade