The RBNZ held rates at 5.5%, as per consensus view. Quite why that came as a surprise and sent NZD lower is interesting, given they already effectively confirmed 5.5% as their peak rate. But it’s possible that the initial false break above 60c ahead of the decision allowed bears to reload at more favourable prices once the RBNZ confirmed that growth was expected to slow. The latest COT data shows that large speculators trimmed shorts over the prior few weeks, so the general risk-off vibe and RBNZ-peak rate combo allows some bears to re-enter.

My summary of their statement.

- Interest rates are constraining economic activity and reducing inflationary pressure as required

- While GDP was stronger than anticipated, its outlook is expected to remain subdued

- Spending growth is expected to decline further

- Headline #CPI has eased for most of our trading partners

- Apart from oil, global import prices have eased

- There’s a near-term risk that activity and inflation do not slow as much as needed

- The OCR needs to stay at a restrictive level to ensure that annual consumer price inflation returns to the 1 to 3% target range

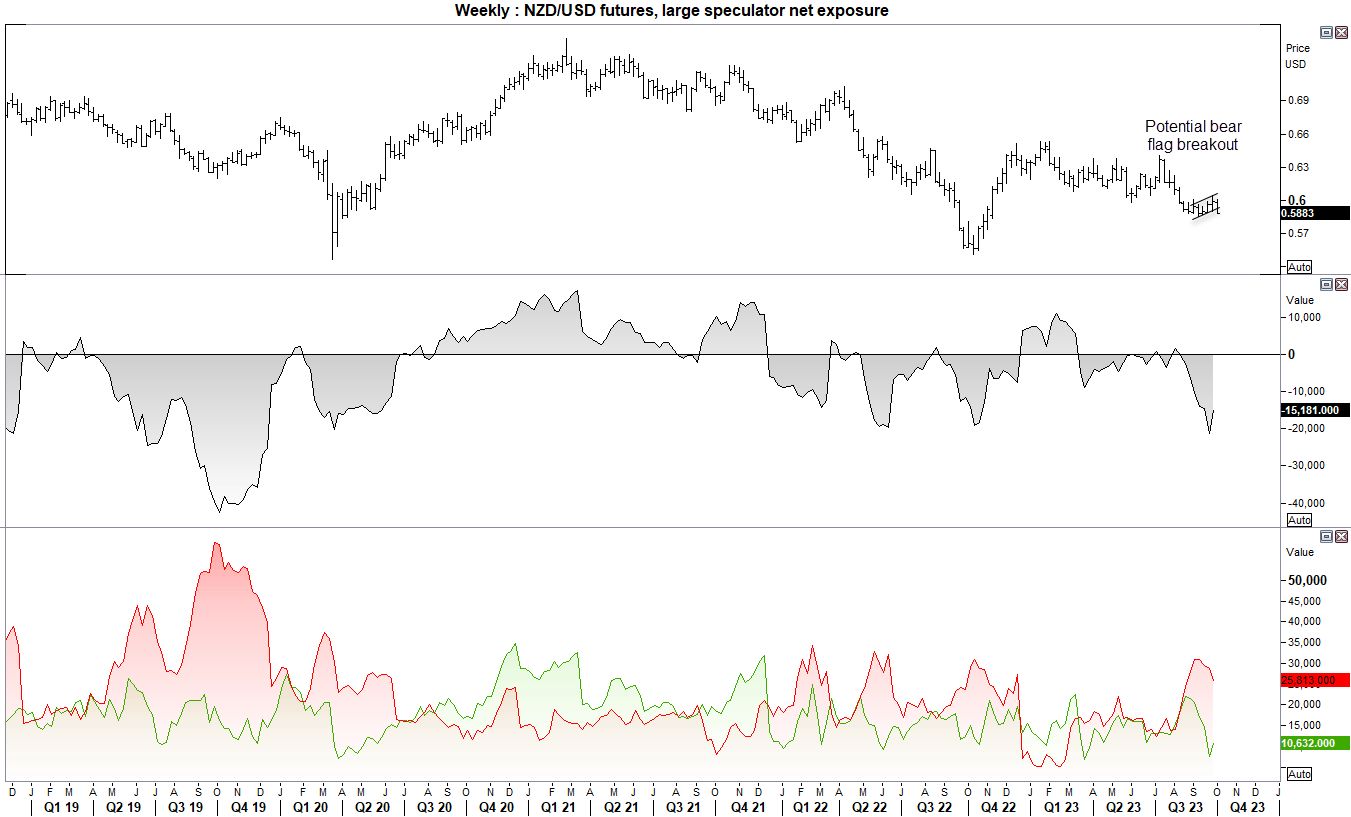

NZD/USD technical analysis (weekly chart)

The weekly chart shows that prices remains within a bear trend and are seemingly breakout of a bear flag pattern. And its mast projects an approximate target just beneath the 2022 lows. Large speculators are net short according to the latest COT report, and at and why it may have reached an extreme by recent standards we have seen net-short exposure twice as high in 2019. Furthermore, bears have trimmed net-short exposure in recent weeks, which leaves potential room for them to reload and short due to risk-off sentiment and confirmation the RBNA are not likely to hike.

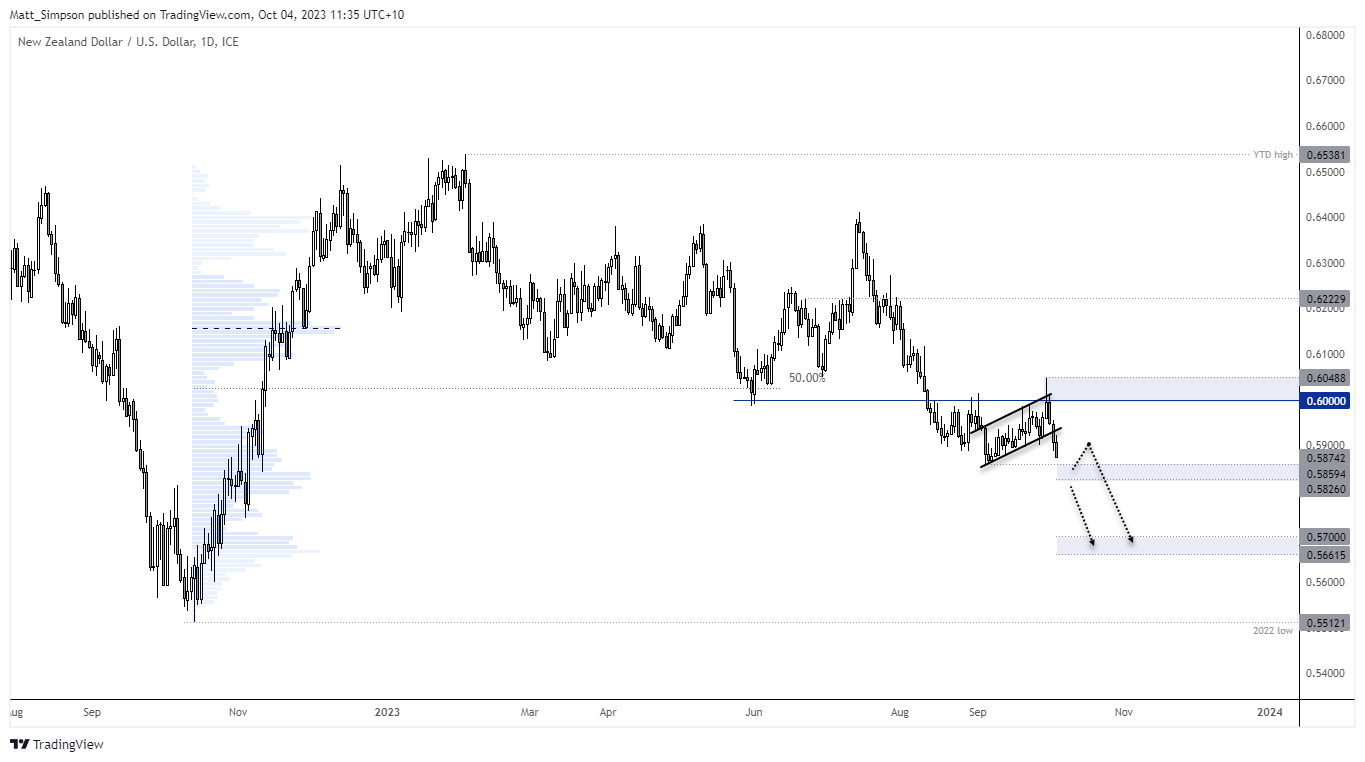

NZD/USD technical analysis (daily chart)

NZD/USD saw a momentum shift with a false break above 60c heading into the RBNZ’s decision. With momentum now realigned with its downtrend, bears could consider short opportunities with breaks of support levels or countertrend bounces towards resistance. 60c is a clear level of resistance, along with the 59c handle.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade