NFP early insight: USD/JPY vulnerable to a soft reading

The final Non-Farms Payroll (NFP) report before the highly-anticipated late-August central banker symposium in Jackson Hole is on Friday, and the only certainty about it is that the result is highly uncertain.

As we noted in our Week Ahead report on Friday, “The monthly US jobs report has been particularly volatile of late as workers remain reticent to return amidst concerns about safety and continued elevated levels of unemployment insurance. Nonetheless, traders and economists are expecting a reading in the 925K range, which would mark the strongest labor market growth in eleven months if seen.”

Meanwhile, recent comments from US central bankers suggest that the Fed is unlikely to outline its taper plans on Jackson Hole regardless of how Friday’s jobs report prints, but that a couple more months of strong wage and job growth (ideally accompanied by a peak in COVID cases) could be enough for the central bank to start the long process of normalizing monetary policy. While there appears to be some disagreement within the committee, Fed Chairman Powell explicitly noted that “…we have some ground to cover on the labor market side. I think we’re some way away from having had substantial further progress toward the maximum employment goal.”

We’ll have our full NFP preview report with all the leading indicators out on Thursday, but we did get one decent harbinger from July’s ISM Manufacturing PMI report. While the headline reading came in about a point below expectations at 59.5%, the employment subcomponent did flip back into positive territory at 52.9% after hovering near flat (50%) territory for the last two months. We’ll be tuning in eagerly to Wednesday’s ADP employment report, as well as Thursday’s weekly jobless claims and ISM Services PMI releases, as we look to handicap Friday’s key NFP report.

Market to watch: USD/JPY

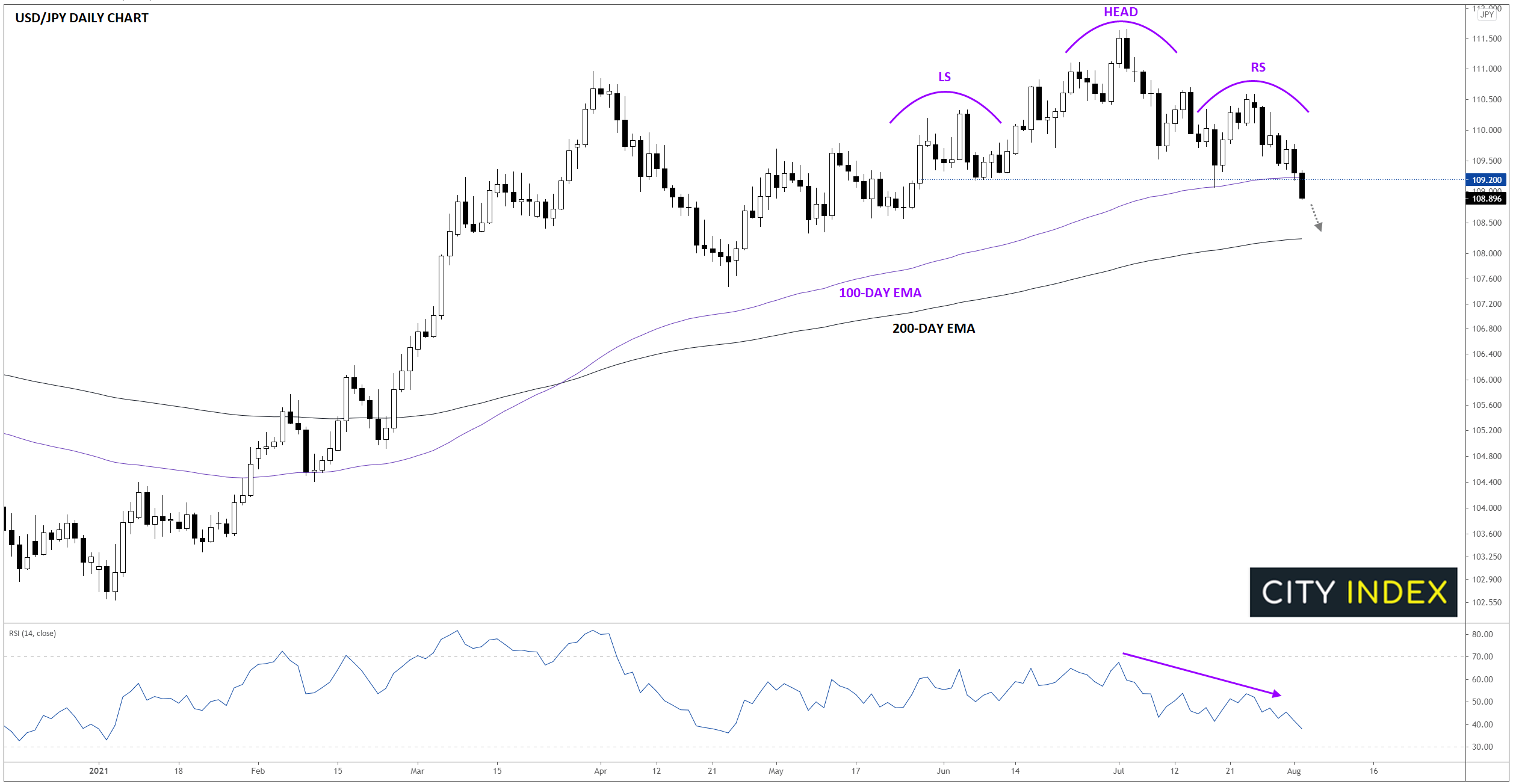

In the FX market, USD/JPY usually has the “cleanest”, most logical reaction to US data, so it makes sense to watch that pair in the lead up to and release of the NFP reading. Technically speaking, USD/JPY has formed a “head-and-shoulders” pattern over the last two months; for the uninitiated, this pattern shows a transition from an uptrend (higher highs and higher lows) to a downtrend (lower highs and lower lows) and is often seen at significant tops in the market:

Source: Tradingview, StoneX

With USD/JPY breaking below the pattern’s neckline and 100-day EMA at 109.20, it’s clear that short-term bears have the upper hand. Especially if we see weak data out of the US labor market this week, USD/JPY traders may look to push rates down toward the 3-month low and 200-day EMA near 108.25 next.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.