Following Tuesday’s big drop in equity prices, we have seen a sharp rebound so far in today’s session. But like we have seen previously, the overall macro backdrop is not very positive right now. Thus, the latest rebound could, once again, get faded into, possibly as soon as later this afternoon.

Short-covering bounce?

Indeed, you get the feeling that today’s rebound is just driven by bargain hunting and short-covering more than anything. When you consider the fact that there is an energy crisis in Europe, with Russia’s decision to suspend gas supplies to Poland and Bulgaria potentially triggering an energy war, China’s determination to beat Covid outbreak with lockdowns, and – above all – a Federal Reserve pursing an aggressive monetary tightening policy, investors find it difficult to buy and hold stocks for the long term, without first seeing a major correction – even if the Nasdaq is close to wiping out its entire 2021 gains.

Europe’s woes continue

In Europe, Russia’s war in Ukraine continues to unnerve investors. There is a possibility that other countries could be hit next if they refuse to buy Russian gas supplies in rubles. These fears have been evidenced, for example, in the euro touching its weakest level versus the dollar since 2017 and the spread between the Italian and German 10-year widening by the most since June 2020. Incoming European macro data has not been great either. Today saw the German Gfk Consumer Climate print -26.5 when -16.1 was expected. In the UK, the CBI Realized Sales index printed -35.0 vs. -6.0 expected. You get the picture.

Tech earnings in focus

In addition to the above macro factors, it is also worth keeping a close eye on micro-level company earnings, as US earnings season gets into full swing this week. We have already seen reports from Microsoft and Alphabet on Tuesday, providing us mixed results. Meta is due to post its results today, with Apple and Amazon rounding things off for the Big Tech on Thursday.

Nasdaq testing key resistance

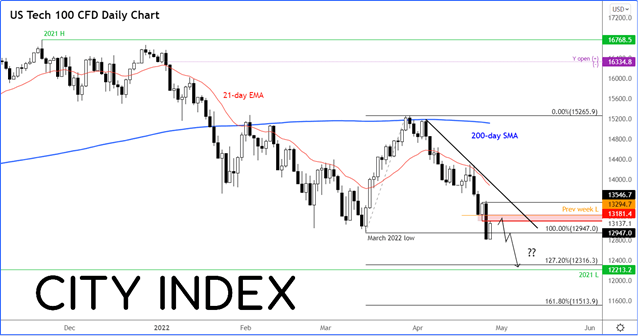

Following Tuesday’s drop, the Nasdaq effectively reached its main downside objective as it swept the liquidity residing beneath the March low. Today’s bounce back is thus hardly surprising: the bears have taken some profit. But are they done, or will we see more losses? Given the weak macro backdrop, and the overall bearish technical outlook, I am of the view that they are not done just yet.

Indeed, the technical outlook is not great on the Nasdaq. The 200-day moving average is pointing lower now and we are holding comfortably below it, objectively telling us that the longer-term trend has turned lower. The shorter moving average on the chart – the 21-day exponential – is also painting the same picture. So, both these objective short-term and longer-term indicators are telling us to remain bearish.

Price action itself shows stronger moves have been to the downside, with traders showing more respect to resistance levels than support.

In fact, the Nasdaq was testing a key short-term resistance area at the time of writing and so it was possible that the rebound could end here. As per the chart, the shaded red region between 13180ish to 13295ish is where the index had bounced from on Monday, before this area gave way the next day. Having failed to provide support, we could see this zone turn into resistance today and lead to another move lower.

If the selling pressure resumes as I expect, then the next big downside target is the 2021 low at 12213. A couple of additional downside targets could be the Fibonacci extension levels from the March upswing, at 12316 (127.2%) and then 11513 (161.8%).

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore - Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade