When will Lloyds report Q1 results?

Lloyds is due to report Q1 results before the market opens on Wednesday, 27th April.

What to watch?

Lloyds is set to report Q1 results to a backdrop of higher interest rates, rising costs, the ongoing war in Ukraine, and a strong housing market but a quickly deteriorating economic outlook. Expectations are for a 10% rise in net interest income but an almost 18% fall in pre-tax profit to £1.56 billion.

NII

After the BoE hiked rates for the past three meetings, the higher interest rate environment is set to benefit Lloyds by widening the net interest income. This is the difference between what Lloyds charges borrowers and what it pays to depositors – which is a crucial source of income for the domestically focused bank. Expectations are for Lloyds to report a 10% year-on-year rise in underlying net interest income to £3.01 billion. Net interest margin is expected to rise to 2.63%, up from 2.57% in Q4 last year; Lloyds has previously said that they expect it to remain above 2.6% in 2022.

Loans and mortgages

Lloyds is the UK’s largest mortgage lender and is expected to benefit from the ongoing strength in the housing market across the first three months of the year. The housing market continued to boom despite rising interest rates and the rising cost of living crisis. That said, the housing market is expected to start cooling as living expenses and mortgage rates tick higher, which could dampen the outlook. Broadly speaking, loans have performed well. However, there are concerns that any more significant rate hikes from the BoE could tip the UK into recession, weighing on demand for loans and mortgages.

Tough comparisons

2022 Q1 earnings are up against tough comparisons from the same period in 2021, which benefited from the release of bad loan reserves, reserves set aside across the pandemic to offset an expected rise in defaults. The move artificially strengthened UK banks’ profits. Instead, with the cost-of-living crisis growing amid surging inflation, we could start to see concerns over defaults rise again, and provisions increase.

Dividend

Lloyds currently pays a dividend of 4.45% and is returning £2 billion to shareholders in its share buyback programme.

Where next for Lloyd’s share price?

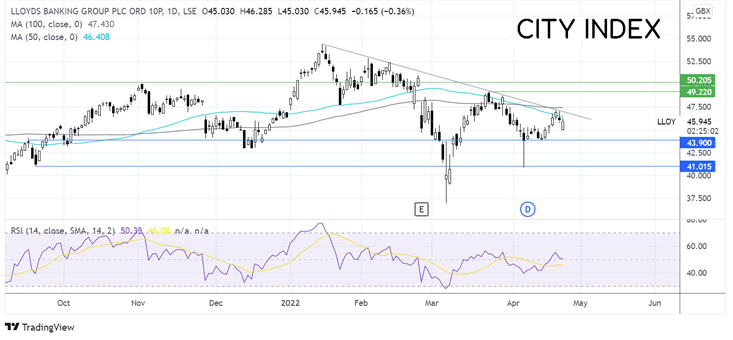

Lloyds share prices 15% so far this year. The share price trades below its 50 and 100 sma; the 50 SMA has also crossed below the 100 SMA in a bearish signal.

After facing rejection at the 100 sma, the price has fallen lower, breaking below the 50 SMA, which keeps sellers hopeful of further downside.

Sellers need to break below 43.90, last week’s low, to bring 43.1, a level which has offered support on several occasions, into play, ahead of 40.9, the April low.

Meanwhile, buyers will look for a move back above the 50 SMA at 46.40 to expose the 100 sma at 47.45. A move above here could create a higher high and see bulls gain momentum towards 49.20

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.