USD/JPY Key Points

- The Japanese yen is the worst-performing major currency pair today…and so far this year!

- The New Year’s Day earthquakes have thrown an H1 rate hike by the BOJ into doubt while other countries are seeing strong economic data less dovish comments from central bankers.

- GBP/JPY looks particularly strong, but both USD/JPY and EUR/JPY remain in clear bullish trends.

USD/JPY Fundamental Analysis

Despite general risk-off trading today, the Japanese yen hasn’t caught much of a bid; in fact, it’s actually the worst performing major currency on the day and year, lagging even the beaten down Australian dollar.

While other currencies have been supported by stronger-than-expected economic data (UK CPI and US Retail Sales) or less dovish comments from key central bankers (ECB President Lagarde), the yen has seen little in the way of country-specific news or data of late.

Instead, traders appear to be recognizing the opportunity cost of holding a currency with zero current yield, and expectations of BOJ interest rate increases in the first half of the year have taken a big hit after the New Year’s Day earthquakes. In the wake of the disaster, BOJ policymakers have pushed back on expectations for imminent rate hikes, arguing instead that the economy may need more stimulus as the country rebuilds.

Looking ahead, there’s little in the way of Japan-specific economic data scheduled until the BOJ meeting on Tuesday, January 23, though the BOJ has essentially stated outright that it won’t make any changes until after the spring wage negotiations at the earliest. Therefore, intermarket and technical analysis are likely to be the more important drivers for yen crosses in the coming days.

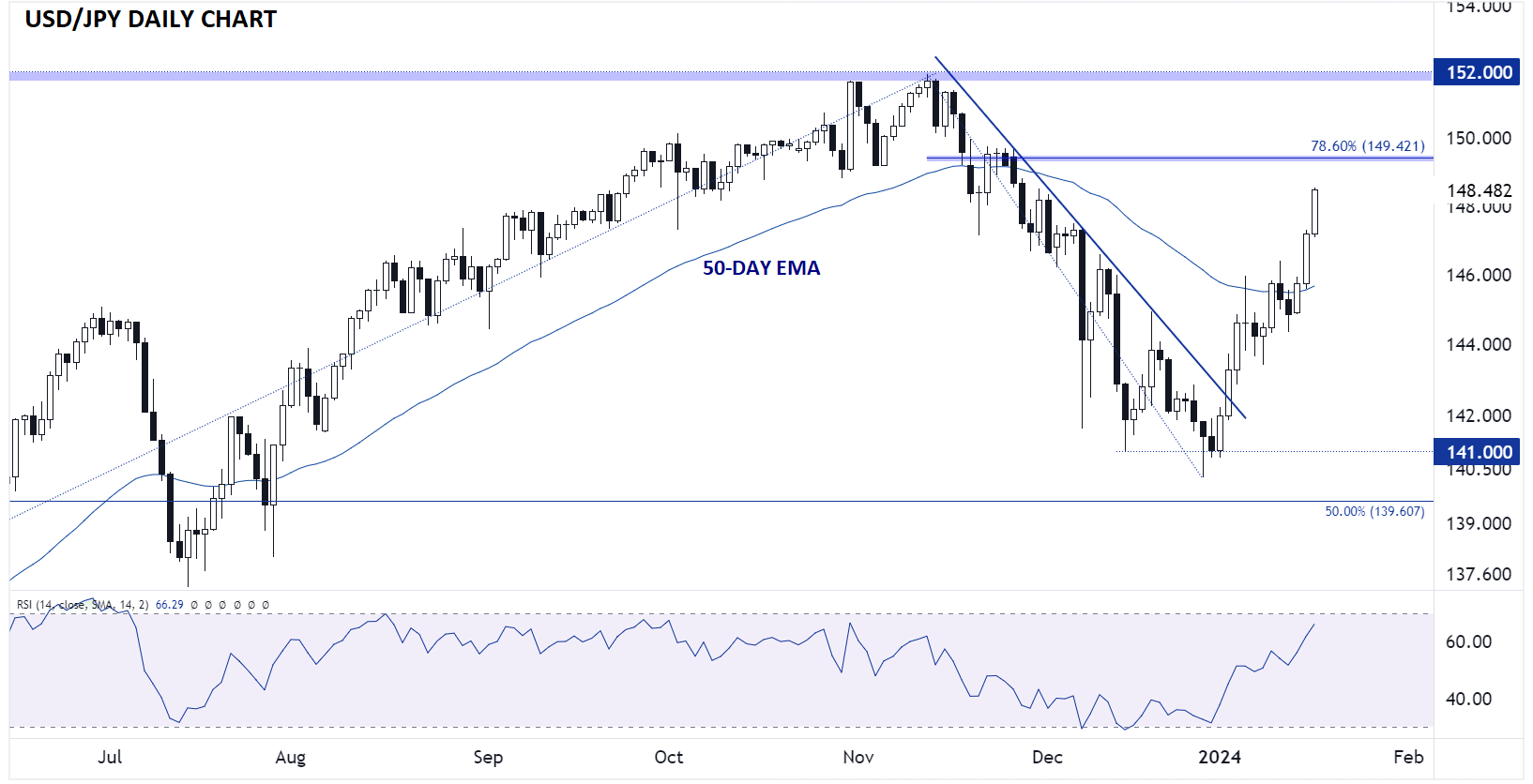

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

Looking first to USD/JPY, we can see that 2024 hasn’t been kind to the Japanese yen. USD/JPY has only fallen three days so far this year, gaining more than 700 pips (5%+) since the close on New Year’s Eve. Looking ahead, USD/JPY has recovered most of its November-December selloff, but the 78.6% Fibonacci retracement of the pullback at 149.40 still looms as the last hurdle before the pair can retest its 33-year high at 152.00.

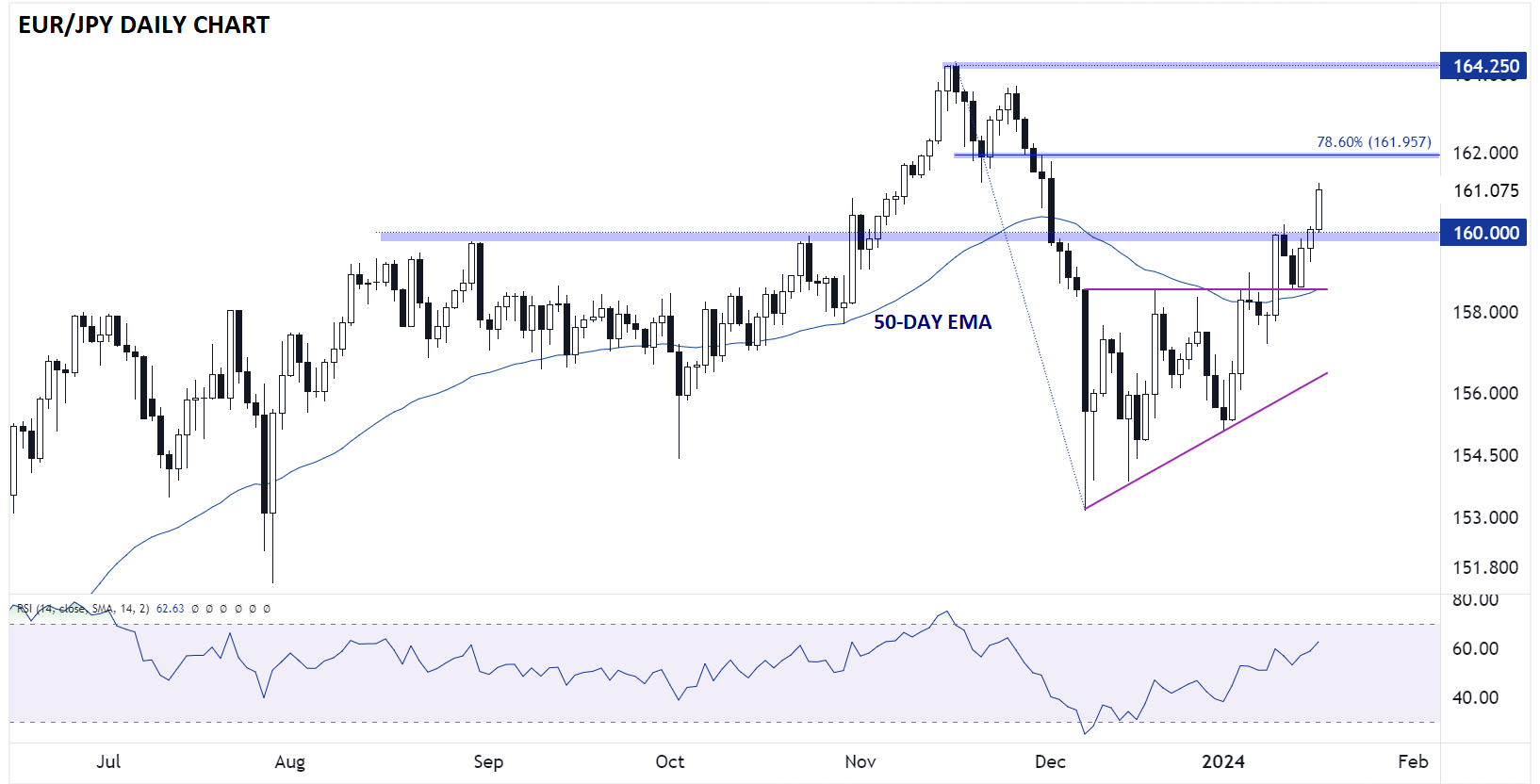

Japanese Yen Technical Analysis – EUR/JPY Daily Chart

Source: TradingView, StoneX

EUR/JPY looks relatively similar to the aforementioned USD/JPY, with rates rallying consistently since we flipped our calendars to 2024. In its case, EUR/JPY broken out of a sideways consolidation pattern last week then proceeded to bounce off previous-resistance-turned-support at 158.60 to start this week’s trade. Moving forward, the path of least resistance remains to the topside for now, with potential resistance at 162.00 (the 78.6% Fibonacci retracement) and 164.25 (the 15-year high).

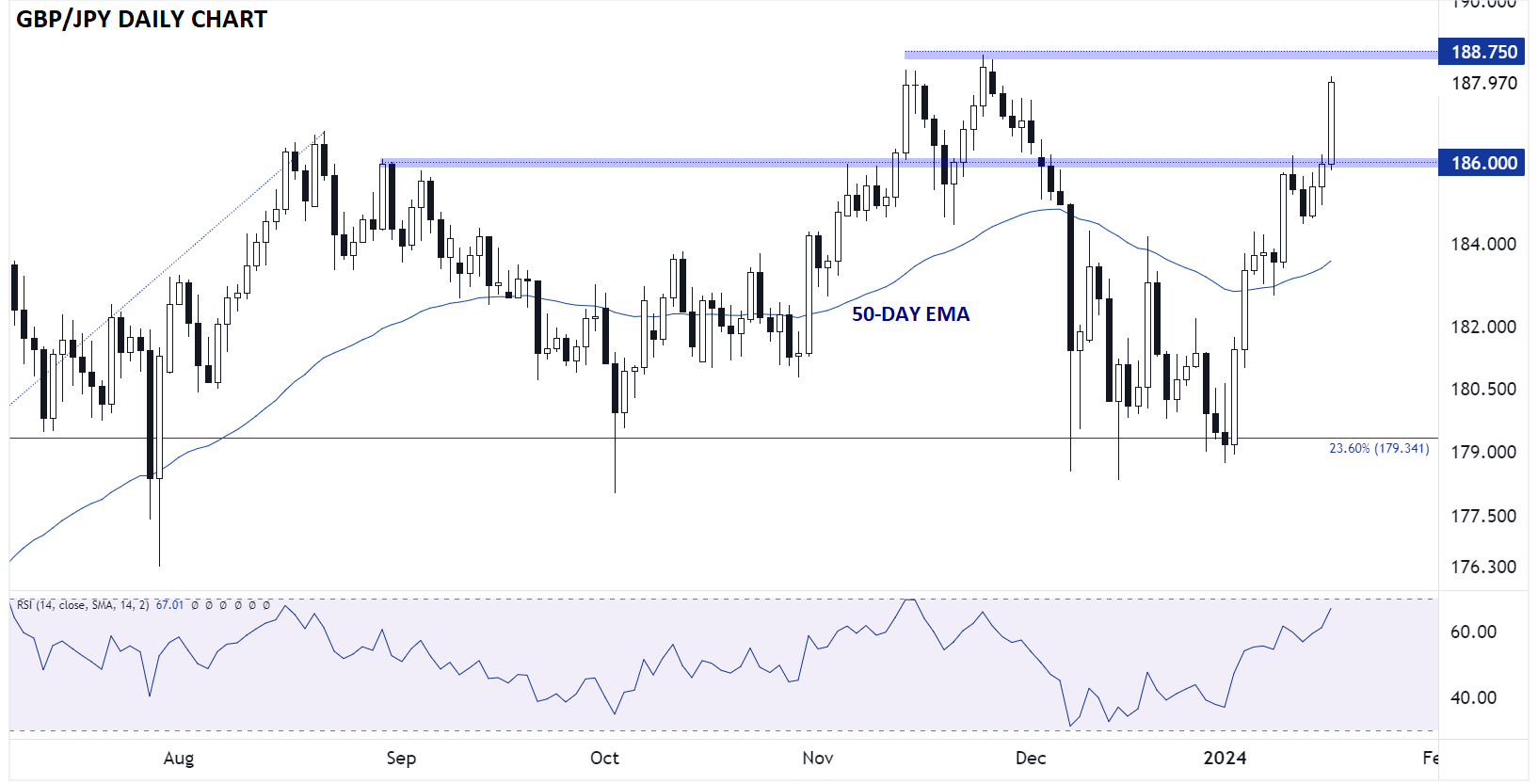

Japanese Yen Technical Analysis – GBP/JPY Daily Chart

Source: TradingView, StoneX

Last but not least, the ever-volatile GBP/JPY cross looks perhaps the most bullish of all. GBP/JPY has already retraced almost its entire November-December decline, bringing the 8-year high at 188.75 into striking distance later this week. Despite the nearly 900-pip rally so far this year, GBP/JPY is still not overbought on the 14-day RSI, hinting that a move to 190.00 or higher could well be in play next week if 188.75 resistance gives way.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX