- Gold outlook: What are investors watching this week?

- Why did gold ease off last week?

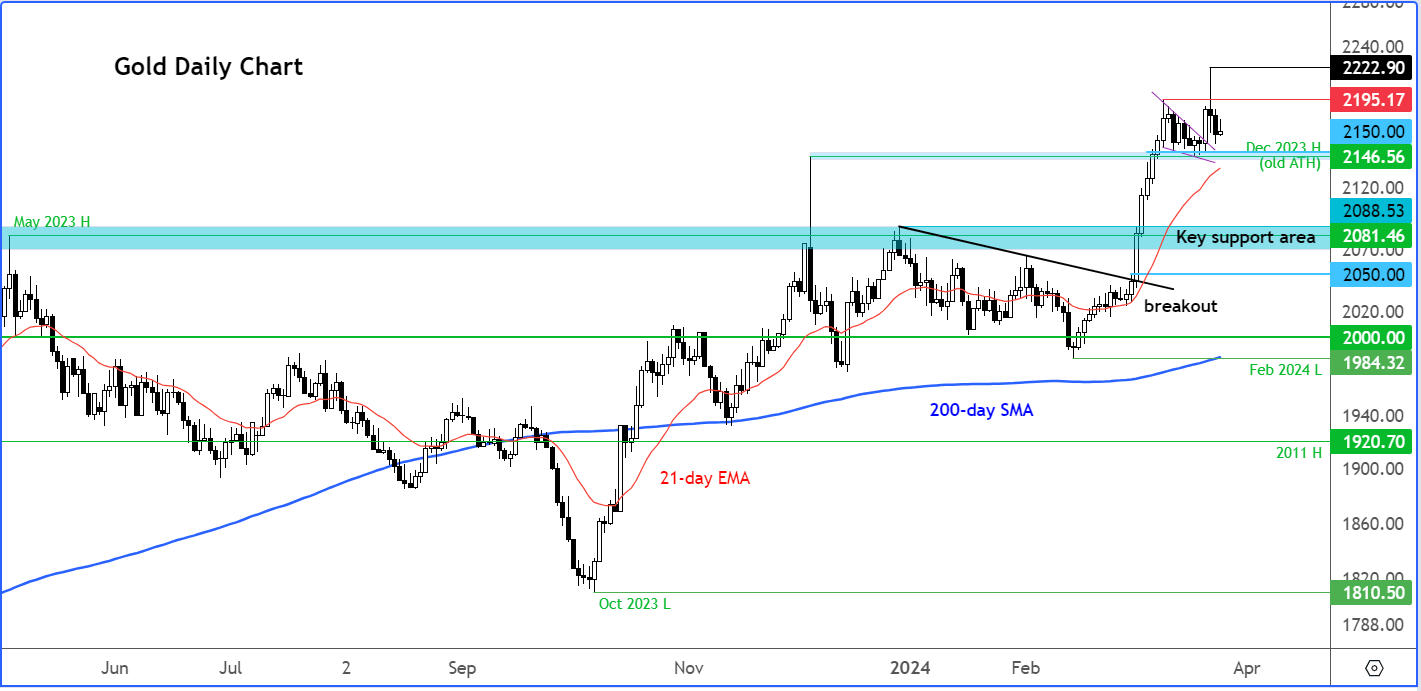

- Gold technical analysis point higher

Gold outlook video and insights on WTI, EUR/USD and EUR/CHF

The robust gold trend somewhat faltered towards the end of last week due to a resilient US dollar. As the precious metal pulled back from its earlier record peak, it displayed mild bearish price action, leading to some calls that it may have peaked. While there is some doubt about its short-term technical prospects, I am unequivocally convinced that its long-term trajectory remains bullish, and it is conceivable that prices could soon reach unprecedented highs again.

Why did gold ease off last week?

In addition to profit-taking, the weakening of gold in the latter part of last week can be attributed to the strength of the US dollar. For gold to reach new peaks, the greenback must resume its downward trend.

Last week witnessed a rebound in the Dollar Index, closing on a positive note. Despite the Federal Reserve maintaining a dovish stance, the dollar gained strength, bolstered by external factors such as the unexpected rate cut by the Swiss National Bank and dovish stances from the Bank of England and Reserve Bank of Australia. Drops in the pound, Aussie dollar, and euro further boosted the dollar's ascent, alongside encouraging US economic indicators such as the latest PMIs, existing home sales, and unemployment claims. However, these indicators are unlikely to dissuade the Fed from considering rate cuts in June, particularly if inflation remains subdued.

Gold outlook: What are investors watching this week?

Looking forward, the economic calendar ahead appears relatively subdued following recent volatility driven by major macroeconomic releases and central bank meetings. Attention will turn to the Fed's preferred measure of inflation, i.e., Core PCE Price Index on Friday, followed by the Non-Farm Payrolls (NFP) report and Consumer Price Index (CPI) data in the subsequent weeks. The March US data, scheduled for early April release, holds considerable sway over the dollar's trajectory. Weakness in these figures, especially in forthcoming inflation data, could precipitate a sustained decline in the dollar, potentially lending support to gold.

Gold outlook: technical levels to watch

With gold breaking out of a multi-year consolidation pattern, the long-term trend is clear, although short-term outlook is uncertain due to the recent pullback from overbought levels.

Establishing higher lows and higher highs before reaching new record highs last week, the long-term trend is clearly bullish. A deviation from this sequence would signal a shift to a bearish outlook. The most recent higher low at $1984 in February would mark a potential conclusion to gold’s long-term bullish trend, if breached.

Short-term weakness won't significantly affect the long-term technical outlook, with many buyers waiting to capitalise on any dips – for as long as that $1984 level remains intact.

Former resistance levels could become support upon retesting, notably the $2075 to $2081 range, which had served as significant resistance in the past few years. Now, it is a crucial support area to watch.

Another pivotal level at $2146, December 2023's high. This level serves as a reference point for short-term directional trades. Breaking below it could trigger a larger correction towards that $2075 to $2081 support range, where it would potentially present decent buying opportunities.

Key resistance levels include $2195, where gold struggled to hold above during its recent record high breakout, with the subsequent target at $2222 – the most recent (record) high.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade