GBP/USD holds above 1.1950 as Boris resigns

The recent selloff in GBP/USD has stalled and the pound is attempting a move higher despite news that Boris Johnson has resigned.

The move by Boris Johnson comes after a third of his government resigned following months of damaging headlines. He is expected to remain as a caretaker leader until October.

With a new leader incoming, the government’s agenda is now uncertain. Many key issues are at stake, such as Brexit, competition post Brexit, and how to tackle the cost of living crisis? The new leader could change the course of such issues. In short, the move will mean more limbo for the UK economy, while the leadership race takes place, at a time when it needs a strong sense of direction.

The pound hit a session high following the announcement, clearly pleased that Boris Johnson won’t try to rule the country with such dwindling support and relieved that he hasn’t gone down the route of a snap election.

However, this latest political earthquake could keep the pound under pressure over the coming weeks. More uncertainty at a time when Brexit relations are dire, and the cost of living crisis is set to intensify could see the pound fall back below 1.19; the upside potential of GBP/USD seems very limited.

My colleague Fawad Razaqzada commented:

“It always looked unlikely that Boris Johnson was going to hang in as many of his close ministers quit left, right and centre. Markets had priced this in, which is why we saw the pound react a little positively to the news.

The somewhat positive — or lack of negative — reaction also suggests markets are relieved that we are moving ahead swiftly with this, rather than it posing a prolonged political uncertainty over the markets.

So I reckon the downside arising from political uncertainty is going to be very limited from here for the pound. Indeed, the bigger risk facing GBP/USD is its vulnerability to the global recession risks rather than domestic political chaos.”

Where next for GBP/USD?

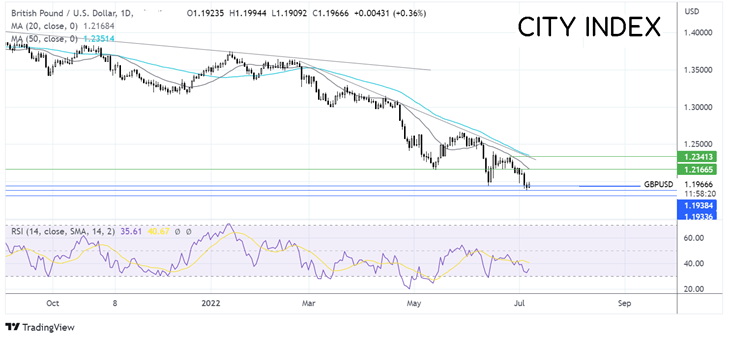

GBP/USD is building on an overnight bounce, rising from a two-year low of 1.1875 reached yesterday. The corrective pullback has pulled the RSI away from oversold territory, but technical indicators remain bearish.

Sellers will need to break below 1.1875 yesterday’s low to extend the selloff towards 1.18 round number.

Buyers will need to push GBP/USD over 1.2170 the May low and the 20 sma to negate the near-term downtrend. A move over 1.2320 could create a higher high.