GBP/USD slips after UK borrowing data, US consumer confidence in focus

GBP/USD is falling away from 1.25 after solid gains in the previous session after the pound capitalised on the weaker USD.

Today data showed that UK government borrowing came in £13.2 billion below official forecasts for the last fiscal year, boosted by solid tax revenue and despite another month of huge subsidies for energy bills in March.

For March alone, borrowing reached £21.5 billion, the second highest level on record but also in line with forecasts.

Looking ahead CBI manufacturing orders will be in focus and should provide further insight into the health of the sector. Selling prices are forecast to cool to 20 from 25, which could be a signal that inflation is cooling.

BoE’s Broadbent is due to speak, and his views will be watched carefully after Deputy Governor Dave Ramsden addressed the UK’s high inflation levels on Friday, saying that high inflation is a bigger risk than over-tightening.

Meanwhile, the Fed is on a blackout period. The greenback fell yesterday after the Dallas Fed manufacturing index fell to a multi-month low, in a sign of the economy slowing. Attention will be on US consumer confidence data later which is expected to hold steady around 104. The data comes ahead of GDP data later in the week.

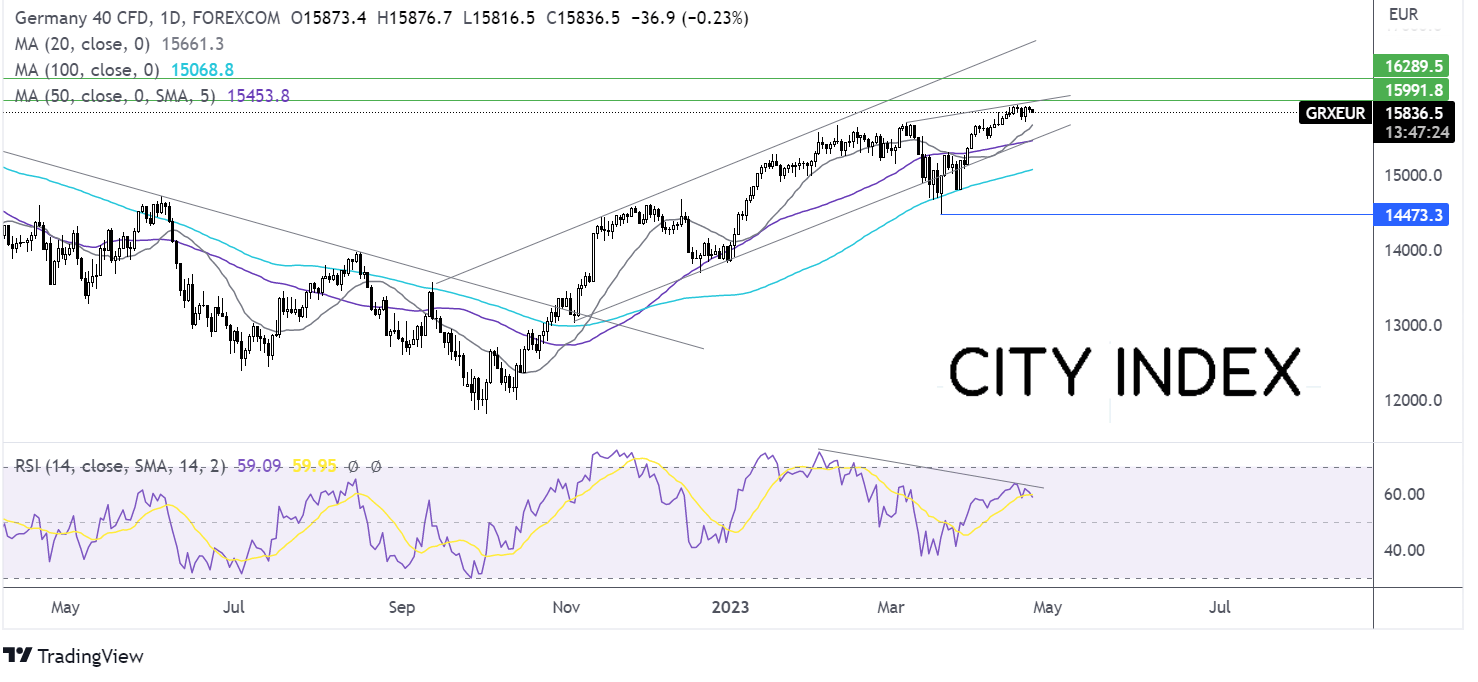

Where next for GBP/USD?

After a steep run up across March, GBP/USD is consolidating between 1.24 to 1.25 and is immediately supported by the 20 sma. The RSI keeps buyers hopeful of further gains.

Buyers need to rise above 1.25 to test 1.2545, the April high to create a higher high.

Meanwhile, a break below the 20 sma, and 1.24 opens the door to 1.2370, last week’s low. Below here 1.2275, the April low comes into focus.

DAX falls as risk sentiment falters, US earnings due

The DAX is set to open lower on Tuesday, extending losses from the previous session. The German index briefly reached a new 2023 high yesterday of 15,919 before closing 0.1% lower.

While the improving Geman IFO economic sentiment lifted the index, hawkish commentary from the ECB and nerves surrounding US earnings, dragged the index lower. ECB’s Isabel Schnabel said that the central bank was considering a 50 basis point rate hike in May.

While there are several economic data points of interest this week, including German CPI and Eurozone GDP, earnings will also be very much in focus, with big names such as Deutsche Bank.

Looking ahead US earnings will drive sentiment, with big names including General Motors, Microsoft and Alphabet due to report.

US consumer confidence will also be in focus, with a fall below 100 likely to unnerve investors. Attention will also be on the expectations sub-index which is set to rise to 73 from 70.4 but still remain below 80 which often signals a recession.

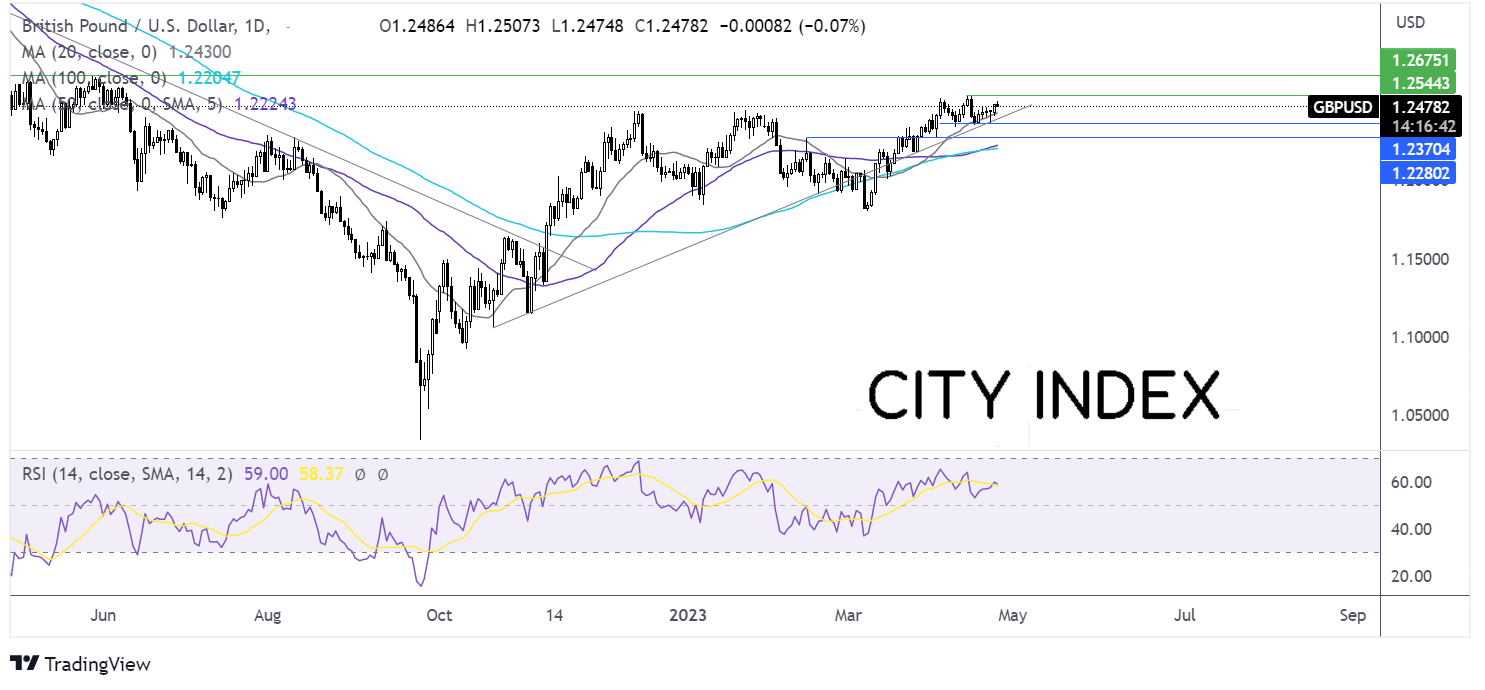

Where next for the DAX?

The DAX is edging away from the 2023 high of 5919 reached yesterday. The bearish divergence on the RSI suggests that momentum is fading.

Sellers will be looking for a fall below support at 15700, the weekly low. A break below here exposes the 20 sma at 15660. A key support can be seen at 15454, the confluence of the 100 sma, the lower band of the rising channel and the April low, which could prove a tough nut to crack.

Buyers would need a rise above 15900 round number, to provide a bullish signal and to retest 15919 for further upside towards 16000.