- GBP/USD outlook hinges on US CPI, FOMC and BoE

- US dollar steady after Friday’s data-fuelled rally

- GBP/USD’s positive correlation with stocks is additional source of support for cable

The GBP/USD closed lower last week as the dollar made a comeback against all major currencies. But the cable has started the new week on the front foot, in what promises to be big next few days. We have several key data releases coming up this week from both sides of the pond, including US CPI on Tuesday, while both the Federal Reserve and Bank of England will be making their respective interest rate decisions later in the week. This makes the GBP/USD our featured currency pair of the week.

US dollar steady after Friday’s data-fuelled rally

The dollar index closed higher on Friday, in what was a textbook reaction across financial markets in response to the stronger jobs and consumer sentiment data. Along with the dollar, bond prices and gold fell, as yields rose. The GBP/USD came to within a couple of points of breaking below 1.25 handle, before bouncing off the low. The cable has since bounced back, now trading near the 1.26 area. The dollar has also weakened against a few other major currencies, although it has extended its gains against the likes of the yen and gold, as bond yields have remained near their highs made on Friday.

The dollar rallied on Friday after the non-farm payrolls report exceeded expectations, showing nearly 200K jobs added compared to the anticipated 185K. However, there was a downward revision of 35K in the data for the previous two months, somewhat dimming the overall positive employment picture. Still, the unemployment rate fell, and weekly wages saw a greater-than-expected growth of 0.4% month-over-month. Later in the day, the UoM Consumer Sentiment survey came in well ahead of expectations at 69.4 vs. 62.0 expected.

GBP/USD outlook: Cable facing big test

The GBP/USD will be facing a big test this week. On the data front, as well as UK earnings and US CPI data on Tuesday, we will have UK GDP and US PPI on Wednesday, followed by US retail sales on Thursday and manufacturing PMI data on Friday. In addition to these key data releases, both the Federal Reserve and Bank of England will be making their respective interest rate decisions this week.

This is the final Fed meeting of 2023, which means the FOMC will present its staff projections, the dot plots, as well as the usual statement and then a press conference with Chairman Jerome Powell. Fed Fund futures currently imply almost 100% chance of the Fed holding rates. A notable recent shift is the change in expectations for the Fed's initial rate cut, moving from May to March. Current pricing indicates a 40% likelihood of a cut. Given the forward-looking nature of markets and weaknesses in certain sectors of the US economy, anticipating cuts in the first half of next year is not entirely unfounded. But let’s see what the Fed signals as this could move the odds firmly back in the favour of a cut in May.

Meanwhile, the Bank of England and the other two major central banks in Europe – ECB and SNB – are also expected to keep their policies unchanged on Thursday. The BOE has indicated a prolonged hold on the current rate, and the ECB has recently paused, with market expectations ruling out another hike. The pound could move if the BoE’s stance has changed, although that’s highly unlikely in my view.

Don’t forget GBP/USD’s positive correlation with stocks

While the outcome of these macro events remains crucial, it is worth pointing out that the GBP/USD has also closely mirrored the movements of the stock markets. In November, it experienced an upswing alongside a significant rally in major indices. Although the beginning of this month has seen a momentary pause in US indices, the DAX has persistently climbed to reach new all-time highs. Consequently, the underlying long-term trend in stocks still point higher. Perhaps this is why we didn’t see Friday’s drop in the GBP/USD turn into an outright sell-off. Instead, the cable has rebounded to make back most of its losses.

So, there is a possibility that the bullish trend for the GBP/USD will resume, possibly regardless of the short-term volatility resulting from the upcoming macro events – that is, for as long as the stock market rally remains in place. In other words, the direction of risk appetite could be as big an influence on the cable as this week’s macro events.

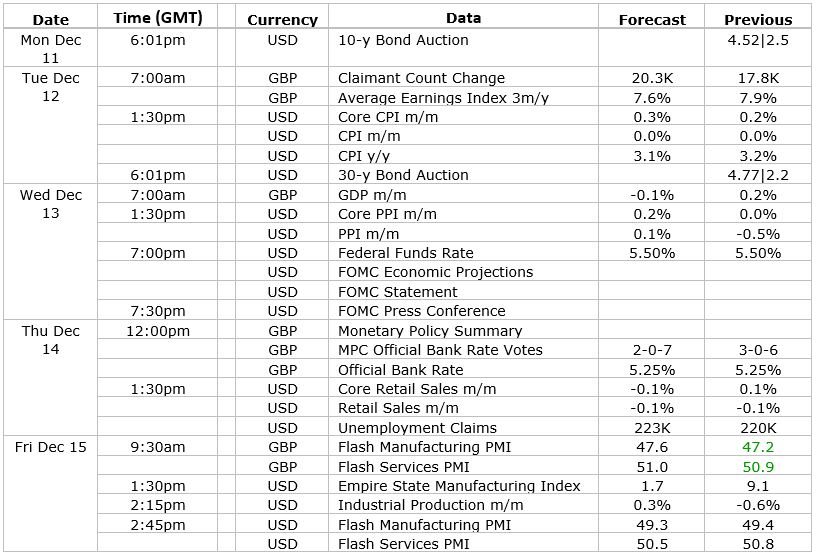

Macro highlights relevant for the GBP/USD

Here’s the full economic calendar, relevant to the GBP/USD pair, this week:

GBP/USD technical analysis

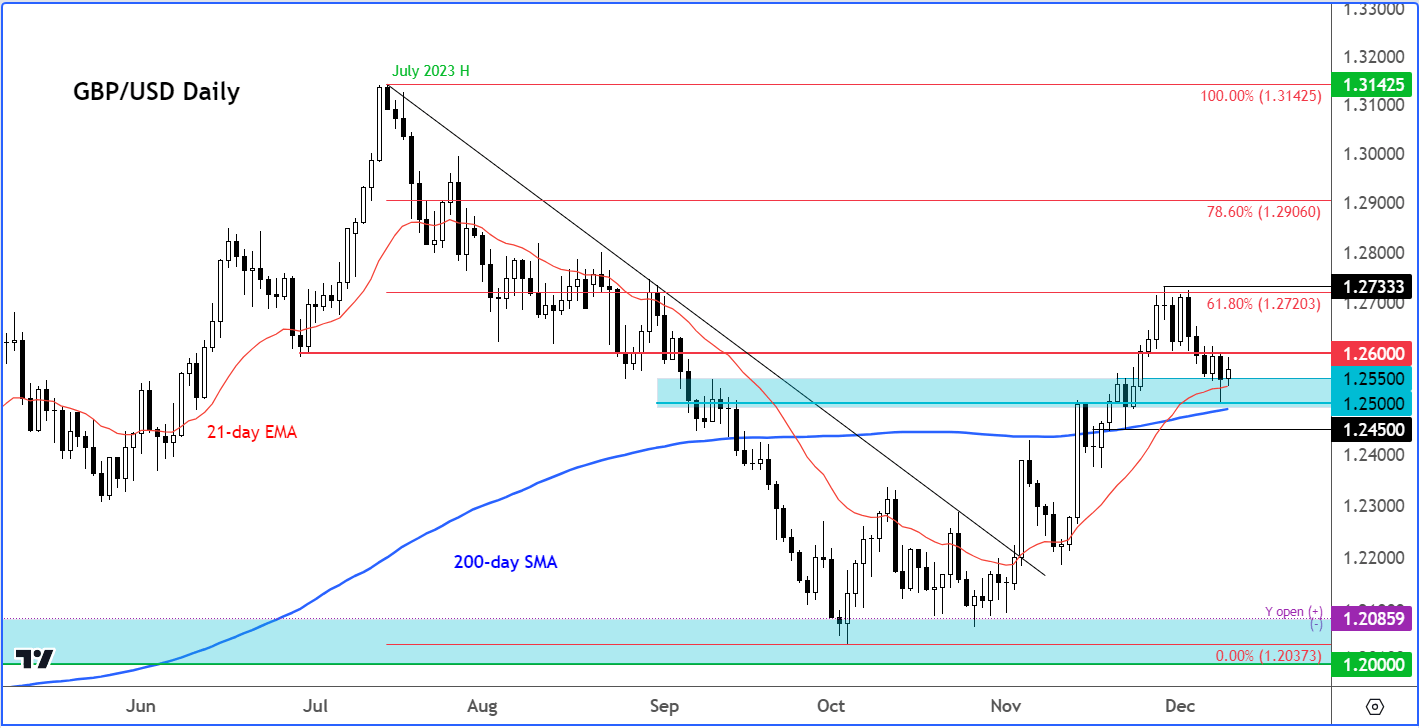

Source: TradingView.com

Despite closing lower last week, the GBP/USD’s bullish trend has remained largely unscathed. The consistent pattern of higher highs and higher lows since the GBP/USD hit a low point in October suggests that the path of least resistance still point upwards for the cable. In the middle of November, the pair surpassed the 200-day average, providing an objective indication that the trend had shifted positively. Consequently, I am inclined to seek bullish opportunities around key support levels like 1.2550 and 1.2500, which were previously resistance levels. My pivotal level is approximately 1.2450, representing the last low before the latest rally. A breach below 1.2450 would establish a lower low, signalling a potential bearish reversal. However, until that scenario potentially unfolds, the GBP/USD outlook will remain bullish from a technical viewpoint. The next level of potential resistance comes in around 1.2600 area, above which there’s not much further resistance until the 61.8% Fibonacci retracement level around 1.2720.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade