- GBP/USD analysis: FOMC, BoE and NFP among macro highlights for cable this week

- Both FOMC and BoE seen keeping interest rates unchanged; it is all about forward guidance

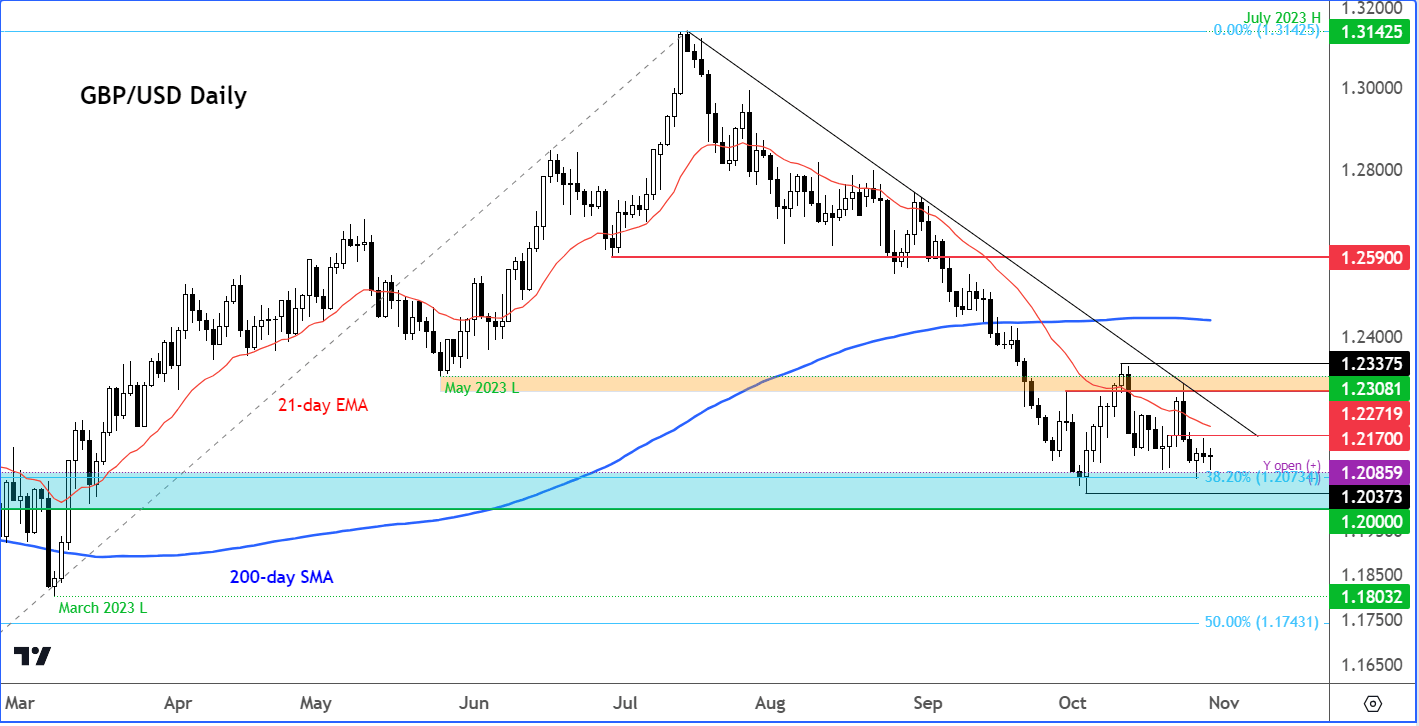

- GBP/USD technical analysis: Selling pressure has waned; 1.20 key support needs to hold for bulls

Welcome to another edition of the Currency Pair of the Week.

The GBP/USD faces a key test this week with the release of several top-tier data from the US, while both the Federal Reserve and Bank of England will be deciding on monetary policy. This makes the GBP/USD our featured currency pair.

After topping out at 1.3142 in July, the cable has shed over 1,100 pips at its lowest point in early October. This was in response to the sharp repricing of “higher for longer” US interest rates narrative. The further resilience of US data we have seen over the past couple of weeks hasn’t led to any further appreciation in interest rate expectations, keeping the dollar in consolidation mode. The GBP/USD has managed to cling on to key support in the 1.20-1.21 area as a result. So, there is a possibility we may see some strength come back into the cable, especially if this week’s US data turn out to be below par.

GBP/USD analysis: Key macro highlights for cable to watch this week

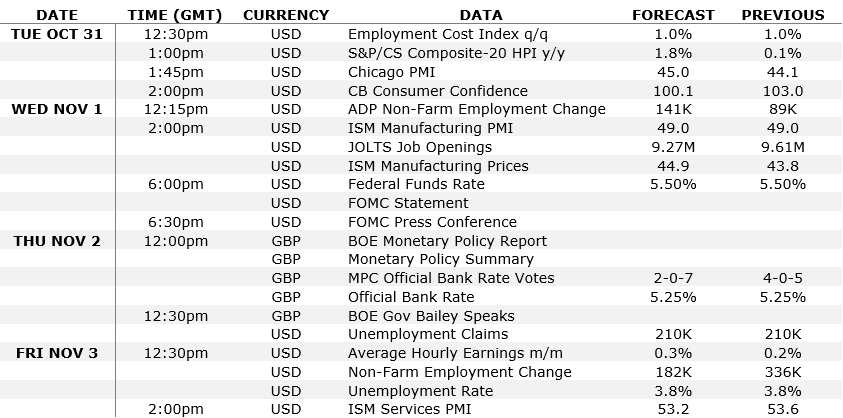

As you can see from the calendar below, it will be a rather busy week for US macro events, which include the Federal Reserve rate decision on Wednesday and the nonfarm payrolls report on Friday, among several other data releases throughout the week. From the UK, the Bank of England’s rate decision stands out on Thursday. Before we discuss these three key events in a bit of detail, below is the full list of data releases relevant to the GBP/USD pair.

FOMC rate decision

Wednesday, November 1

18:00 GMT

The Fed has kept the door to one more rate hike open. But the market seems convinced there will be no more hikes, certainly not at this week’s meeting. The probability of a hike in the next meeting in December was around 20% last week. Those odds could increase or decrease sharply depending on how hawkish or otherwise the Fed is going to be this week. But a lot will also depend on incoming data. We have seen plenty of forecasting-beating US data of late. Last week saw the UoM’s consumer sentiment, pending and new home sales, GDP and both manufacturing and services PMIs all come in ahead of expectations. The week before it was retail sales, industrial production and jobless claims data that topped expectations. So, the US economy is showing continued resilience in the face of high interest rates, putting the Fed in a slightly difficult position as to whether it should tighten its belt even further, or just keep rates at these current levels for a longer-than-expected period of time. A growing number of analysts and economists seem to agree with the latter approach. Let’s see if this is something that the Fed alludes to at this meeting.

BoE rate decision

Thursday, November 2

12:00 GMT

Inflation remained higher than expected in September, which is going to keep policymakers at the Bank of England on their toes. However, sluggish economic growth, falling retail sales and weak PMIs all reinforce the picture of an economy that is losing steam in the face of 14 straight interest rate hikes. The UK’s economic outlook therefore remains bleak, which should help bring inflation down without the need for further tightening. There is a good chance that the pound could fall if the BoE explicitly rules out further tightening on Thursday. But by the time the BoE decides on monetary policy on Thursday, we will have had the FOMC’s rate decision out of the way, which means that the dollar may well have established a new directional bias. This could lessen the impact of Thursday’s BoE meeting on the GBP/USD. In any case, the focus will quicky turn to the US jobs report that will be published the day after on Friday (see below). It therefore makes more sense to watch and trade a GBP cross if you want to see the full impact of the BoE’s rate decision.

US NFP report

Friday, November 3

12:30 GMT

The “higher for longer” narrative will be put to the test again with the release of the latest US jobs report and the ISM services PMI data that would be released later in the day. With the Fed meeting also taking place earlier this week, the US dollar should be in for a roller-coaster ride. But with the dollar moving sharply higher in the last three months or so, most of the positivity may be priced in. For the dollar to accelerate from here, it will take a lot more effort. Put another way, if upcoming US data were to disappoint, the US dollar’s downside reaction may well be more pronounced than would otherwise be the case.

GBP/USD analysis: Technical levels to watch on the cable

Source: TradingView.com

The selling pressure has eased on the GBP/USD in recent weeks, as discussed above. Let’s see if the cable will continue to hold onto key support around the 1.20 area in this busy week of macro events. The bulls will be eyeing a breakout above the bearish trend line to signal a change in the trend. Until that happens, it is essential to remain more neutral in order not to get excited over any short-term noise. The next potential resistance levels to watch are around 1.2170, followed by the bearish trend line around 1.2230ish, and then 1.2300, which has been a more significant support and resistance area in the past.

On the downside, 1.2070-80 area is where all the action started in the first days of 2023, and which also happens to be where the 38.2% Fibonacci retracement level of the long term upswing comes into play. The next support level is seen around 1.2000. As a minimum, the bulls would like to see the cable hold above this psychological level come the end of this week. If we get a convincing break below this level, then we will likely see more follow-up technical selling. So, it is essential that the bulls hold onto their ground here.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade