- GBP/USD analysis: US CPI and retail sales among week’s key data highlights

- Pound traders also face busy week with several market moving data to come

- GBP/USD technical analysis points modestly lower

Welcome to another edition of the Currency Pair of the Week.

GBP/USD analysis: Inflation data from both sides of the pond among key highlights

The GBP/USD is our featured currency pair this week. We have top-tier data from both the UK and US to look forward, with inflation figures from both nations likely to set the tone for both currencies. Ahead of a busy week, the GBP/USD was consolidating around the 1.26 handle, holding in the negative for the month of February despite last week’s slight recovery. All told, consolidation was name of the game for this pair, as traders awaited direction from the macro front.

GBP/USD analysis: US CPI and retail sales among week’s key data highlights

Last week, the FX markets predominantly favoured the US dollar, with the greenback maintaining support despite the absence of significant news developments. The preceding week witnessed a robust US jobs report and several other data indicators surpassing expectations, alongside indications from Fed Chair Powell and the FOMC signalling against an early rate cut. Nonetheless, the buoyancy in the tech sector persisted on Wall Street, culminating in the S&P 500 reaching the historic 5K milestone, largely driven by robust company earnings reports. The strong performance of the stock market weighed on the dollar against some risk-sensitive currencies, including the Australian, Canadian and New Zealand dollars, as well as the British pound. However, losses for the negative-yielding Japanese yen and Swiss franc, where interest rates are among the lowest among developed economies, helped to provide some support for the dollar index. As a result, the Dollar Index posted another, albeit small, weekly gain. The DXY closed higher in January, ending a run of two consecutive monthly losses.

So, on the one hand, strong data is helping to provide the dollar support while the ongoing stock market rally is encouraging some investors to dip into the more risk-sensitive currencies. Therefore, a potentially stronger inflation report could further bolster the dollar's strength against the lower-yielding currencies, whereas a softer reading would be welcomed by all traders favouring foreign currencies over the USD.

The Consumer Price Index is seen falling to 2.9% annual pace in January from 3.4% in December, with a month-over-month print of +0.2% compared to +0.3% in the previous month. Core CPI is expected to print +3.7% y/y, down from +3.9%, or +0.3% month-on-month.

The resilience of the US consumer has been underscored by recent retail sales figures exceeding forecasts for six consecutive months. December saw a 0.6% rise in retail sales, accompanied by a 0.4% increase in core sales. These encouraging retail figures have coincided with an upsurge in consumer sentiment over the past few months. Consequently, the unemployment rate remains low, wages continue to grow, and inflation is experiencing a gradual moderation. With these factors in play, the Fed has found no compelling reason to expedite its policy loosening. Should this week's data releases, particularly in retail sales, signal further economic resilience in the US, anticipate further gains for the US dollar.

However, retail sales are expected to decline this time by 0.2% on a month-over-month basis, although core sales are seen rising +0.1%. Let’s see if we will get another surprise print.

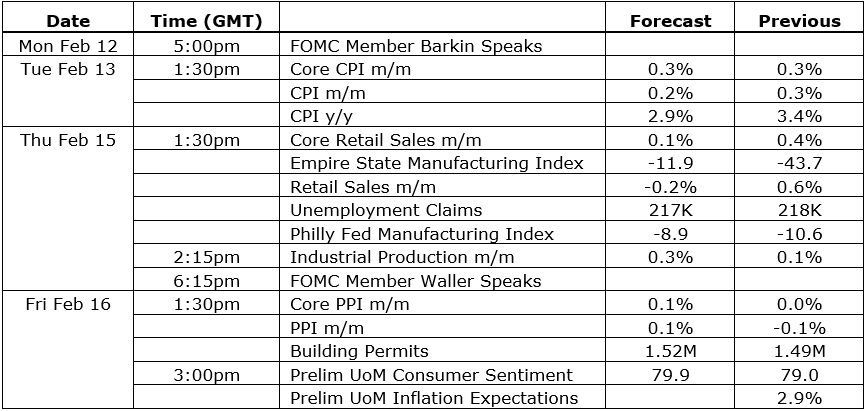

Here’s a list of key data to watch this week from the US:

GBP/USD analysis: Busy week for pound traders

The GBP/USD will be influenced by those US data releases, along with all the other major pairs. But the GBP faces additional volatility due to a busy week of data here in the UK too.

Among the UK data highlights, we have CPI, wages, employment, GDP and retail sales figures all due for release starting on Tuesday.

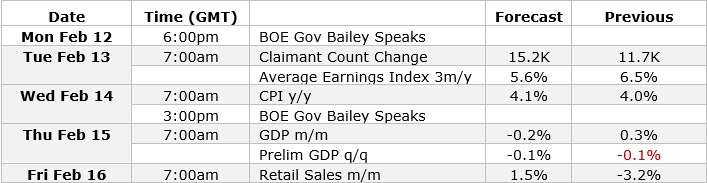

Here’s a list of key data to watch this week from the UK:

The pound could become under pressure if UK inflation turns out to be surprisingly weak, although economists think prices have risen further to 4.1% y/y in January from 4.0% in December. That said, the price action on the GBP/USD will also depend on the US data. Therefore, if you want to isolate the pound’s reaction to the upcoming data from the UK, then it is best to concentrate on a pound cross, such as the EUR/GBP or GBP/JPY, rather than the GBP/USD itself.

GBP/USD technical analysis

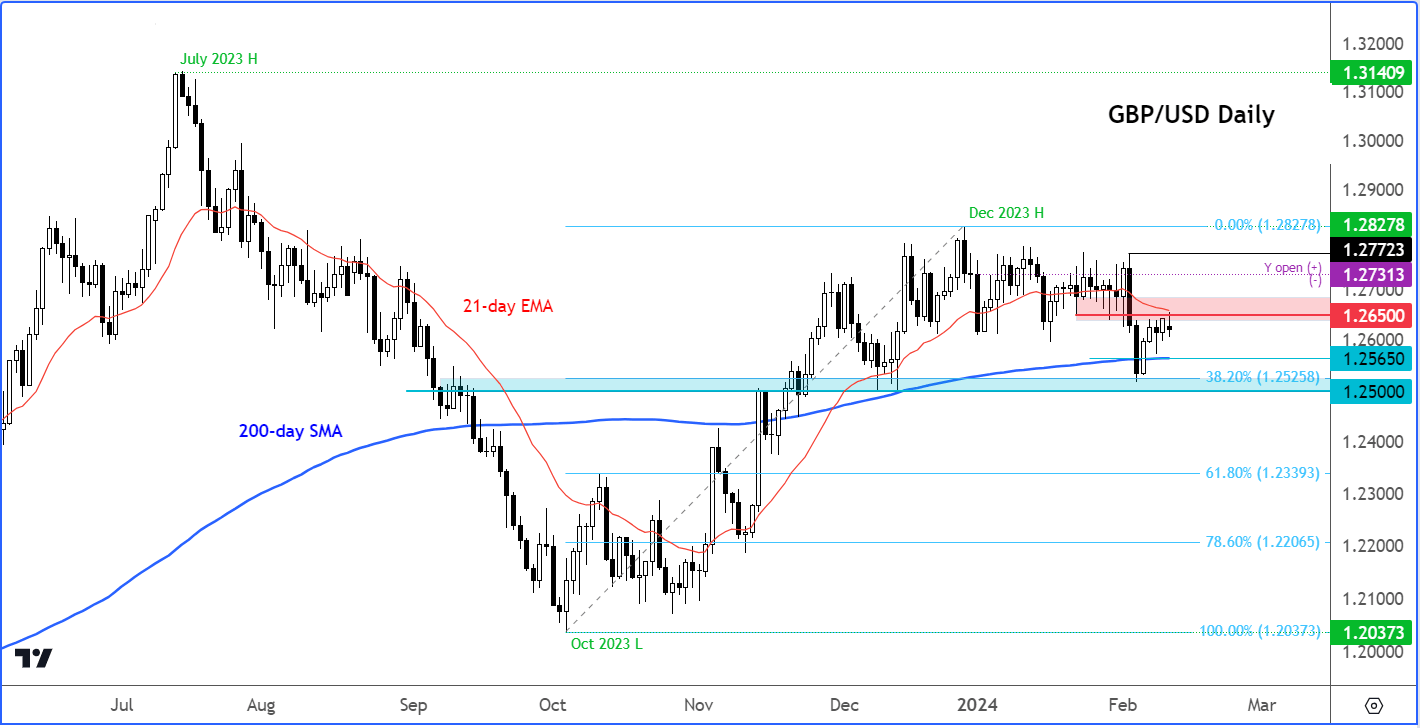

Source: TradingView.com

The key short-term resistance level to watch on the GBP/USD is around 1.2650, this being the former support levels and we have the 21-day exponential moving average coming into play. Above this level, 1.2730ish to 1.2770ish is an additional resistance zone, where a potential bounce could face some trouble. However, if we go above last week’s high of 1.2772 and stay there, then this will be a key bullish reversal sign.

On the downside, interim support is seen around the 200-day average circa 1.2650 area. Below this, the area between the psychologically important level of 1.2500 and the long-term 38.2% Fibonacci level at 1.2525 is key. A potential daily close blow 1.25 handle would be a key bearish reversal sign.

Therefore, as things stand, the GBP/USD is inside a trading range with a modest bearish bias, but without a clear longer term directional bias. This week’s upcoming data could change that and set the tone for weeks to come.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade