Asian Indices:

- Australia's ASX 200 index rose by 37.1 points (0.5%) and currently trades at 7,513.70

- Japan's Nikkei 225 index has risen by 121.28 points (0.33%) and currently trades at 36,668.23

- Hong Kong's Hang Seng index has risen by 368.72 points (2.46%) and currently trades at 15,329.90

- China's A50 Index has fallen by -79.92 points (-0.73%) and currently trades at 10,913.45

UK and European indices:

- UK's FTSE 100 futures are currently up 1.5 points (0.02%), the cash market is currently estimated to open at 7,489.21

- Euro STOXX 50 futures are currently up 2 points (0.04%), the cash market is currently estimated to open at 4,482.32

- Germany's DAX futures are currently down 0 points (0%), the cash market is currently estimated to open at 16,683.36

US index futures:

- DJI futures are currently down -19 points (-0.05%)

- S&P 500 futures are currently up 0.5 points (0.01%)

- Nasdaq 100 futures are currently up 17.5 points (0.1%)

BOJ do little to appease hawks, China stimulus underwhelms

The BOJ left their monetary policy unchanged, with an interest rate at -0.1% and a 10-year JGB target of around 0% with a +/1% band. There was a slight upgrade for CPI in FY 2025 to 1.8% y/y from 1.7%, although the median estimate for 2024 was revised down to 2.4% from 2.8%.

None of which sounds like a central bank trying to dismantle the ultra-dovish policies of previous governor Kuroda. And markets were hoping for something a little more hawkish.

And that's seen the yen strengthen against most FX majors, with exception to the US dollar.

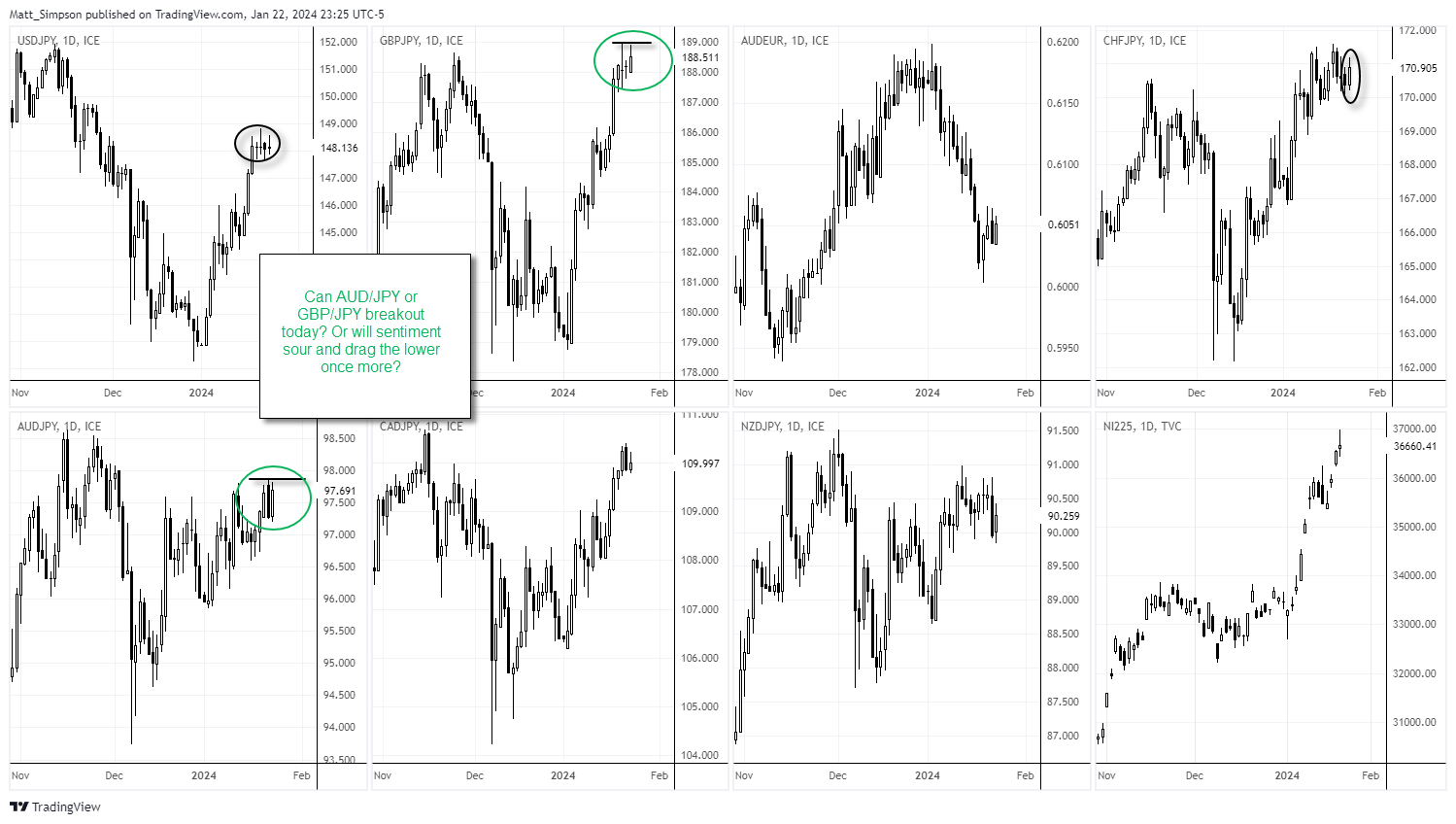

CHF/JPY is the only one to break yesterday's range (to the upside), and AUD/JPY has recouped most of yesterday's losses following reports that China's authorities moving in on a ¥1 trillion ($278 bn) stimulus package - as AUD/USD is currently the strongest forex major.

The question going into the European session is whether we'll see the yen continue to weaken and help some of these pairs breakout.

APAC indices rose on the back of Bloomberg report claiming that authorities are seeking ¥1 trillion ($278 bn) from offshore Chinese state-owned accounts to bring to the mainland, to aid the purchase of shares onshore to support the market. This brings us back to the evergreen question of whether investors will be satisfied with the level of stimulus, but as my colleague Scutty pointed the stimulus treats the symptom and not the cause, which has since seen markets hand back earlier gains. The National Team have likely been supporting the market already, and whilst that may have deterred bears it hasn't really enticed bulls from the sideline.

However, it provided a good enough reason for the US dollar to retrace and become the weakest forex major of the Asian session, with AUD/USD and NZD/USD taking the lead for the session.

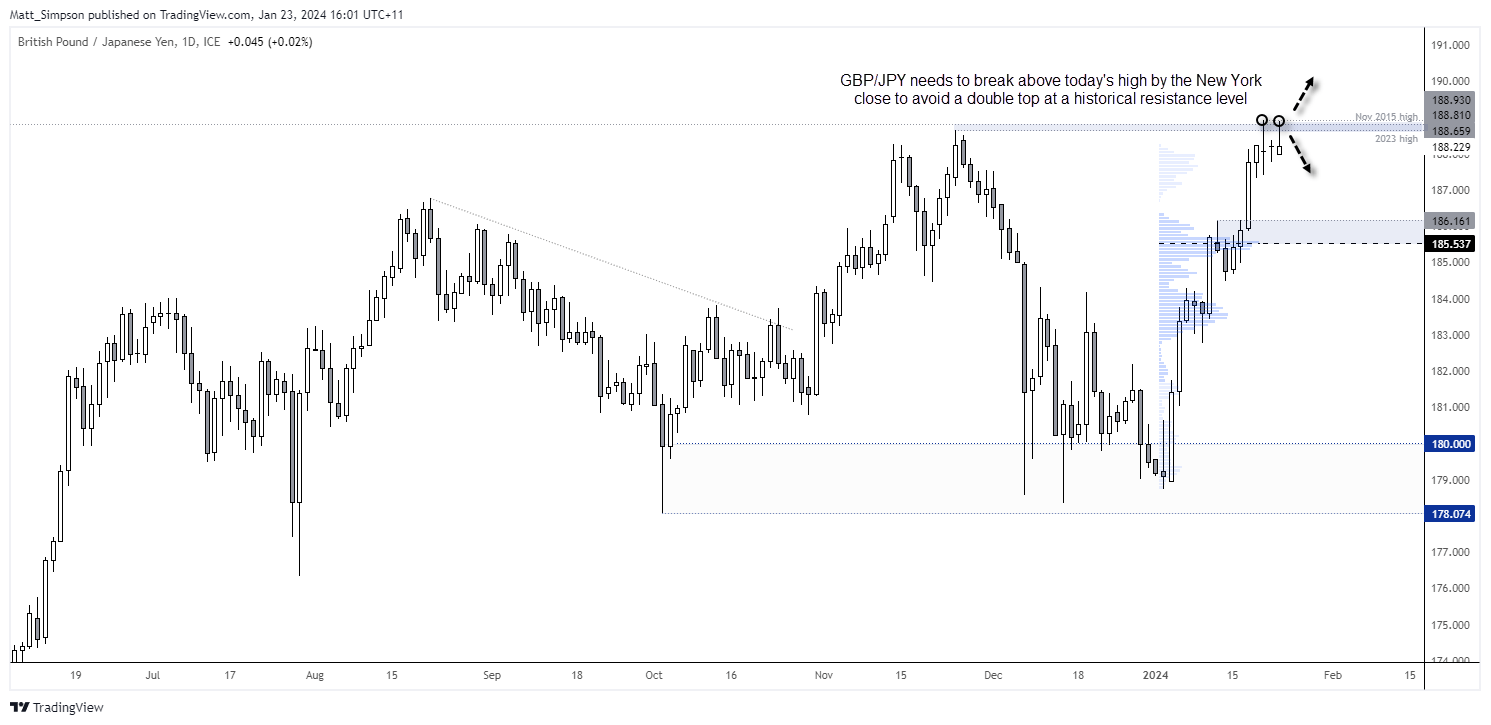

GBP/JPY technical analysis (daily chart):

GBP/JPY is on track for its best month since June and with a bullish engulfing candle. Strong economic data has pushed back bets of BOE cuts any time soon and the BOJ appear no closer to tightening their ultra-loose policy. And that helped GBP/JPY probe the 2015 high following the BOJ’s decision to keep policy unchanged, again.

The daily chart show a strong rally into the 2015 high, but failure to break the 2015 high by the close will leave a double top at a key resistance level tomorrow. And if the BOJ cannot break it higher, we may need to see if a hot set of PMI data arrives from the UK tomorrow. And if we’re too see risk take a turn for the worse – as indicated by US indices balanced precariously at their highs – perhaps we’ll see a reversal lower before any such breakout materialises.

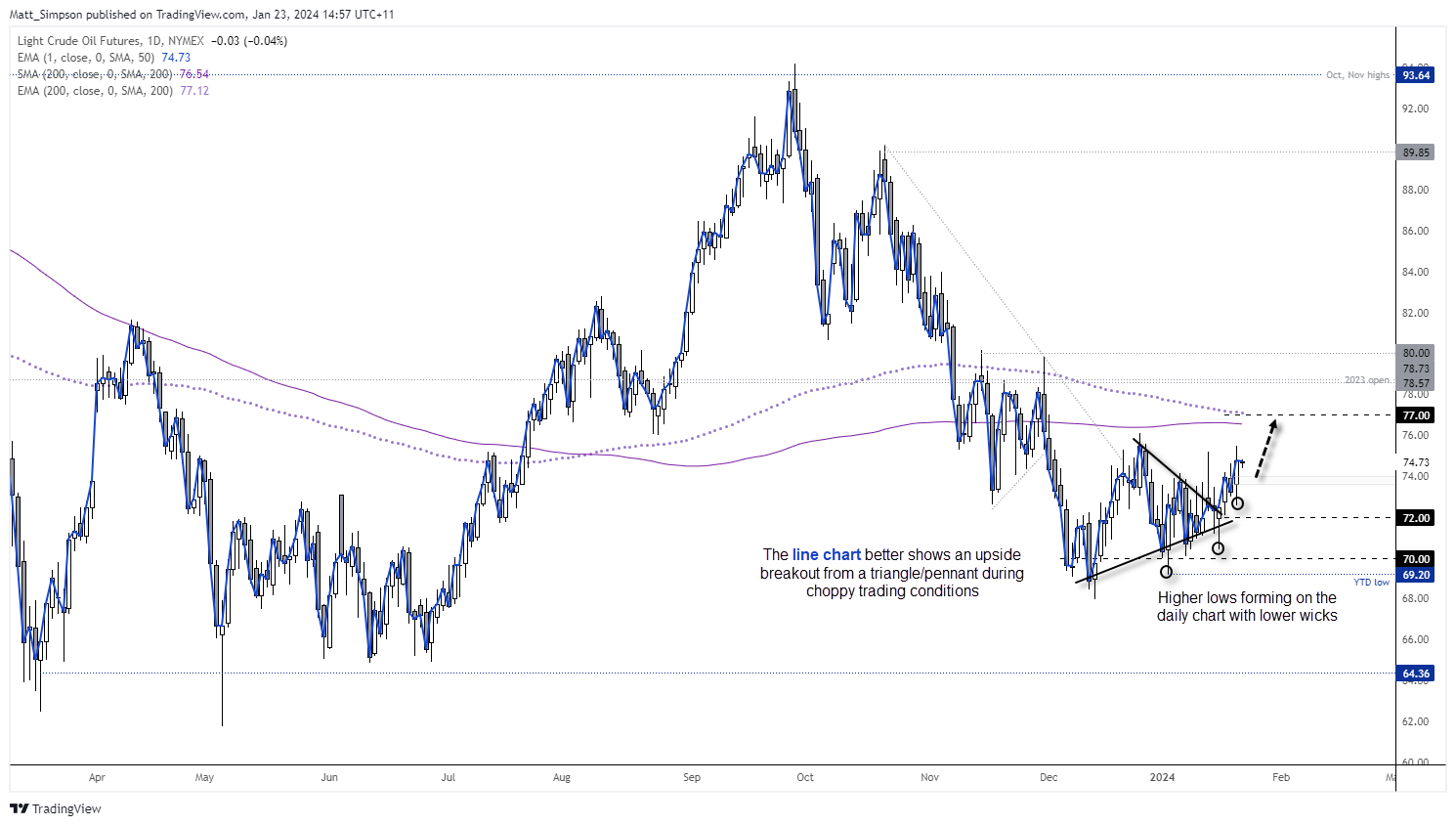

WTI crude oil technical analysis (daily hour chart):

Ahead of the open on Friday, I outlined a bullish bias for crude oil whilst prices remained above $72. Despite a pullback on Friday, we’ve since seen another higher low form on Monday’s wick which closed the day with a bullish outside day. I still see the potential for prices to mean revert towards $77, which sits in between the 200-day average and EMA.

Ideally we will be treated to a retracement within yesterday’s range to increase the potential reward to risk ratio. Perhaps prices can hold above the open price of 73.59 or the 74 handle before moving towards $77. The bias remains bullish above yesterday’s low.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade