Welcome to Forex Friday, a weekly report in which we discuss selected currency themes mainly from a macro viewpoint, but we also throw in a pinch of technical analysis here and there. In this week’s edition, we discuss the dollar and its impressive rally and the Canadian dollar.

Dollar hits highest since 2002

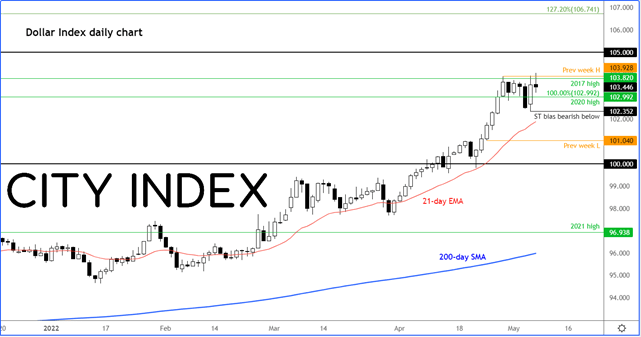

There was a brief sell-off on the dollar in mid-week when the Fed Chair Jay Powell started speaking at the FOMC press conference. Powell confirmed that “75bps isn’t something the FOMC is actively considering,” but that fell on deaf ears as the greenback surged back higher on Thursday, before consolidating on the back of a mixed US jobs report on Friday. Judging by the dollar’s reaction, it doesn’t seem like the markets are taking Powell seriously, as my colleague Joe Perry commented in his post FOMC reaction. Investors are now looking ahead to next week’s release of US CPI. In March, consumer prices raced to a fresh multi-decade high of 8.5% from 7.9% y/y print that had been recorded in February.

Year-to-date, the greenback has now risen more than 8% against a basket of foreign currencies. It has done particularly well against the yen, rising some 13% to repeated multi-decade highs versus the Japanese currency. European currencies have also suffered at the expense of the world’s reserve currency. The pound, euro and franc have all dropped around 7-8 percent each.

The greenback has been in a strong uptrend since the start of 2021. At just over 104.00, the Dollar Index this week reached its best level since 2002, after surpassing the peaks of 2020 (~103.00) and 2017 (~103.80), before easing back amid profit-taking and bargain hunting of downbeat foreign currencies. The King of FX has been doing exceptionally well against currencies where the central bank is still relatively more dovish, such as the yen, yuan, euro and franc.

So, why has dollar rallied so much?

In short, because of a strong economic rebound from the pandemic and, more to the point, soaring inflation. As price pressures have been rising rapidly over the past year or so, the Fed (and other central banks) has been rushing to tighten its ultra-loose monetary policy, in order to avoid letting inflation get completely out of control. To a great degree, the FOMC has failed to achieve this goal, given that consumer prices have reached 8.5%, their highest since the early 80s. There is a risk that prices could get even higher before easing back.

Expectations that interest rates will continue to rise in the US has caused the dollar to rise against currencies where the central bank is expected to keep interest rates comparatively lower. In other words, investors have been piling into the dollar to earn higher interest.

USD/CAD testing key resistance

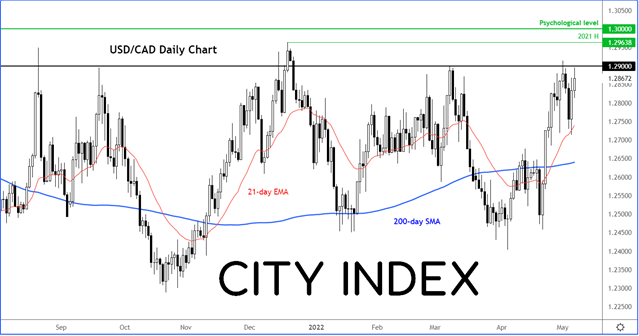

One particular pair to watch is the USD/CAD, which has not moved much as rising oil prices have helped to support the Canadian dollar. But Friday’s significantly weaker jobs report from the North American nation saw the CAD drop noticeably. Canada’s jobless rate dropped to 5.2%, a modern low, but employment only rose by 15K compared with 40K expected.

Will we see a breakout above 1.2900?

In the week ahead, the economic calendar is very quiet, although we still do have US CPI, German ZEW, UK GDP and Chinese trade data all to look forward to. But do keep an eye and ear out on Fed speakers, the direction of the equity markets and generally risk appetite, which could provide fresh energy for FX.

Source for all charts used in this article: StoneX and TradingView.com

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade