Canadian Dollar Technical Forecast: USD/CAD Weekly Trade Levels

- Canadian Dollar attempting third consecutive weekly advance

- USD/CAD rally off support now eyeing key resistance cluster

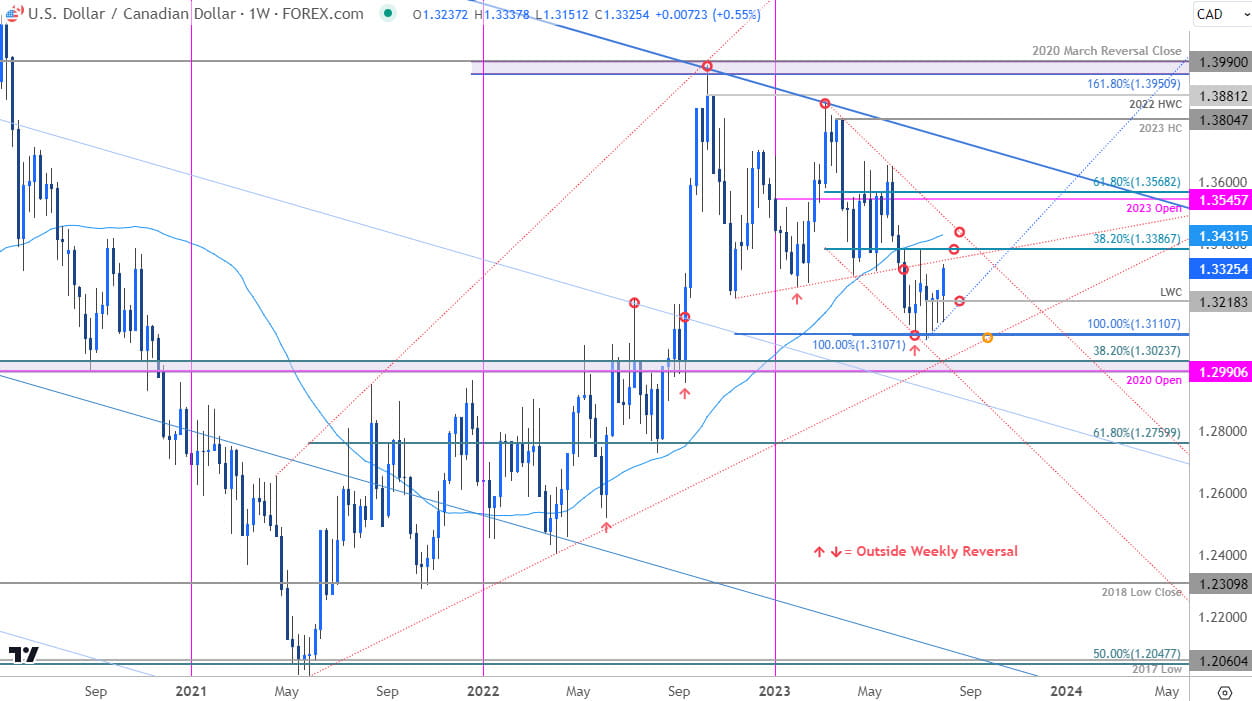

- Resistance 1.3386, 1.3431,1.3545/68 – support 1.3218, 1.3107/11, 1.2990-1.3023

The Canadian Dollar plunged nearly 2% against the US Dollar with USD/CAD poised to mark a third consecutive weekly rally. The advance is now approaching a cluster of technical resistance and the first major hurdles for the bulls. These are the updated targets and invalidation levels that matter on the USD/CAD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In last month’s Canadian Dollar Technical Forecast we highlighted that, “USD/CAD is once again testing key pivot zone” at 1.3107/10- a region defined by the 100% extensions off the 2023 and 2022 highs respectively. Price briefly registered an intra-day low 1.3092 that week before rebounding with price now poised to mark a third consecutive weekly advance off support.

Initial weekly resistance is eyed at former slope support (currently ~1.3350s) backed by the 38.2% Fibonacci retracement of the yearly range at 1.3387 and the 52-week moving average at ~1.3431. Ultimately, a breach / close above yearly channel resistance (red) is needed to validate a breakout towards the yearly open / 61.8% retracement at 1.3545/68- look for a larger reaction there IF reached.

Initial weekly support rests with the yearly low-week close at 1.3218 backed again by 1.3107/10 and 1.2990-1.3023 – note that losses below this threshold could fuel another accelerated sell-off and would have larger implications for the longer-term USD/CAD technical outlook.

Bottom line: USD/CAD is once again rebounding off well-defined lateral support- the immediate focus is on this stretch towards resistance. From at trading standpoint look to reduce long-exposure / raise protective stops on a stretch towards former consolidation support- losses should be limited to the low-week close IF price is indeed heading higher. Keep in mind we have US non-farm payrolls and Canada employment data on tap into the close of the week- stay nimble here. I’ll publish an updated Canadian Dollar Short-term Outlook once we get further clarity on the near-term USD/CAD technical trade levels.

US/ Canada Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- British Pound (GBP/USD)

- Australian Dollar (AUD/USD)

- US Dollar (DXY)

- Crude Oil (WTI)

- Gold (XAU/USD)

- Euro (EUR/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex