As we noted in our FOMC preview report, the market had already fully “priced in” a 75bps (0.75%) rate hike from the Federal Reserve, with only an outside chance at a full 100bps (1.00%) move, so today’s as-expected 75bps increase, bringing the benchmark Fed Funds rate to the 2.25-2.50% range, has had only a minimal impact on price by itself.

Despite the lack of fireworks from this month’s decision itself, there are still actionable tidbits to glean from the central bank’s monetary policy statement and Fed Chairman Powell’s ongoing press conference:

The FOMC’s monetary policy statement

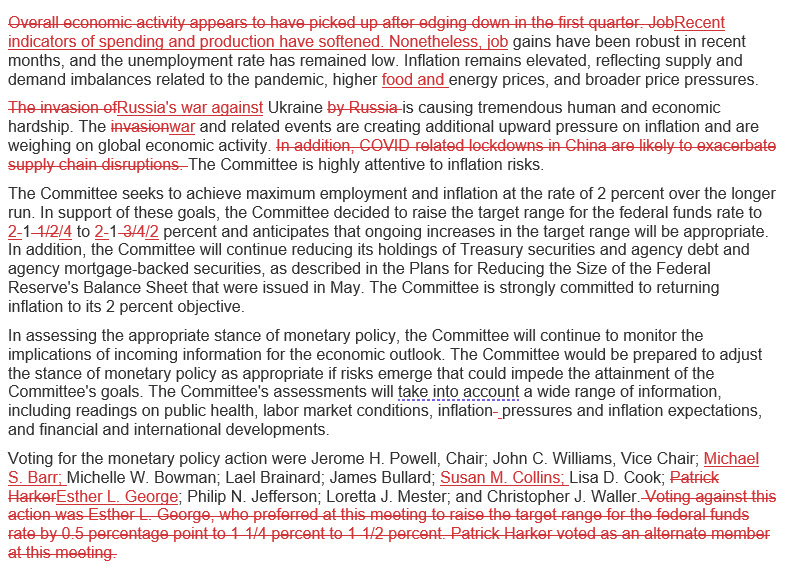

As the “redline” comparison below shows, there were only small tweaks to the central bank’s monetary policy statement:

- Downgraded “Overall economic activity appears to have picked up after edging down in the first quarter” to “Recent indicators of spending and production have softened”

- Acknowledged higher food prices in addition to energy.

- Recharacterized Russia’s “invasion” of Ukraine to a “war”

- Removed the reference to COVID related lockdowns in China and their impact on supply chains.

- The vote was unanimous after Esther George’s dovish dissent last month.

Source: Federal Reserve

Fed Chairman Jerome Powell’s press conference

As all central bankers are wont to do, Fed Chairman Jerome Powell is trying to toe the line between offering useful guidance and avoiding pre-committing to any specific policy path in his press conference. Indeed, he explicitly stated that the committee will go “meeting-by-meeting” and give less clear guidance now that interest rates are “in the range of neutral.”

On balance, the Fed chief is coming off as relatively dovish, and traders have taken that message to heart, driving down the implied odds of a 75bps interest rate increase in September from above 50% to roughly 40% according to the CME’s FedWatch tool.

Other headlines from Powell’s press conference so far:

- FOMC STRONGLY COMMITTED TO BRINGING INFLATION DOWN

- PACE OF RATE HIKES TO DEPEND ON INCOMING DATA

- ANOTHER UNUSUALLY LARGE INCREASE TO DEPEND ON DATA

- LIKELY APPROPRIATE TO SLOW INCREASES AT SOME POINT

- FED TO OFFER LESS `CLEAR GUIDANCE' ON RATE MOVES, WILL MAKE DECISIONS MEETING-BY-MEETING

- POLICY CURRENTLY AT NEUTRAL, NEED TO GET TO AT LEAST A MODERATELY RESTRICTIVE LEVEL

- TAKE EST. FOR RATES NEXT YEAR `WITH A GRAIN OF SALT'

- PATH TO SOFT LANDING HAS NARROWED, MAY NARROW FURTHER

- DO NOT THINK THE US IS CURRENTLY IN A RECESSION

- HAVEN'T MADE DECISION ON POINT WHEN TO SLOW RATE HIKES

- THERE'S SOME EVIDENCE LABOR DEMAND MAY BE SLOWING A BIT

Market impact

Because the monetary policy statement met the market’s expectations almost word-for-word, there was essentially no notable reaction to the initial release. However, as we go to press, traders are clearly acknowledging the dovish tone of Powell’s press conference. Most importantly, treasury yields are declining across the curve, with the 2-year yield dropping 6bps to 3.0% and the benchmark 10-year now yielding 2.74%, down 7bps, to test its lowest level since mid-April.

Not surprisingly, stocks are enthused by the potential for less aggressive interest rate hikes, with major indices rising by between 1.5% (the Dow) and 4% (the Nasdaq Composite). The greenback is seeing major sell pressure come in to fall by nearly 100 pips against most of her major rivals, and gold is testing 2-week highs in the mid-$1730s.

As long as we don’t get any late surprises from Powell, these initial trends could extend further as traders price in the potential for slower rate hikes from the Fed throughout the rest of 2022.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade