Asian Indices:

- Australia's ASX 200 index fell by -18.7 points (-0.26%) and currently trades at 7,285.30

- Japan's Nikkei 225 index has fallen by -545.95 points (-1.91%) and currently trades at 27,999.73

- Hong Kong's Hang Seng index has fallen by -334.13 points (-1.44%) and currently trades at 22,858.50

- China's A50 Index has fallen by -76 points (-0.48%) and currently trades at 15,804.96

UK and Europe:

- UK's FTSE 100 futures are currently down -101.5 points (-1.41%), the cash market is currently estimated to open at 7,168.42

- Euro STOXX 50 futures are currently down -71 points (-1.71%), the cash market is currently estimated to open at 4,090.35

- Germany's DAX futures are currently down -242 points (-1.56%), the cash market is currently estimated to open at 15,289.69

US Futures:

- DJI futures are currently down -532.16 points (-1.48%)

- S&P 500 futures are currently down -156 points (-0.99%)

- Nasdaq 100 futures are currently down -40.75 points (-0.88%)

Asian indices al in the red as Omicron spreads

The PBOC (People’s Bank of China) reduced their 1-year loan prime rate by 5 basis points to 3.8% from 3.85% today, and markets suspect there could be further easing in 2022. Yet domestic markets traded in the red in line with global equity sentiment, signalling markets are a little underwhelmed with the expected easing seen today. The CSI 300 is down around -1% and the China A50 is off by around -0.5%. Yet is has fared better than some other indices with Japan’s TOPIX down -2.3% and the Nikkei off by around -2.1%.

Read our guide on the PBOC (People's Bank of China) and inflationUS futures tracked Asian indices lower

US futures continued to fall overnight as the selling which began on Thursday seeks to mark up a third consecutive bearish day for Wall Street. US officials have been urging Americans to seek booster shots to fend off the “raging Omicron”, as dubbed by Dr Fauci on Sunday, helping to keep the risk-off vide alive and well for traders over a month that is typically bullish for equities.

Biden’s spending bill faces resistance from within

US Senator (and Democrat) Joe Manchin appeared on Fox News saying that he “cannot vote to continue with this piece of legislation” when asked about the $1.75 trillion spending bill, citing his concerns for inflation. After the interview he then released a statement saying the bill Democrats hoped to pass could “drastically hinder” the countries ability to fight the pandemic. The White House Press secretary responded and said the party would find a way to press ahead in 2022.

WTI opened the week beneath $70, and continued lower

The prospects of restrictions coming back into play has weighed on oil prices as traders suspect demand could be dented heading into the new year. This has finally taken prices out of their sideways range and $70 is likely to remain a pivotal level (and tempting for bears to fade into rallies whilst prices remain beneath it). How to start oil tradingGBP/JPY and GBP/CHF feeling the pressure of lockdowns and risk-off sentiment

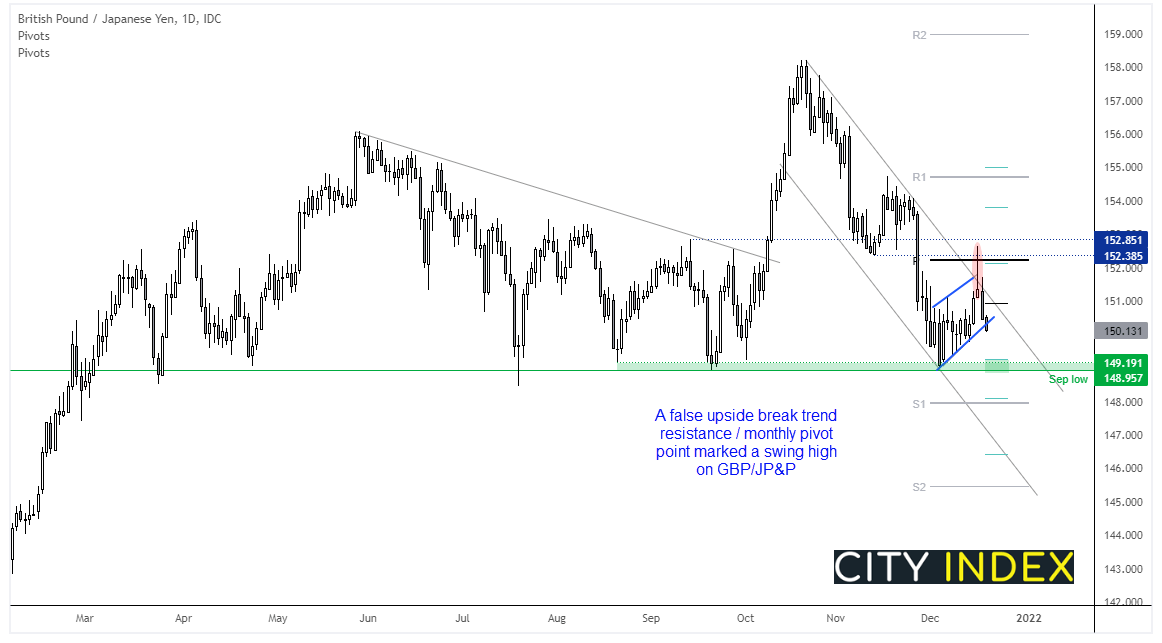

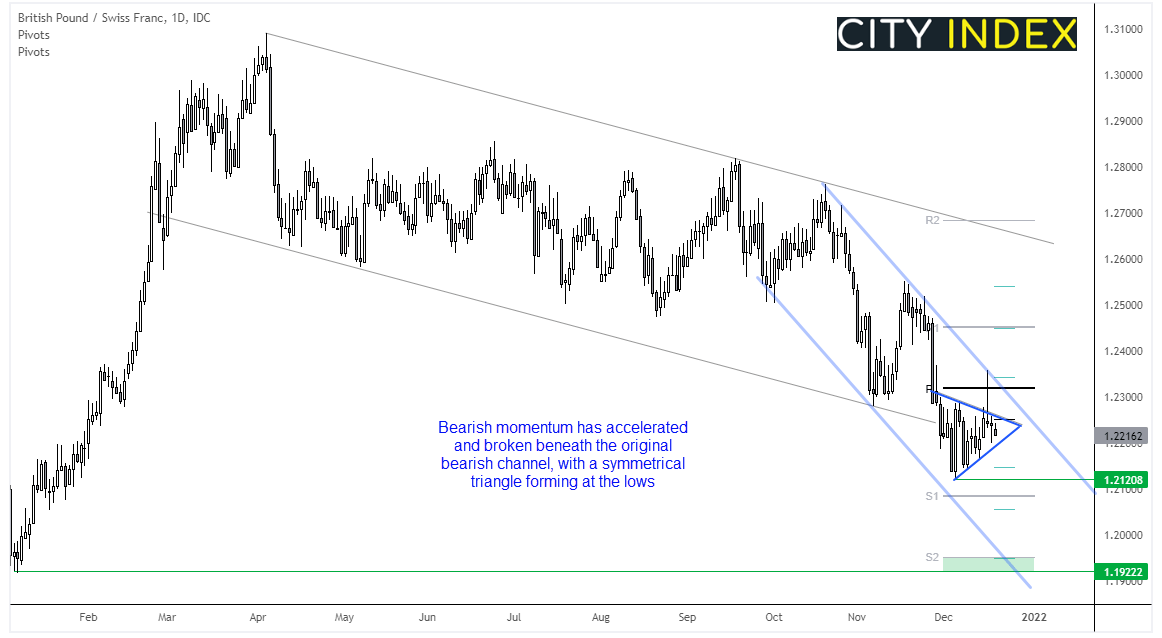

Given headlines surrounding the UK’s potential to lockdown over Christmas alongside concerns elsewhere regarding Omicron, then we should be on guard for a risk-off environment and downside breakout for GBP/CHF and GBP/JPY.

GBP/JPY initially saw an upside break on Thursday following BOE’s hike, yet it failed to hold above the monthly pivot and returned back within the channel with a bearish hammer, making a likely swing high. Prices continued lower on Friday and have now probed trend support overnight and appears set to break lower to target the zone around 149.

Whilst it has experienced period of choppy price action along the way, GBP/CHF remains in a downtrend on the daily chart and it has also provided periods of strong bearish momentum. Thursday’s bearish pinbar is of interest because it failed to hold above the monthly pivot point, and it also saw a false break above the symmetrical triangle. Prices are now coiling up so we are waiting for another burst of volatility.

FTSE 350: Market Internals

FTSE 350: 4152.47 (0.13%) 17 December 2021

- 227 (64.67%) stocks advanced and 107 (30.48%) declined

- 6 stocks rose to a new 52-week high, 2 fell to new lows

- 51% of stocks closed above their 200-day average

- 45.01% of stocks closed above their 50-day average

- 16.52% of stocks closed above their 20-day average

Outperformers:

- + 8.19%-Cineworld Group PLC (CINE.L)

- + 7.56%-Micro Focus International PLC (MCRO.L)

- + 7.05%-Capita PLC (CPI.L)

Underperformers:

- -7.54% - Trustpilot Group PLC (TRST.L)

- -3.15% - Croda International PLC (CRDA.L)

- -2.95% - Synthomer PLC (SYNTS.L)

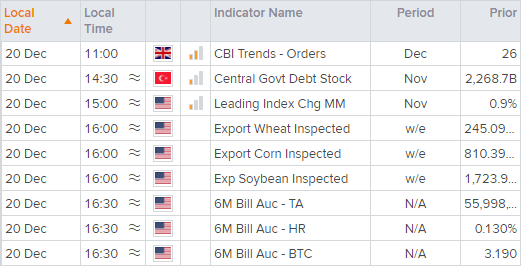

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade