Asian Indices:

- Australia's ASX 200 index rose by 47.1 points (0.65%) and currently trades at 7,322.40

- Japan's Nikkei 225 index has risen by 45.23 points (0.16%) and currently trades at 28,920.12

- Hong Kong's Hang Seng index has risen by 314.6 points (1.09%) and currently trades at 29,197.06

UK and Europe:

- UK's FTSE 100 futures are currently up 10.5 points (0.15%), the cash market is currently estimated to open at 7,120.47

- Euro STOXX 50 futures are currently up 11 points (0.27%), the cash market is currently estimated to open at 4,133.43

- Germany's DAX futures are currently up 37 points (0.24%), the cash market is currently estimated to open at 15,626.23

US Futures:

- DJI futures are currently up 322.58 points (0.95%)

- S&P 500 futures are currently up 7.75 points (0.05%)

- Nasdaq 100 futures are currently up 5.75 points (0.14%)

Learn how to trade indices

Index futures creep higher

Asian equities were higher overnight, mostly thanks to the news of a $1.2 trillion infrastructure bill which Joe Biden announced near the end of the US session. Index futures are creeping higher and suggesting a mildly stronger open for cash markets today. The S&P 500 E-mini contract is drifting higher inside a tight bullish channel on its hourly chart, and close to probing yesterday’s record high.

The FTSE failed to break convincingly beneath Wednesday’s bearish hammer to confirm the near-term reversal pattern. Given its now well above its weekly pivot and 20-day eMA (and formed a bullish engulfing candle) then momentum could favour bulls heading into this session. 7110.50 was yesterday’s POC (point of control – most actively traded price) and may act as a magnet, and / or provide support. A break above 7130 assumes bullish continuation.

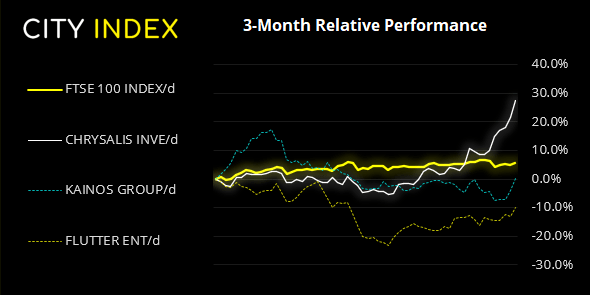

FTSE 350: Market Internals

FTSE 350: 4068.46 (0.51%) 24 June 2021

- 139 (39.60%) stocks advanced and 202 (57.55%) declined

- 17 stocks rose to a new 52-week high, 4 fell to new lows

- 83.76% of stocks closed above their 200-day average

- 51.57% of stocks closed above their 50-day average

- 17.95% of stocks closed above their 20-day average

Outperformers:

- + 4.94% - Chrysalis Investments Ltd (CHRY.L)

- + 4.69% - Kainos Group PLC (KNOS.L)

- + 3.72% - Flutter Entertainment PLC (FLTRF.I)

Underperformers:

- -9.78% - John Wood Group PLC (WG.L)

- -7.83% - Airtel Africa PLC (AAF.L)

- -6.23% - LXi REIT PLC (LXIL.L)

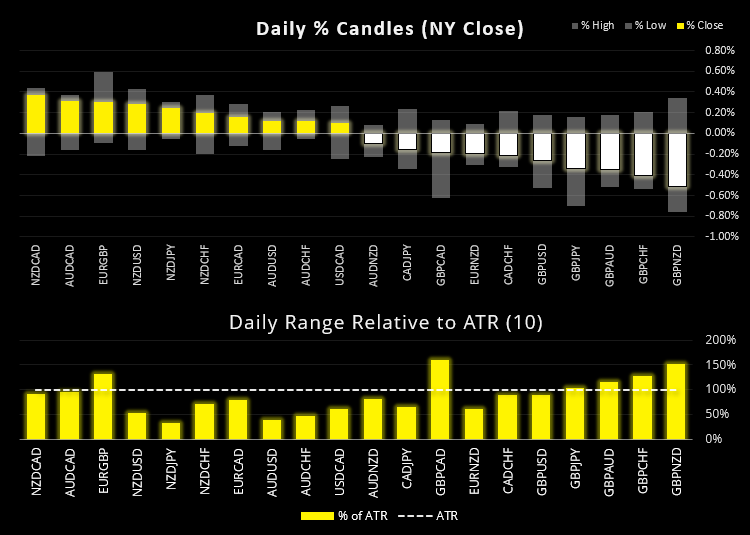

Forex: NZD and AUD strongest majors this week (so far)

The dollar was slightly weaker overnight, down 0.3% and 0.15% against NZD and AUD, which are the strongest majors thanks to higher equities from the infrastructure bill (NZD and AUD are also the strongest currencies this week so far).

USD/JPY is meandering around 111 and today’s Core PCE print is likely to dictate which side of this key level it closes this week. Whilst the daily trend remains constructively bullish, we’d may need to see a strong inflation print to see is comfortably higher today. Any signs of mediocracy risks sending this pair lower from current levels.

USD/CHF is tracking the US dollar index (DXY) very closely and is an equally good major to monitor alongside USD/JPY, ahead of today’s inflation data.

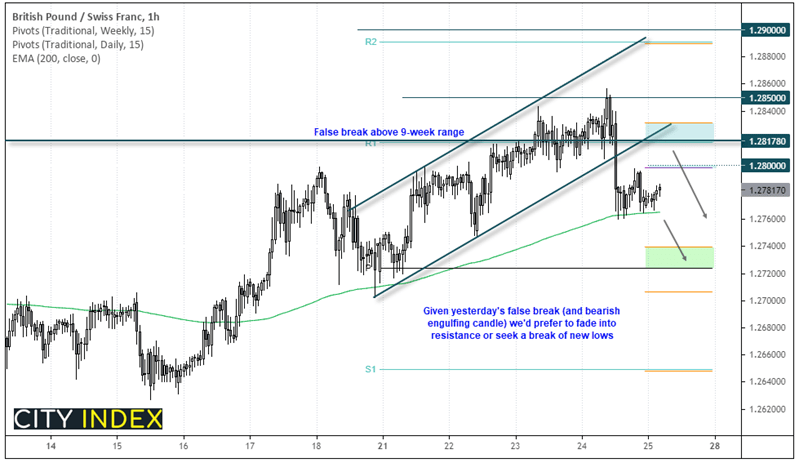

The British pound may have been firm heading into yesterday’s BOE meeting, but it certainly wasn’t after it. As we noted in yesterday’s report, GBP/CHF had broken out of its 9-week range yet yesterday’s bearish engulfing candle saw it close firmly back beneath it. Whilst prices were trying to drift higher overnight, our bias remains bearish over the near-term.

The hourly chart shows a downside break of a rising channel before falling to the 100-bar eMA, which is now acting as support. In fact, it’s almost formed a double bottom at this dynamic support level, so we’re on guard for an upwards spike after the UK open. Yet, given the clear momentum shift at yesterday’s high yesterday, we see any minor rally as a potential opportunity to fade at a higher (more favourable) price, assuming prices go on to retest yesterday’s low and break beneath them it of course. Alternatively, bears could wait for a break of yesterday’s low as this also clears the 100-dar eMA.

Learn how to trade forex

Commodities:

Gold and silver remain in tight ranges ahead of today’s CPI report ahead of their lows. Analysis for both is quite similar.

Copper futures are sitting just beneath the 4.434 high, and a strong inflation print could push prices higher as part of the reflation trade. 4.5350 is the next major level of resistance for bulls to target and bears to defend.

Going further afield…. soybean futures appear to be trying to form a base back above 1300. They’ve fallen -22.7% since the May high and spent one day just beneath the February low, before printing a two-bar bullish reversal pattern on the daily chart. Since then, a pullback respected 1300 and printed a bullish hammer, and a break above 1380 suggest a deeper counter-trend correction.

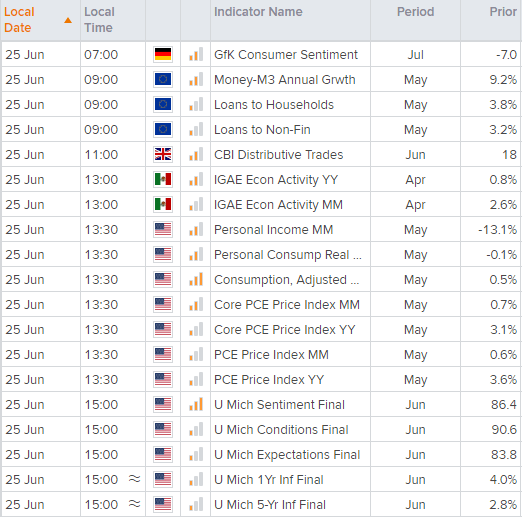

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.