Asian Indices:

- Australia's ASX 200 index rose by 51.4 points (0.71%) and currently trades at 7,313.20

- Japan's Nikkei 225 index has fallen by -267.33 points (-0.93%) and currently trades at 28,375.57

- Hong Kong's Hang Seng index has fallen by -207.61 points (-0.74%) and currently trades at 27,865.25

UK and Europe:

- UK's FTSE 100 futures are currently up 17.5 points (0.25%), the cash market is currently estimated to open at 7,118.38

- Euro STOXX 50 futures are currently up 6.5 points (0.16%), the cash market is currently estimated to open at 4,059.17

- Germany's DAX futures are currently up 35 points (0.23%), the cash market is currently estimated to open at 15,546.38

US Futures:

- DJI futures are currently down -208.98 points (-0.6%)

- S&P 500 futures are currently up 12.25 points (0.08%)

- Nasdaq 100 futures are currently down -0.75 points (-0.02%)

Learn how to trade indices

Indices see red in Asia, 7070 key support for FTSE

Japanese share markets were in the red, weighed down by coronavirus concerns and blue-chips following Wall Street’s weak lead. Cases in South Korea have also spiked, weighing on stocks across Asia, although the ASX 200 bucked the trend are rose 0.65%, led by healthcare and tech stocks.

European futures have opened higher, led by the DAX (+0.2%) and FTSE (0.17%).

The FTSE’s bearish engulfing / outside day held above 7070 support (just) and a late scramble saw it close above the 20-day eMA. As the FTSE has shown the ability to throw supposed bearish reversal candles before grinding higher anyway, perhaps we shouldn’t completely write if off just yet. But for today’s session we suspect 7070 could be a pivotal level if re-tested, as a break beneath it spells trouble and confirms yesterday’s engulfing candle. On the upside, 71270, 7153 and 7170 are key resistance levels for bulls to conquer.

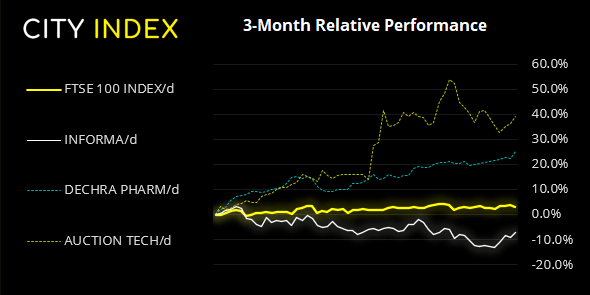

FTSE 350: Market Internals

FTSE 350: 4076.49 (-0.89%) 06 July 2021

- 105 (29.91%) stocks advanced and 236 (67.24%) declined

- 27 stocks rose to a new 52-week high, 1 fell to new lows

- 84.33% of stocks closed above their 200-day average

- 59.26% of stocks closed above their 50-day average

- 23.93% of stocks closed above their 20-day average

Outperformers:

- + 2.33% - Informa PLC (INF.L)

- + 2.28% - Dechra Pharmaceuticals PLC (DPH.L)

- + 2.25% - Auction Technology Group PLC (ATG.L)

Underperformers:

- -5.30% - Virgin Money UK PLC (VMUK.L)

- -4.55% - Antofagasta PLC (ANTO.L)

- -4.39% - Tullow Oil PLC (TLW.L)

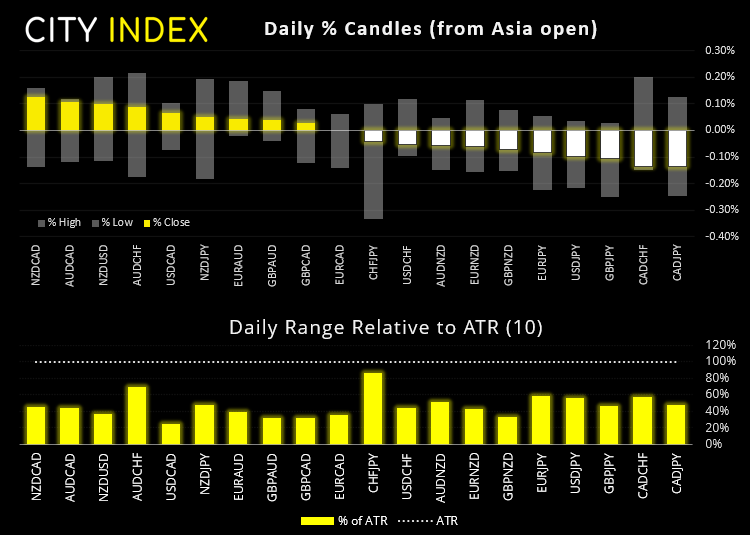

Forex: Ivey PMI and FOMC minutes in focus

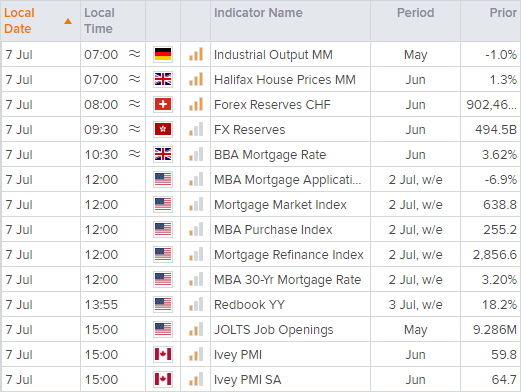

German industrial production kicks off data at 07:00 BST. Given yesterday’s weak ZEW report and the stronger US dollar, then EUR/USD could be vulnerable to a few more pips to the downside should this disappoint below the -0.2% expected. Yet this is also a lagging indicator, it may save itself for the FOMC minutes released at 19:00 BST.

Canada’s Ivey PMI is expected to expand at the slower rate of 57, down from 64.7. If correct, it will be the slowest expansion in five months, back when it was contracting. With CAD pairs on the back foot due to weaker oil prices (which show the potential to weaken further over the near-term) then a softer-than expected PMI print could be another bull for CAD bulls.

Today’s main calendar event is the FOMC minutes released at 19:00. The key thing for traders to watch out for is if there is a growing call among members to begin tapering. Remember how the dollar rallied after the FOMC meeting? Well, a rising call for tapering could well see the dollar extends its gains. And we already see evidence of expectations on the dollar’s price action, with the US dollar index producing a three-bar bullish reversal by yesterday’s close.

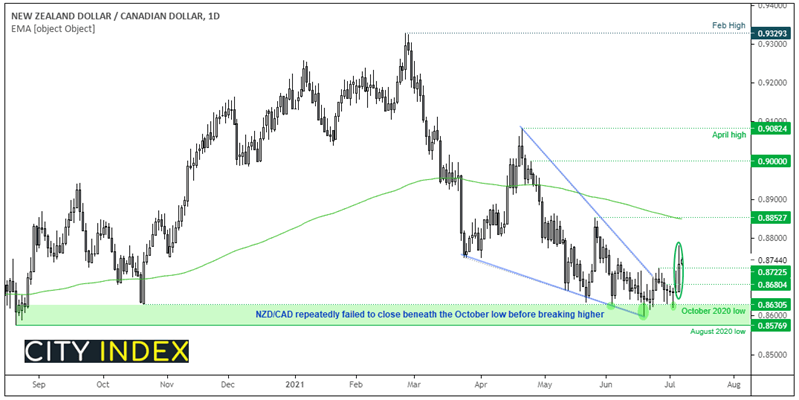

Divergent theme building for NZD/CAD

With improving business and consumer sentiment in New Zealand combined with growing expectations for RBNZ to hike this year, it’s possible we’ve seen an important low on NZD/CAD. That this coincides with relative underperformance of Canada’s economic data and oil printing an interim top, it adds further weight behind a bullish NZD/CAD stance.

Since May, the daily chart shows its inability to close beneath 0.8630 on several occasions, leaving bullish reversal candles in its wake. Its bearish trend from the March high has been losing steam since mid-April and a bullish wedge pattern has formed. Yesterday’s bullish range expansion closed above the 0.87225 swing high to warn of a change in trend, so our bias remains bullish above last week’s low. Although, if this is part of a strong move higher then we wouldn’t expect to see 0.8680 re-tested soon. We’ll see if it has legs to test the top of the pattern (April high) but the 200-day eMA around 0.8852 makes a viable interim target, ahead of the 0.9000 handle.

Learn how to trade forex

Commodities: Gold clings on to 1800

Gold is treading water just beneath its 200-day eMA, after printing a bearish hammer back below its 200-day eMA yesterday/ A break below 1790 confirms the near-term reversal pattern. It will be a major market to watch around the FOMC minutes and they will likely dictate which side of 1800 it closes on by the end of the day.

Brent futures are -0.3% lower but trying to build support around its weekly S1 support level at 74.36. Given yesterday’s bearish key reversal we’d look for weakness beneath its broken trendline or the weekly pivot at 75.60.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.