Asian Indices:

- Australia's ASX 200 index rose by 11.9 points (0.16%) and currently trades at 7,233.60

- Japan's Nikkei 225 index has fallen by -188.3 points (-0.69%) and currently trades at 26,933.77

- Hong Kong's Hang Seng index has fallen by -175.73 points (-0.72%) and currently trades at 24,151.98

- China's A50 Index has fallen by -132.89 points (-0.87%) and currently trades at 15,059.77

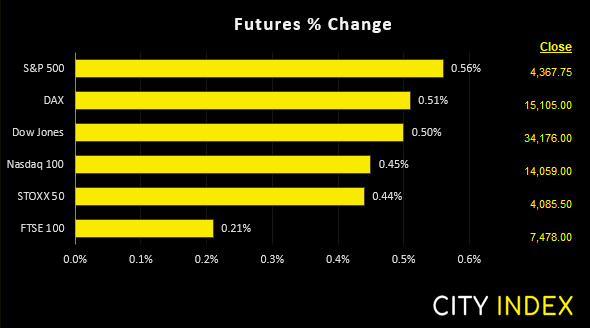

UK and Europe:

- UK's FTSE 100 futures are currently up 16 points (0.21%), the cash market is currently estimated to open at 7,529.62

- Euro STOXX 50 futures are currently up 17.5 points (0.43%), the cash market is currently estimated to open at 4,091.78

- Germany's DAX futures are currently up 76 points (0.51%), the cash market is currently estimated to open at 15,118.51

US Futures:

- DJI futures are currently up 171 points (0.5%)

- S&P 500 futures are currently up 63 points (0.45%)

- Nasdaq 100 futures are currently up 24.5 points (0.56%)

The summit is reported to be Macron’s proposal, which has been agreed ‘in principle’ by the US and Russia. Over the weekend he spoke with Putin twice and Biden once to seal the deal, which aims to “discuss security and strategic stability in Europe”. The news gave sentiment a boost earlier in the Asian session which sees US and European futures markets trading higher, although take note that US equity markets will be closed today due to a public holiday in the US.

FTSE 350: Market Internals

FTSE 350: 4222.78 (-0.32%) 18 February 2022

- 91 (26.00%) stocks advanced and 250 (71.43%) declined

- 4 stocks rose to a new 52-week high, 25 fell to new lows

- 31.43% of stocks closed above their 200-day average

- 91.71% of stocks closed above their 50-day average

- 16.57% of stocks closed above their 20-day average

Outperformers:

- + 3.80% - Standard Chartered PLC (STAN.L)

- + 2.99% - Endeavour Mining PLC (EDV.L)

- + 2.34% - C&C Group PLC (GCC.L)

Underperformers:

- -7.24% - EVRAZ plc (EVRE.L)

- -6.36% - AVEVA Group PLC (AVV.L)

- -5.75% - Future PLC (FUTR.L)

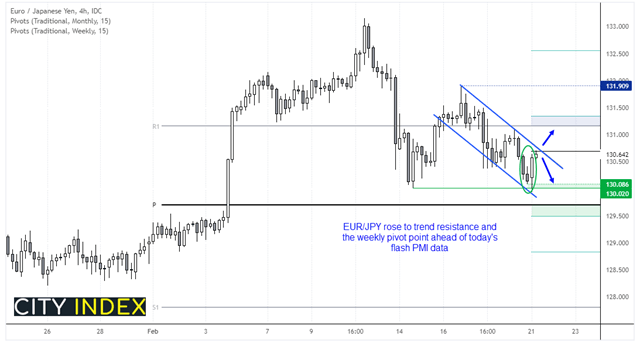

EUR/JPY rallies into resistance ahead of flash PMI’s

The Japanese yen and US dollar are the weakest currencies so far today, as an undertone of risk-on kick started the week. This allowed EUR/JPY to rose back above last week’s low after a false break of 130.02 support and form a bullish outside candle, as part of a 3-bar bullish reversal.

The cross remains within a bearish channel and below the weekly pivot point but the momentum shift from support is constructive for a potential rally. With the potential for Russia-Ukraine headlines to continue gripping markets and with flash PMI data for Europe released shortly, this market could go either way. But for now, the 130.70 area is likely a pivotal level for traders.

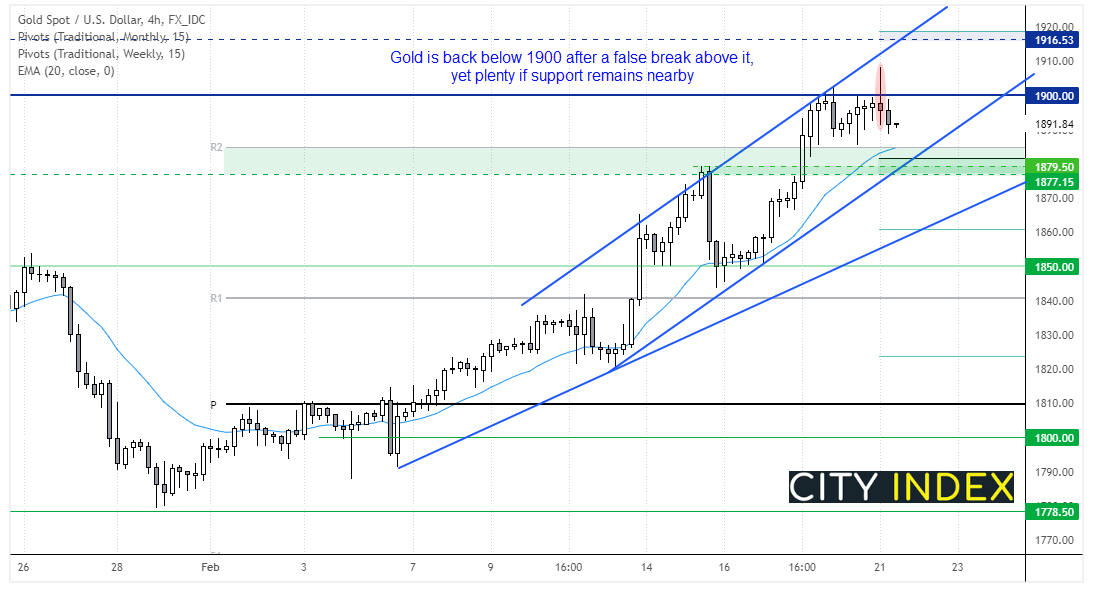

Gold falters around 1900

Earlier in the session, gold rose to its highest level since June 2021. Yet the burst of risk-on saw it hand back those gains and now readers lower for the day around 1890. A bearish pinbar formed on the four-hour chart and we now see the potential for prices to retrace against its bullish trend.

Yet plenty of support levels reside nearby including the monthly R2 pivot, weekly pivot point, previous lows and bullish channel. And whilst the Biden-Putin summit is a good start to the week, the situation is far from sorted and gold clearly remains a favourite hedge against the crisis. We therefore expect any dips on gold to be brought until the situation is truly rectified.

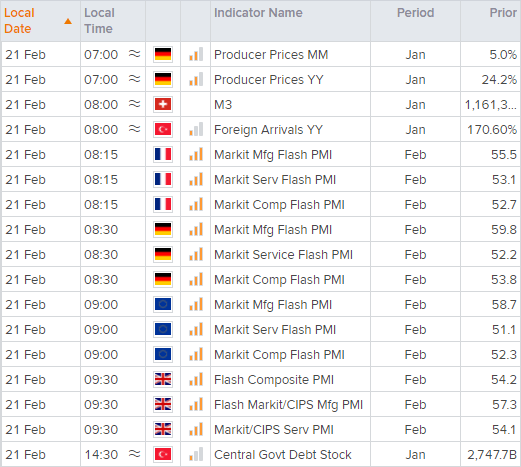

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade