Asian Indices:

- Australia's ASX 200 index rose by 100.4 points (1.36%) and currently trades at 7,493.00

- Japan's Nikkei 225 index has fallen by -456.23 points (-1.64%) and currently trades at 27,325.53

- Hong Kong's Hang Seng index has risen by 237.62 points (0.92%) and currently trades at 26,198.65

UK and Europe:

- UK's FTSE 100 futures are currently up 30.5 points (0.44%), the cash market is currently estimated to open at 7,062.80

- Euro STOXX 50 futures are currently up 21.5 points (0.53%), the cash market is currently estimated to open at 4,110.80

- Germany's DAX futures are currently up 78 points (0.5%), the cash market is currently estimated to open at 15,622.39

US Futures:

- DJI futures are currently down -42 points (-1.4903%)

- S&P 500 futures are currently up 71.75 points (0.48%)

- Nasdaq 100 futures are currently up 22.5 points (0.51%)

Learn how to trade indices

Asian indices bounced overnight despite China’s PMI miss

Factory output hit a 17-month low in July for China with the PMI expanding at just 50.4. Higher costs of raw materials and floods have dragged on the headline number, although it’s possible that this could be a temporary blip as opposed to a major slowdown for the world’s second largest economy.

The ASX 200 hit a record high following reports that Square Inc will pay $29 billion to acquire Afterpay (APT). Strong earnings data helped Japan’s share markets rebound to see the Nikkei 225 rise 1.8% and the TOPIX 1000 top 2%. Semiconductor stocks led the KOSPI 200 0.4% higher thanks to strong export and PMI data.

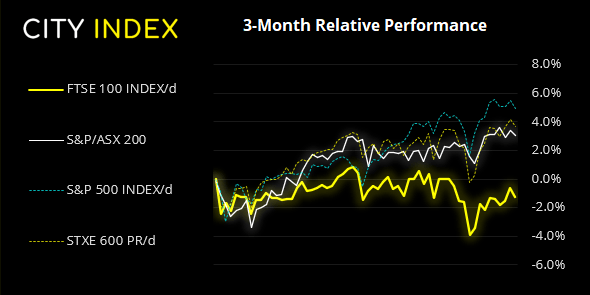

A dark cloud pattern formed on the FTSE 100 on Friday (2-bar bearish reversal) yet support was found around 7,000 before paring losses near the end of the session. If sentiment can recover today then a break above Thursday’s highs assumes bullish continuation, whereas a break beneath Friday’s low brings the 6929 – 6948 lows into focus.

The DAX has been oscillating between 15420 – 15680 since July 22nd so, until we see a break outside of that range, range-trading strategies are preferred.

The STOXX 600 closed lower on Friday after hitting a new record high on Thursday, although support was found at the monthly R1 pivot. Regardless, our bias remains bullish above the 456.23 low.

FTSE 100: Market Internals

FTSE 100: 7032.30 (-0.65%) 30 July 2021

- 205 (58.40%) stocks advanced and 132 (37.61%) declined

- 10 stocks rose to a new 52-week high, 0 fell to new lows

- 54% of stocks closed above their 200-day average

- 37% of stocks closed above their 50-day average

- 57% of stocks closed above their 20-day average

Outperformers:

- + 3.23% - Rightmove PLC (RMV.L)

- + 3.03% - Pearson PLC (PSON.L)

- + 2.35% - London Stock Exchange PLC (LSE.L)

Underperformers:

- -7.99% - Intertek (ITRK.L)

- -7.45% - Intermediate Capital Group PLC (ICAG.L)

- -3.68% - International Consolidated Airlines Group PLC (ICP.L)

PMI data in focus

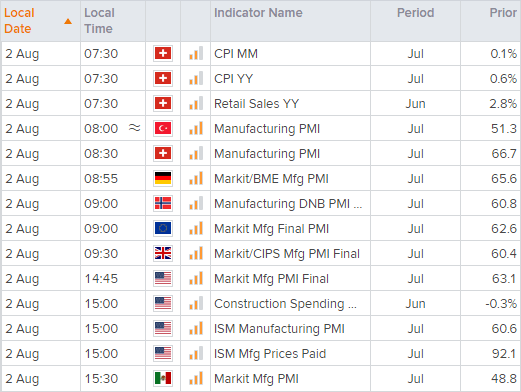

UK manufacturing PMI is released at 09:30 BST and expected to remain flat (yet expansionary) at 60.4. ISM Manufacturing for the July is scheduled for 15:00 and is the main calendar event today. June’s headline figure expanded at 60.6, which is a fairly punchy number although it has softened from its 64.7 high set in March. Prices paid will be a closely watched component given it is an inflationary input, which currently sits at a record high of 92. The headline figure is expected to rise slightly to 60.8. Markit economic also release their final PMI data for July.

The US dollar index (DXY) closed back above its 200-day eMA on Friday after a single day beneath it on Thursday. Due to the bearish engulfing candle on the weekly chart, we remain bearish on the dollar over the near-term, although DXY could well extend Friday’s bounce before bears regain control. We are seeking bearish setups below or around the 92.08 (monthly pivot point) and 92.53 low.

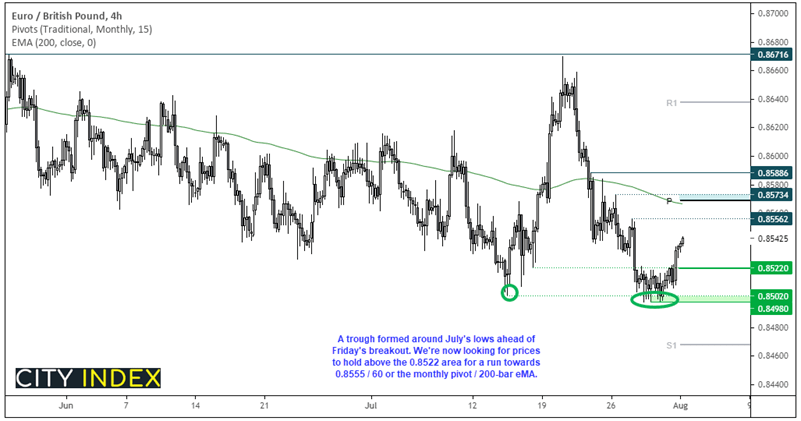

EUR/GBP failed to break to new lows last week after two small Doji’s appeared on the daily chart, ahead of a bullish rebound on Friday. Resistance was found at the 20-day eMA which leaves the potential for a retracement from current levels, but we’d look for a higher low to build above the 0.8522 breakout level. If prices can old above the 0.8522 area then we’d seek bullish setups around that level and target 0.8560, just beneath the monthly pivot and 200-bar eMA.

GBP/USD printed a bearish engulfing/outside candle on Friday as part of a 2-bar reversal back below 1.3900. It didn’t quite reach our 1.40 target but came close enough.

GBP/AUD is not too far from testing 1.9000, although we should question how much upside potential remains given its lack of retracement.

Learn how to trade forex

Oil slips on softer China PMI:

Oil prices slipped overnight following China’s weaker than expected PMI report. WTI is back above 73.0 after a quick dip below it, although prices remain elevated above the monthly pivot point around 72.0 so our bias remain bullish.

Copper futures continue to hold above 4.4350 support and the monthly pivot point. We are awaiting bullish momentum to return to break prices out of its consolidation.

Gold touched a 2-day low overnight but has stabilised at its 200-day eMA. Given the monthly pivot point is at 1804 then we see the potential for a bounce form current levels.

Silver is forming a potential bull flag on the four-hour chart, yet several levels of technical resistance hover nearby.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.