EUR/USD Key Points

- EUR/USD is ticking higher as the US dollar edges lower on progress toward peace in the Middle East.

- EUR/USD’s technical outlook reflects indecision and caution on the part of traders ahead of next week’s busy economic data calendar.

EUR/USD Fundamental Analysis

In its meeting yesterday, the ECB didn’t bring either a trick or a treat for traders; ECB President Lagarde and company stuck to the script with no changes to monetary policy and reiterated that monetary policy would remain restrictive for some time.

In the wake of the mostly as-expected central bank meeting, it’s perhaps not surprising that EUR/USD ended the day essentially unchanged.

Meanwhile across the Atlantic, the September US Core PCE release came out as expected at 0.3% m/m (3.7% y/y), prompting little in the way of changing expectations for the Fed’s monetary policy moving forward.

Perhaps the most important “fundamental” update came from the Middle East, where reports suggested Israel and Hamas were considering a ceasefire and hostage release. With fears over the conflict spreading still lingering over the market and weighing on risk appetite, any signs of progress toward peace are worth cheering.

Solely from a trading perspective, such developments generally decrease demand for safe haven assets like the US dollar, and that’s exactly what we’re seeing today with EUR/USD rising back to unchanged levels on the week near 1.0590 as we go to press.

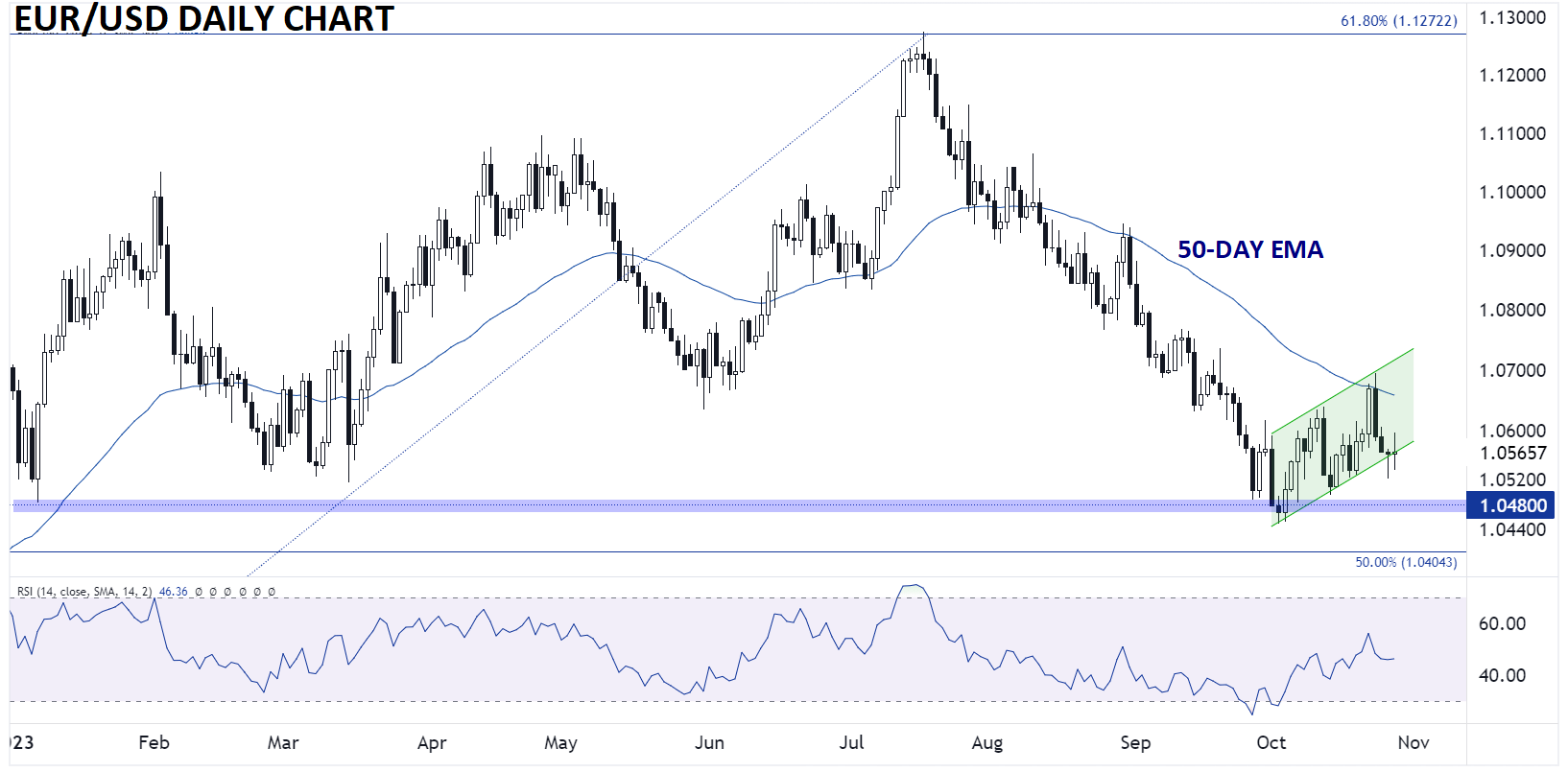

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

As the chart below shows, EUR/USD was threatening to break below a possible bearish flag pattern on the daily chart yesterday, but rates managed a late reversal to close back within that pattern. After another foray lower in today’s trade, the world’s most widely-traded currency pair is once again on track to close within its near-term rising channel.

In addition to the aforementioned positive news on the geopolitical front, traders may also be hesitant to be positioned too aggressively heading into next week’s key economic data, highlighted by Eurozone Flash CPI, the FOMC’s Monetary Policy Meeting, and US Non-Farm Payrolls on Friday.

For now, the short-term technical outlook reflects that indecision, leaving a neutral bias within this week’s 1.0525-1.0700 range.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX